Minnesota Form M15NP Additional Charge for Underpayment 2019

What is the Minnesota Form M15NP Additional Charge For Underpayment

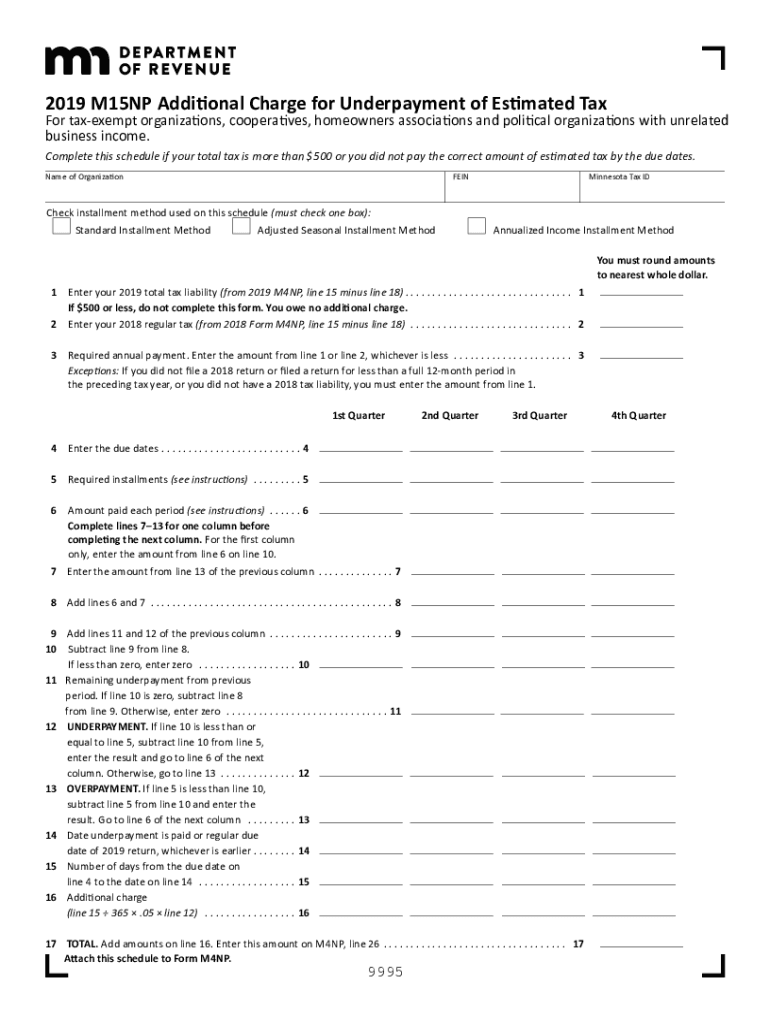

The Minnesota Form M15NP is specifically designed to address the additional charge for underpayment of state taxes. This form is utilized by taxpayers who have not paid sufficient estimated tax throughout the year and are subject to penalties. It serves as a formal declaration of the underpayment and allows individuals to calculate the amount owed to the state. Understanding the implications of this form is crucial for maintaining compliance with Minnesota tax regulations.

Steps to complete the Minnesota Form M15NP Additional Charge For Underpayment

Completing the Minnesota Form M15NP involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your total tax liability for the year, then determine the amount of tax you have already paid. Subtract the amount paid from your total tax liability to identify any underpayment. Finally, fill out the form accurately, ensuring all calculations are correct, and submit it by the specified deadline.

Legal use of the Minnesota Form M15NP Additional Charge For Underpayment

The legal use of the Minnesota Form M15NP is governed by state tax laws that require taxpayers to report any underpayment of taxes. This form must be completed and submitted to the Minnesota Department of Revenue to avoid further penalties. It is essential to understand that the information provided on this form must be truthful and accurate, as providing false information can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form M15NP are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by the same deadline as your state income tax return. It is advisable to check the Minnesota Department of Revenue website for specific dates, as they can vary each year. Missing the deadline can result in additional charges, so keeping track of these important dates is essential for compliance.

Required Documents

To complete the Minnesota Form M15NP, certain documents are required. These include your most recent tax return, W-2 forms, 1099 forms, and any documentation related to estimated tax payments made throughout the year. Having these documents on hand will facilitate the accurate completion of the form and help ensure that all necessary information is included.

Penalties for Non-Compliance

Failure to comply with the requirements of the Minnesota Form M15NP can lead to significant penalties. Taxpayers who do not file the form or who underreport their underpayment may face financial penalties imposed by the Minnesota Department of Revenue. These penalties can accumulate over time, increasing the overall amount owed. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing.

Quick guide on how to complete minnesota form m15np additional charge for underpayment

Complete Minnesota Form M15NP Additional Charge For Underpayment effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, as you can access the suitable template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Minnesota Form M15NP Additional Charge For Underpayment on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Minnesota Form M15NP Additional Charge For Underpayment without any hassle

- Find Minnesota Form M15NP Additional Charge For Underpayment and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Minnesota Form M15NP Additional Charge For Underpayment and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form m15np additional charge for underpayment

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m15np additional charge for underpayment

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is m15np and how does it relate to airSlate SignNow?

M15np is a unique identifier for a specific feature set within airSlate SignNow. This designation emphasizes our commitment to providing efficient electronic signature solutions. By using m15np, users can streamline their document workflows while ensuring security and compliance.

-

What features does airSlate SignNow offer that utilize the m15np framework?

With the m15np framework, airSlate SignNow includes robust features such as document management, customizable templates, and advanced eSignature capabilities. These tools empower users to create, send, and track their documents seamlessly. The m15np system enhances productivity by simplifying the entire signing process.

-

How does airSlate SignNow pricing work with the m15np options?

AirSlate SignNow offers flexible pricing plans that incorporate the m15np features. Whether you're a small business or a large enterprise, there is a suitable plan designed to fit different needs and budgets. By choosing a plan with m15np options, you gain access to all essential features for electronic signing.

-

What are the benefits of using airSlate SignNow with m15np?

Using airSlate SignNow with the m15np offering provides numerous benefits, including increased efficiency, security, and user satisfaction. With m15np, businesses can reduce turnaround times for document signing and enhance collaboration. Additionally, it ensures compliance with legal standards across various industries.

-

Can I integrate airSlate SignNow with other tools using m15np?

Yes, airSlate SignNow, with its m15np framework, offers extensive integration capabilities. You can easily connect with popular applications like Google Drive, Salesforce, and more. This flexibility allows businesses to streamline their existing workflows, making document signing even more efficient.

-

Is support available for users utilizing the m15np features?

Absolutely! AirSlate SignNow provides comprehensive support for users utilizing the m15np features. Whether you need help during setup or have questions about specific functionalities, our dedicated support team is here to assist you. Access detailed documentation and customer service resources easily.

-

How secure is airSlate SignNow when using the m15np function?

Security is a top priority for airSlate SignNow, especially with m15np. We employ advanced encryption technologies to protect your documents during transit and storage. Additionally, m15np supports compliance with industry standards, ensuring your data remains confidential and secure.

Get more for Minnesota Form M15NP Additional Charge For Underpayment

Find out other Minnesota Form M15NP Additional Charge For Underpayment

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now