REV 677 LE 05 14 POWER of ATTORNEY and DECLARATION of REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F 2014

Understanding the REV 677 LE 05 14 Power of Attorney and Declaration of Representative

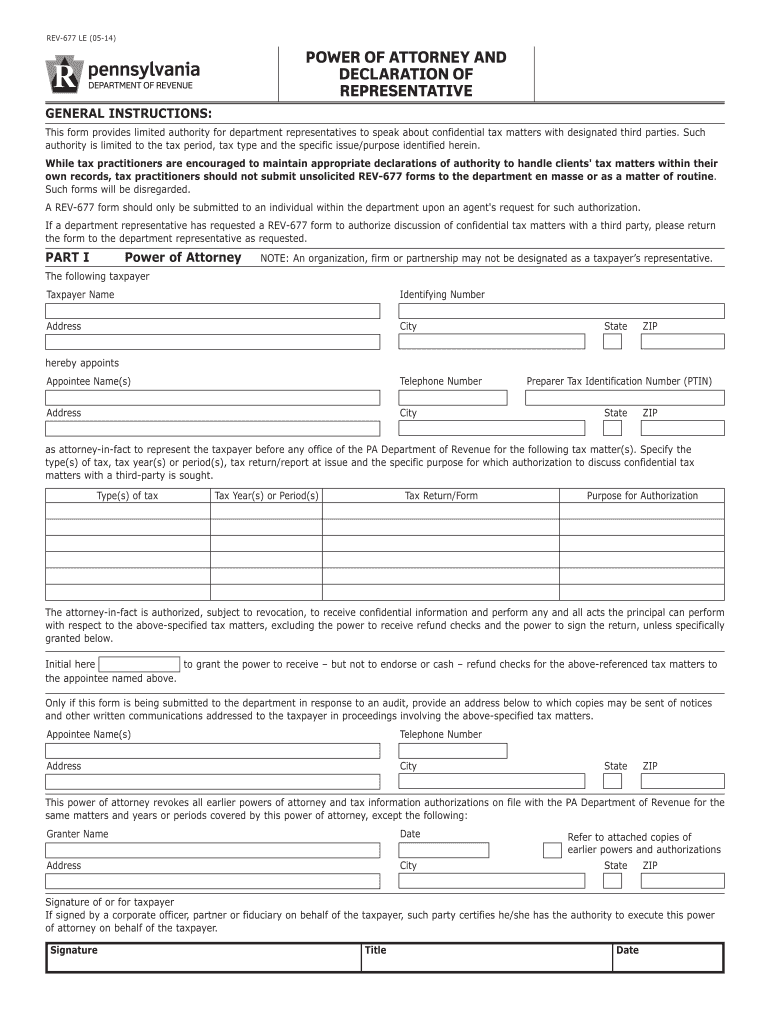

The REV 677 LE 05 14 Power of Attorney and Declaration of Representative is a crucial document that grants limited authority to designated representatives. This form allows them to discuss confidential tax matters on behalf of the taxpayer with the appropriate department representatives. It is particularly useful for individuals who may need assistance managing their tax affairs, ensuring that their representatives can communicate effectively with tax authorities.

How to Use the REV 677 LE 05 14 Power of Attorney

To utilize the REV 677 LE 05 14 Power of Attorney, fill out the form with accurate information regarding the taxpayer and the designated representative. Ensure that all required fields are completed, including the taxpayer's identification details and the specific powers being granted. Once filled out, the form must be signed and dated by the taxpayer to validate the authority granted to the representative. This document can then be submitted to the relevant tax authority for processing.

Steps to Complete the REV 677 LE 05 14 Power of Attorney

Completing the REV 677 LE 05 14 Power of Attorney involves several key steps:

- Obtain the form from the relevant tax authority or authorized source.

- Fill in the taxpayer's details, including name, address, and taxpayer identification number.

- Provide the representative's information, ensuring that their identification details are accurate.

- Specify the limited authority being granted, detailing the scope of the representative's powers.

- Sign and date the form to confirm the authorization.

- Submit the completed form to the appropriate department.

Key Elements of the REV 677 LE 05 14 Power of Attorney

Several key elements define the REV 677 LE 05 14 Power of Attorney:

- Limited Authority: The form specifies the extent of the powers granted, ensuring that representatives act within defined boundaries.

- Confidentiality: It allows representatives to discuss confidential tax matters, maintaining the privacy of the taxpayer's information.

- Designated Representatives: The form must clearly identify who is authorized to act on behalf of the taxpayer.

- Signature Requirement: A valid signature from the taxpayer is essential to validate the document.

Legal Use of the REV 677 LE 05 14 Power of Attorney

The legal use of the REV 677 LE 05 14 Power of Attorney is governed by specific regulations that ensure compliance with tax laws. This form is legally binding, provided it meets all requirements, including proper completion and signatures. It is essential for taxpayers to understand their rights and responsibilities when granting authority to representatives, as misuse can lead to complications with tax authorities.

Examples of Using the REV 677 LE 05 14 Power of Attorney

Examples of scenarios where the REV 677 LE 05 14 Power of Attorney may be utilized include:

- A taxpayer needing assistance from a tax professional to address tax issues or audits.

- An individual who is unable to attend meetings with tax authorities due to health or logistical reasons.

- Business owners who require their accountants to handle tax matters on their behalf.

Quick guide on how to complete rev 677 le 05 14 power of attorney and declaration of representative general instructions this form provides limited authority

Complete REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your files quickly without delays. Manage REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F with ease

- Obtain REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 677 le 05 14 power of attorney and declaration of representative general instructions this form provides limited authority

Create this form in 5 minutes!

How to create an eSignature for the rev 677 le 05 14 power of attorney and declaration of representative general instructions this form provides limited authority

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS?

The REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS is a form that grants limited authority for department representatives to discuss confidential tax matters with designated third parties. This form ensures that your tax information is handled appropriately and securely while allowing for necessary communication.

-

How can I use the REV 677 LE 05 14 POWER OF ATTORNEY in my business?

You can utilize the REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS by designating trusted representatives to manage your tax matters. This will streamline the process of handling confidential information, ensuring compliance while giving you peace of mind.

-

What are the benefits of using the REV 677 LE 05 14 POWER OF ATTORNEY form?

The benefits of the REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS include enhanced confidentiality, simplified communication with tax authorities, and reduced compliance risks. This form helps ensure that your designated representatives can act on your behalf while safeguarding sensitive information.

-

Can I integrate the REV 677 LE 05 14 POWER OF ATTORNEY with other services?

Yes, the REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS can be integrated with various services such as cloud storage and accounting software. This integration helps streamline the submission process, allowing for seamless management of your documents and tax matters.

-

Is the REV 677 LE 05 14 POWER OF ATTORNEY form customizable?

Absolutely! The REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS can be tailored to meet your specific needs. This customization ensures that you can designate the appropriate authorities for your unique tax situations.

-

How much does the REV 677 LE 05 14 POWER OF ATTORNEY cost?

The cost of utilizing the REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS varies based on the platform you choose to use. airSlate SignNow offers cost-effective solutions that provide excellent value for managing your documents and signatures securely.

-

Who can I authorize using the REV 677 LE 05 14 POWER OF ATTORNEY?

You can authorize any individual or entity that you trust to manage your tax matters using the REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS. This flexibility allows you to designate individuals who are best equipped to handle your confidential tax information.

Get more for REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F

- Va form tangible

- California pre lien and mechanics lien national lien law form

- Business license new application yes no town of pulaski form

- Cabo form

- F622 099 000 what you should know installing sheetrockdrywall form

- Business associate agreement 2018 07 17 form

- Sta form

- Denrsd gov sd eform 2052ld v1

Find out other REV 677 LE 05 14 POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE GENERAL INSTRUCTIONS This Form Provides Limited Authority F

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form