Fillable Form M15np Additional Charge for Underpayment 2021

What is the fillable form M15NP additional charge for underpayment?

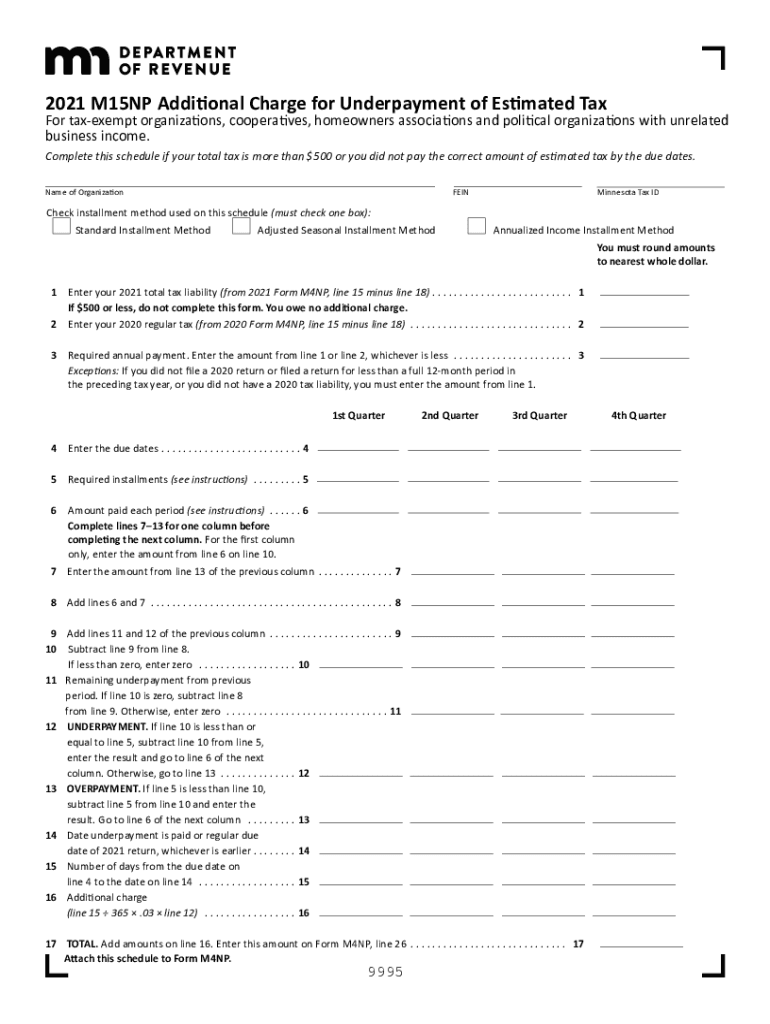

The fillable form M15NP is a document used by taxpayers to report and calculate additional charges for underpayment of taxes. This form is particularly relevant for individuals who may not have withheld enough taxes throughout the year or who have underpaid their estimated tax obligations. Understanding the M15NP is essential for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the fillable form M15NP additional charge for underpayment

Using the fillable form M15NP involves several steps. First, download the form from a reliable source. Next, gather all necessary financial documents, including income statements and previous tax returns. Fill out the form by providing accurate information regarding income, deductions, and any payments made. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the fillable form M15NP additional charge for underpayment

Completing the fillable form M15NP requires careful attention to detail. Follow these steps:

- Download the form from a trusted source.

- Provide your personal information, including name, address, and Social Security number.

- Calculate your total income and any applicable deductions.

- Determine the total tax owed and compare it to the amount already paid.

- Calculate any additional charges for underpayment based on IRS guidelines.

- Review all entries for accuracy before submission.

Legal use of the fillable form M15NP additional charge for underpayment

The fillable form M15NP is legally recognized for reporting underpayment of taxes, provided it is filled out accurately and submitted on time. Compliance with IRS regulations is crucial to ensure that the form is valid. It is important to keep copies of the completed form and any supporting documents in case of audits or inquiries from tax authorities.

Filing deadlines / important dates

Filing deadlines for the fillable form M15NP typically align with the annual tax filing deadlines set by the IRS. Taxpayers should be aware of these key dates to avoid penalties:

- April 15: Standard deadline for individual tax returns.

- Estimated tax payments: Due quarterly, typically on April 15, June 15, September 15, and January 15 of the following year.

Penalties for non-compliance

Failure to accurately complete and submit the fillable form M15NP can result in significant penalties. The IRS may impose fines for late submissions or underpayment of taxes. Additionally, interest may accrue on any unpaid amounts. It is essential to understand these consequences to ensure compliance and avoid financial repercussions.

Quick guide on how to complete fillable form m15np additional charge for underpayment

Complete Fillable Form M15np Additional Charge For Underpayment with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Form M15np Additional Charge For Underpayment on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Fillable Form M15np Additional Charge For Underpayment effortlessly

- Find Fillable Form M15np Additional Charge For Underpayment and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight key portions of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your delivery method for the document: via email, SMS, an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign Fillable Form M15np Additional Charge For Underpayment to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form m15np additional charge for underpayment

Create this form in 5 minutes!

How to create an eSignature for the fillable form m15np additional charge for underpayment

How to make an e-signature for your PDF in the online mode

How to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is m15np and how does it work with airSlate SignNow?

m15np is a unique identifier related to our product offerings. With airSlate SignNow, businesses can easily send and eSign documents using our intuitive interface, allowing for quick transactions and improved efficiency. The m15np framework ensures seamless integration across various platforms.

-

What pricing options are available for airSlate SignNow considering m15np?

AirSlate SignNow offers flexible pricing plans tailored to meet diverse needs. The m15np strategy is designed to provide businesses with cost-effective solutions that enhance document workflow without breaking the bank. You can choose from monthly or annual subscriptions, depending on your organization's requirements.

-

What key features does airSlate SignNow include with m15np?

AirSlate SignNow, under the m15np model, includes essential features like secure eSigning, document templates, and automated workflows. These tools are designed to simplify the signing process while maintaining compliance and security. Users can benefit from a streamlined experience that enhances productivity.

-

How does airSlate SignNow improve workflow efficiency with m15np?

By incorporating m15np into our workflow, airSlate SignNow signNowly reduces the time it takes to process documents. Businesses can send documents for eSignature in just a few clicks, removing lengthy delays associated with traditional methods. This efficiency results in quicker deals and satisfied clients.

-

Can airSlate SignNow integrate with other software using m15np?

Yes, airSlate SignNow supports integrations with numerous applications utilizing the m15np approach. This allows businesses to connect their existing software tools for a cohesive workflow. Whether it's CRM systems or cloud storage, our platform can easily sync with your tech stack.

-

What benefits can businesses expect from using airSlate SignNow and m15np?

Businesses can expect signNow time savings and improved document management when using airSlate SignNow with m15np. The easy-to-use interface and reliable eSigning capabilities allow for efficient processes, improved customer satisfaction, and reduced turnaround times for contracts and agreements.

-

Is airSlate SignNow secure, and how does m15np enhance security?

Absolutely! AirSlate SignNow prioritizes security, and the m15np framework bolsters this by employing advanced encryption and authentication measures. This ensures that all documents are securely handled, providing peace of mind for businesses when signing sensitive information.

Get more for Fillable Form M15np Additional Charge For Underpayment

Find out other Fillable Form M15np Additional Charge For Underpayment

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template