Form it 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year 2022

What is the Form IT 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year

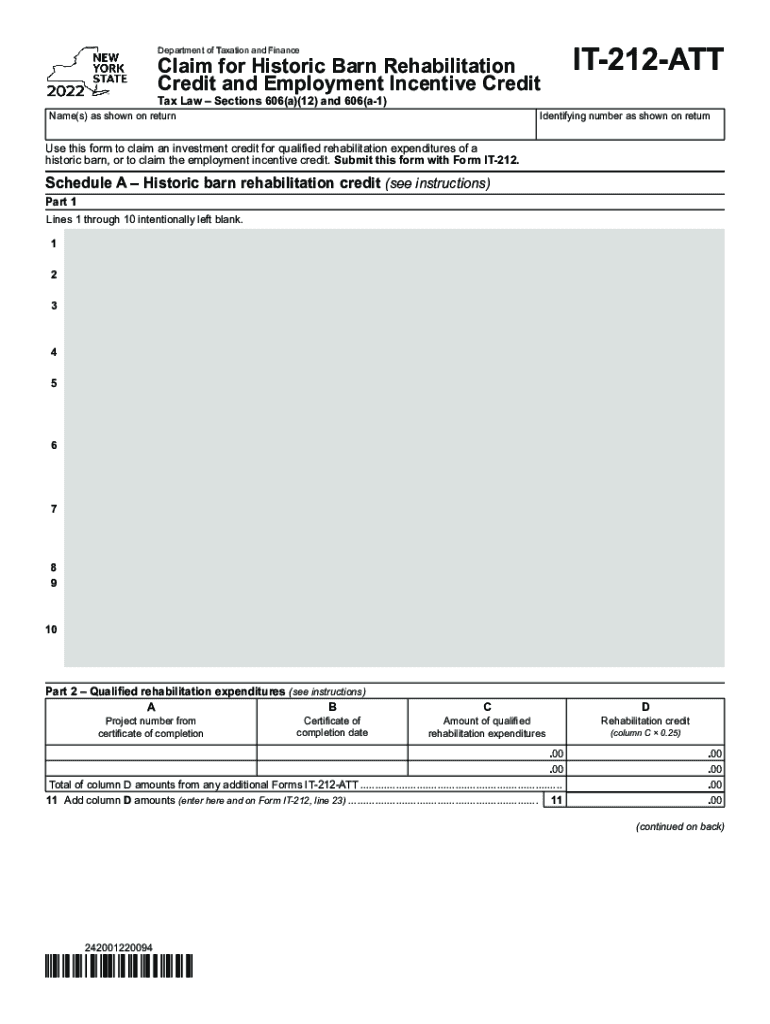

The Form IT 212 ATT is specifically designed for taxpayers in New York who are claiming the Historic Barn Rehabilitation Credit and the Employment Incentive Credit. This form allows eligible taxpayers to receive tax credits for rehabilitating historic barns and for creating or retaining jobs in designated areas. The credits are aimed at promoting the preservation of historic structures while also encouraging economic growth through employment opportunities.

Steps to Complete the Form IT 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year

Completing the Form IT 212 ATT involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the rehabilitation of the barn and any employment records. Next, accurately fill out the personal information section, including your Social Security number and contact details. Follow this by detailing the expenses incurred for the barn rehabilitation, ensuring that they meet the eligibility criteria outlined by the state. Finally, review your entries for completeness and accuracy before submitting the form.

Eligibility Criteria for the Form IT 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year

To qualify for the credits claimed on Form IT 212 ATT, taxpayers must meet specific eligibility criteria. The barn must be recognized as a historic structure and must undergo substantial rehabilitation. Additionally, the taxpayer must demonstrate that the rehabilitation has led to job creation or retention in the local economy. It is essential to consult the guidelines provided by the New York State Department of Taxation and Finance to confirm that all requirements are met before submission.

Required Documents for the Form IT 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year

When filing the Form IT 212 ATT, certain documents are required to substantiate your claim. These include proof of expenses related to the barn rehabilitation, such as invoices and receipts, as well as documentation demonstrating job creation or retention. Taxpayers may also need to provide photographs of the barn before and after rehabilitation to illustrate the improvements made. Ensuring all required documents are included will help facilitate a smoother review process by tax authorities.

