Printable New York Form it 631 Claim for Security Officer Training Tax Credit 2020

What is the Printable New York Form IT 631 Claim For Security Officer Training Tax Credit

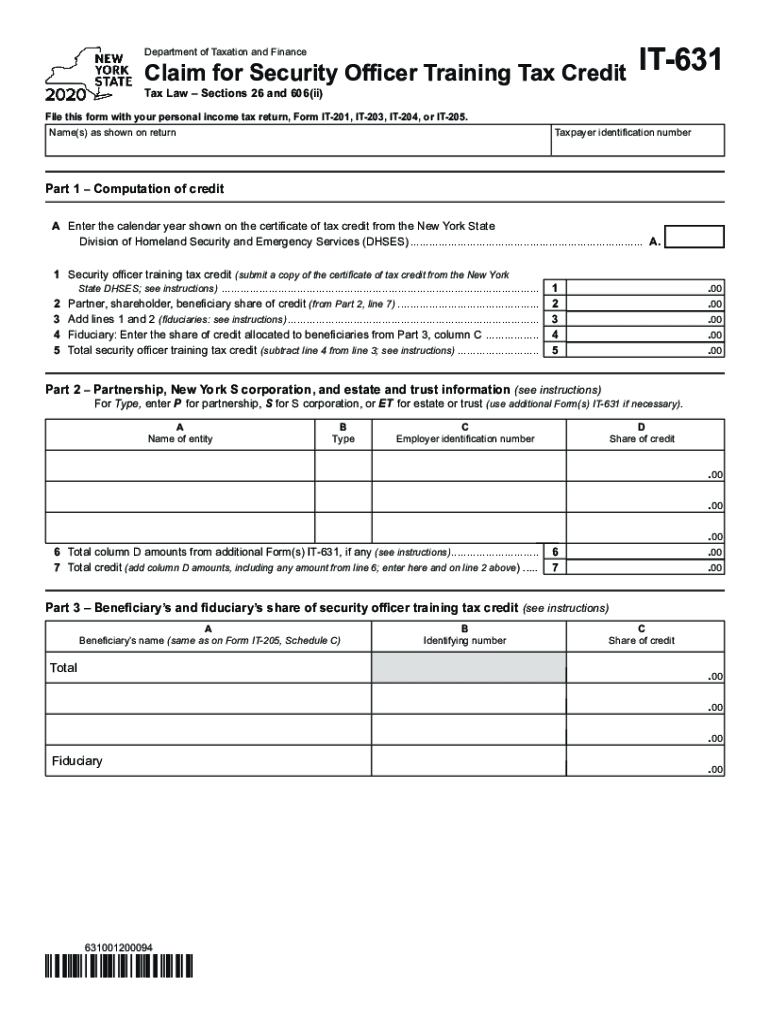

The Printable New York Form IT 631 is a tax credit claim form designed specifically for businesses that invest in training their security officers. This form allows eligible employers to claim a credit against their New York State taxes for expenses incurred in providing training to their security personnel. The training must meet specific criteria outlined by the state, ensuring that the workforce is adequately prepared and certified to handle security-related tasks effectively.

How to use the Printable New York Form IT 631 Claim For Security Officer Training Tax Credit

Using the Printable New York Form IT 631 involves several straightforward steps. First, gather all necessary documentation related to the training expenses, including receipts and proof of training completion. Next, accurately fill out the form, providing details such as the names of the security officers trained, the type of training received, and the associated costs. Once completed, submit the form along with your tax return to the New York State Department of Taxation and Finance. Ensure that all information is correct to avoid delays in processing your claim.

Steps to complete the Printable New York Form IT 631 Claim For Security Officer Training Tax Credit

To complete the Printable New York Form IT 631, follow these steps:

- Download the form from an official source.

- Enter your business information, including the name, address, and Employer Identification Number (EIN).

- List the names of the security officers who received training.

- Detail the training programs attended, including dates and costs.

- Calculate the total credit amount based on the eligible expenses.

- Sign and date the form to certify its accuracy.

Eligibility Criteria

Eligibility for claiming the tax credit using the Printable New York Form IT 631 requires that the training provided meets specific standards. The training must be directly related to the duties of security officers and must be conducted by a qualified instructor or institution. Additionally, the employer must be registered to do business in New York State and must have incurred eligible expenses during the tax year for which the credit is being claimed.

Form Submission Methods

The Printable New York Form IT 631 can be submitted through several methods. Employers may choose to file the form electronically as part of their tax return, which is often the most efficient option. Alternatively, the form can be printed and mailed to the appropriate address provided by the New York State Department of Taxation and Finance. In-person submissions may also be possible at designated offices, depending on local regulations and availability.

Required Documents

When submitting the Printable New York Form IT 631, employers must include supporting documentation to validate their claim. This typically includes:

- Receipts for training expenses.

- Certificates of completion for the training programs.

- Any additional documentation that proves the training met state requirements.

Having these documents ready will facilitate a smoother review process by tax authorities.

Quick guide on how to complete printable 2020 new york form it 631 claim for security officer training tax credit

Effortlessly Prepare Printable New York Form IT 631 Claim For Security Officer Training Tax Credit on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers a superb environmentally friendly substitute to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Printable New York Form IT 631 Claim For Security Officer Training Tax Credit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Printable New York Form IT 631 Claim For Security Officer Training Tax Credit with Ease

- Obtain Printable New York Form IT 631 Claim For Security Officer Training Tax Credit and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically designed for that purpose, provided by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or through an invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Printable New York Form IT 631 Claim For Security Officer Training Tax Credit to ensure efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 631 claim for security officer training tax credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 631 claim for security officer training tax credit

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 631?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and eSign documents efficiently. It 631 describes the regulatory framework that many companies must follow, making compliance crucial. By utilizing airSlate SignNow, you can ensure that your document processes align with the requirements of it 631.

-

How much does airSlate SignNow cost for businesses looking to comply with it 631?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. For organizations focused on meeting it 631 regulations, it’s essential to select a plan that provides the necessary features for secure eSignature processes. Contact our sales team for tailored pricing that fits your compliance requirements.

-

What features does airSlate SignNow offer to enhance compliance with it 631?

airSlate SignNow provides features such as secure document storage, audit trails, and customizable workflows designed to support compliance with it 631. These features ensure that your document handling processes are not only efficient but also legally compliant. This makes it easier for businesses to meet their regulatory needs.

-

Can airSlate SignNow integrate with other tools that support it 631 compliance?

Yes, airSlate SignNow can integrate seamlessly with a variety of tools like CRM systems and document management software that are crucial for compliance with it 631. These integrations help streamline your workflow and maintain a consistent approach towards regulatory adherence. Leverage these integrations to enhance efficiency and ensure compliance.

-

What are the benefits of using airSlate SignNow for it 631 document processes?

Using airSlate SignNow for document processes related to it 631 offers signNow benefits, including faster turnaround times and improved document security. The platform ensures that every signature meets compliance standards, reducing potential legal risks. By streamlining document workflows, businesses can focus on their core operations.

-

How does airSlate SignNow ensure the security of documents related to it 631?

airSlate SignNow prioritizes the security of documents by employing advanced encryption and secure cloud storage protocols. This is particularly important for documents requiring compliance with it 631. With airSlate SignNow, you can trust that your sensitive information is protected against unauthorized access.

-

Is airSlate SignNow user-friendly for teams working with it 631?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for teams to manage documents efficiently. Whether you're addressing compliance with it 631 or simply looking to streamline workflows, the intuitive interface simplifies the signing process for all users.

Get more for Printable New York Form IT 631 Claim For Security Officer Training Tax Credit

- Prison intake form

- Certificate of acknowledgment form

- At issue memorandum request to set case for trial family form

- Tennessee department of professional responsibility printable complaint form

- Printed overages assignment of rights to claim excess proceeds sample document form

- I declare under the penalty of perjury under form

- Form 1052

- Gc 399 notice of the conservatees death california courts form

Find out other Printable New York Form IT 631 Claim For Security Officer Training Tax Credit

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation