M15NP, Additional Charge for Underpayment of Estimated Tax 2022-2026

What is the M15NP, Additional Charge For Underpayment Of Estimated Tax

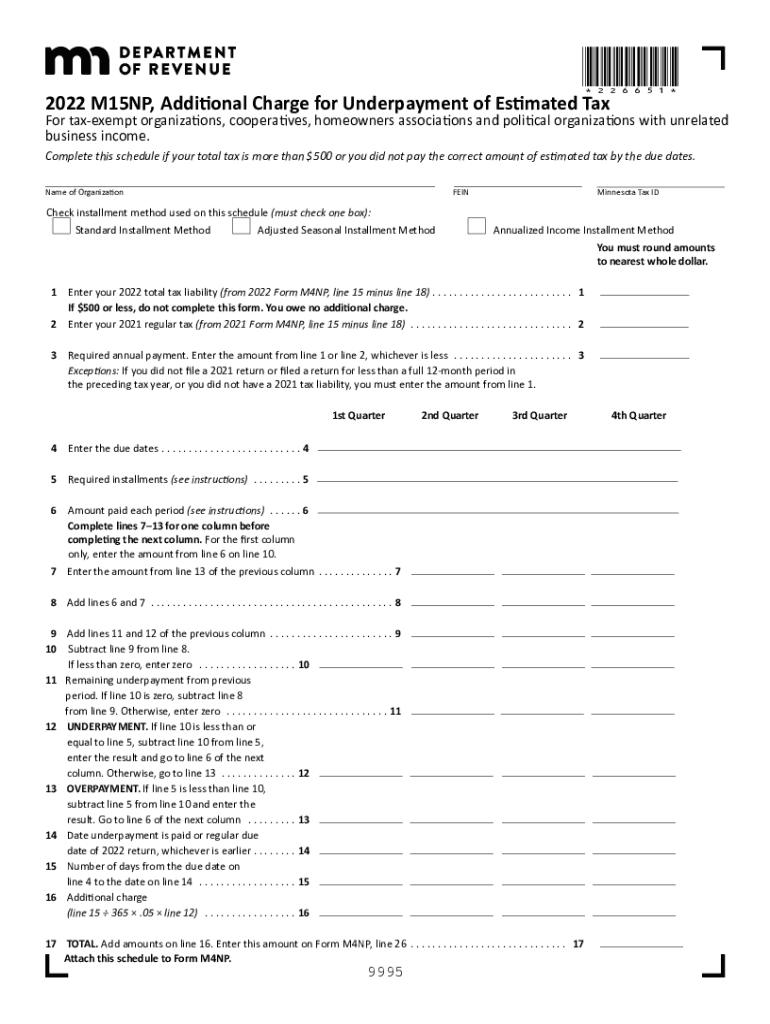

The M15NP form is specifically designed to calculate the additional charge for underpayment of estimated tax in the United States. This form is essential for taxpayers who have not paid enough estimated tax throughout the year, leading to potential penalties. The M15NP helps individuals and businesses assess their tax liability and determine the amount owed to avoid further penalties. Understanding this form is crucial for maintaining compliance with tax obligations.

How to use the M15NP, Additional Charge For Underpayment Of Estimated Tax

Using the M15NP involves several key steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your total tax liability for the year and compare it to the estimated tax payments you have made. The M15NP form will guide you through determining any additional charges due to underpayment. It is advisable to consult with a tax professional if you encounter any complexities during this process.

Steps to complete the M15NP, Additional Charge For Underpayment Of Estimated Tax

Completing the M15NP requires careful attention to detail. Follow these steps:

- Begin by entering your personal information at the top of the form.

- List your total tax liability for the year.

- Document the estimated tax payments you have made to date.

- Calculate the difference to determine if you owe additional charges.

- Complete any necessary calculations as prompted by the form.

- Review your entries for accuracy before submission.

Legal use of the M15NP, Additional Charge For Underpayment Of Estimated Tax

The M15NP form is legally recognized as a valid document for reporting additional charges related to underpayment of estimated tax. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Compliance with IRS regulations is crucial, as failure to properly use this form can lead to penalties and interest on unpaid amounts.

Filing Deadlines / Important Dates

Filing deadlines for the M15NP are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. If you are self-employed or have other specific circumstances, be aware of any additional deadlines that may apply. Keeping track of these dates is essential for maintaining compliance and avoiding unnecessary charges.

Penalties for Non-Compliance

Failure to comply with the requirements of the M15NP can result in significant penalties. If you do not submit the form on time or inaccurately report your estimated tax payments, you may face fines from the IRS. Additionally, unpaid taxes can accrue interest, increasing your overall liability. Understanding these penalties can motivate timely and accurate filing.

Quick guide on how to complete 2022 m15np additional charge for underpayment of estimated tax

Prepare M15NP, Additional Charge For Underpayment Of Estimated Tax easily on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Manage M15NP, Additional Charge For Underpayment Of Estimated Tax on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign M15NP, Additional Charge For Underpayment Of Estimated Tax with ease

- Locate M15NP, Additional Charge For Underpayment Of Estimated Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using the tools airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Choose how you would prefer to deliver your form, either by email, SMS, or invitation link, or download it to your computer.

Forget about missing or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign M15NP, Additional Charge For Underpayment Of Estimated Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 m15np additional charge for underpayment of estimated tax

Create this form in 5 minutes!

People also ask

-

What is m15np and how does it work with airSlate SignNow?

M15np is a feature within airSlate SignNow that streamlines the document signing process. It allows users to send and eSign documents securely, ensuring a quick turnaround on important paperwork. By leveraging m15np, businesses can improve workflow efficiency and reduce the time spent on document management.

-

How much does airSlate SignNow with m15np cost?

Pricing for airSlate SignNow, including the m15np feature, varies based on the plan selected. For teams that require advanced capabilities, m15np is included in professional and business plans, which offer a range of functionalities. Visit our pricing page for detailed information on costs and available plans.

-

What are the key features of m15np in airSlate SignNow?

M15np in airSlate SignNow includes electronic signatures, document templates, and real-time tracking of document status. These features enhance the signing experience, providing users with a fast, secure, and organized method of document management. Additionally, m15np offers integrations with various applications to streamline processes further.

-

Can m15np integrate with other software tools?

Absolutely! M15np is designed to integrate seamlessly with a variety of software tools and platforms. This ensures that businesses can incorporate airSlate SignNow into their existing workflows effortlessly, enhancing productivity and collaboration across teams.

-

What benefits does using m15np in airSlate SignNow provide?

Using m15np in airSlate SignNow signNowly improves the speed and reliability of document processing. It reduces manual errors and eliminates the need for physical paperwork, ultimately saving time and resources. These benefits enhance overall efficiency and contribute to a smoother business operation.

-

Is m15np secure for handling sensitive documents?

Yes, m15np in airSlate SignNow prioritizes security and compliance with industry standards. It employs encryption and secure access protocols to ensure that your sensitive documents are well protected. Businesses can rest assured knowing their data is safe while using airSlate SignNow.

-

How easy is it to get started with m15np in airSlate SignNow?

Getting started with m15np in airSlate SignNow is incredibly easy. Users can sign up for an account and within minutes, begin sending documents for eSignature. Comprehensive tutorials and customer support are also available to help users navigate any challenges they might face.

Get more for M15NP, Additional Charge For Underpayment Of Estimated Tax

- Nebraska tenant in form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497318081 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497318082 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497318083 form

- Nebraska landlord tenant 497318084 form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497318085 form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497318086 form

- Letter from tenant to landlord about insufficient notice of rent increase nebraska form

Find out other M15NP, Additional Charge For Underpayment Of Estimated Tax

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form