Filing Deadlines for the Form IT 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year

It is crucial to be aware of the filing deadlines associated with the Form IT 212 ATT to avoid any penalties or missed opportunities for claiming credits. Typically, the form must be submitted by the tax filing deadline for the respective tax year. Taxpayers should also keep in mind any extensions that may apply, as well as specific deadlines for submitting supporting documentation to ensure compliance with state regulations.

Legal Use of the Form IT 212 ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Tax Year

The legal use of the Form IT 212 ATT is governed by state tax laws, which outline the proper procedures for claiming the Historic Barn Rehabilitation Credit and the Employment Incentive Credit. To ensure that the form is legally valid, it must be completed accurately and submitted within the designated time frame. Additionally, taxpayers should maintain copies of all submitted materials and supporting documents in case of future inquiries or audits by tax authorities.

Quick guide on how to complete form it 212 att claim for historic barn rehabilitation credit and employment incentive credit tax year 2022

Effortlessly Prepare Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents rapidly without delays. Handle Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year with Ease

- Obtain Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year and click Get Form to begin.

- Use the tools provided to fill out your document.

- Select pertinent sections of the documents or hide sensitive information using the tools available through airSlate SignNow specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year and ensure outstanding communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 212 att claim for historic barn rehabilitation credit and employment incentive credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 212 att claim for historic barn rehabilitation credit and employment incentive credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for it 212 users?

airSlate SignNow provides a wide range of features for it 212 users, including customizable templates, real-time tracking of document status, and advanced security measures. This ensures that your documents are not only easily accessible but also protected. The user-friendly interface allows for straightforward signing and sending of documents, streamlining your workflow.

-

How does pricing work for airSlate SignNow services related to it 212?

Pricing for airSlate SignNow services related to it 212 is competitive and designed to meet the needs of businesses of all sizes. You can choose from various plans that offer different features, ensuring you only pay for what you need. Additionally, airSlate SignNow often provides discounts for annual subscriptions, making it a cost-effective solution.

-

What integrations does airSlate SignNow support for it 212?

airSlate SignNow supports multiple integrations that benefit it 212 users, such as popular CRM systems, cloud storage services, and productivity tools. This wide range of integrations ensures seamless workflow automation and data transfer, saving you time and reducing manual entry errors. You can connect with tools like Salesforce, Google Drive, and more to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for it 212 documentation?

Utilizing airSlate SignNow for your it 212 documentation offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. The platform's user-friendly interface and automated workflows minimize the hassle of managing paper documents. Furthermore, it enhances your team's productivity, allowing them to focus on core business tasks.

-

Can I use airSlate SignNow for mobile signing related to it 212?

Yes, airSlate SignNow allows for mobile signing, making it convenient for it 212 users to sign documents on-the-go. The mobile-friendly design ensures that you can manage and sign documents from your smartphone or tablet, increasing accessibility and flexibility. With this feature, you can capture signatures anywhere, anytime, which is ideal for remote work situations.

-

Is airSlate SignNow compliant with industry standards for it 212?

Absolutely! airSlate SignNow is compliant with industry standards for it 212, including eSignature laws and regulations like the ESIGN Act and UETA. This compliance provides users with the legal assurance that signed documents are valid and enforceable. Security measures such as encryption also protect sensitive information, further ensuring compliance and safety.

-

What customer support options are available for airSlate SignNow users of it 212?

airSlate SignNow offers numerous customer support options for it 212 users, including live chat, email support, and a comprehensive knowledge base. The support team is well-equipped to assist with any technical issues or questions you may have regarding the platform. Furthermore, regular webinars and tutorials are available to enhance your understanding and usage of the service.

Get more for Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year

- Tn letter tenant form

- Letter landlord repair 497326739 form

- Letter tenant landlord 497326740 form

- Tennessee tenant landlord form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles tennessee form

- Letter from tenant to landlord about landlords failure to make repairs tennessee form

- Tn tenant rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession tennessee form

Find out other Form IT 212 ATT Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Tax Year

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed