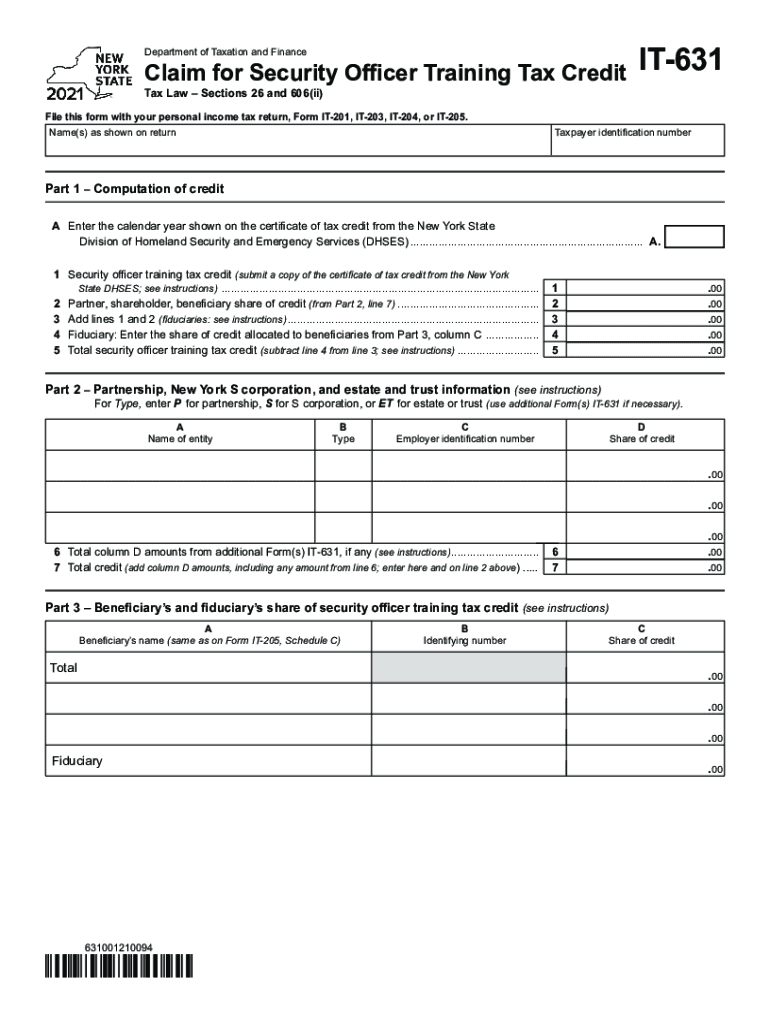

Form it 631 Claim for Security Officer Training Tax Credit 2021

What is the Form IT-631 Claim for Security Officer Training Tax Credit

The Form IT-631 is a tax document used to claim a credit for expenses incurred during security officer training in New York. This form is specifically designed for businesses that invest in training their security personnel. By completing this form, businesses can receive a tax credit that helps offset the costs associated with training, thereby promoting a safer working environment and enhancing the skills of security officers.

How to Use the Form IT-631 Claim for Security Officer Training Tax Credit

To utilize the Form IT-631, businesses must first ensure that they meet the eligibility criteria set by the New York State Department of Taxation and Finance. Once eligibility is confirmed, businesses can download the form from the official state website or obtain it from authorized tax professionals. After filling out the necessary information, including details about the training expenses and the security officers involved, the completed form should be submitted with the business's tax return.

Steps to Complete the Form IT-631 Claim for Security Officer Training Tax Credit

Completing the Form IT-631 involves several steps:

- Gather all relevant documentation related to the training expenses, including invoices and receipts.

- Fill out the form accurately, providing all required information about the business and the training conducted.

- Calculate the total amount of the credit being claimed based on the training expenses.

- Review the form for accuracy to avoid any potential penalties or delays.

- Submit the form along with your business's tax return by the designated deadline.

Eligibility Criteria for the Form IT-631 Claim for Security Officer Training Tax Credit

To qualify for the tax credit claimed through Form IT-631, businesses must meet specific eligibility criteria. These include:

- The business must be registered in New York State.

- Training must be provided to security officers employed by the business.

- Expenses must be directly related to the training programs and must be documented with receipts.

Required Documents for the Form IT-631 Claim for Security Officer Training Tax Credit

When completing the Form IT-631, businesses must provide several supporting documents to substantiate their claims. Key required documents include:

- Invoices and receipts for training expenses.

- Documentation proving the employment of the security officers who received training.

- Any additional records that demonstrate compliance with training requirements.

Form Submission Methods for the Form IT-631 Claim for Security Officer Training Tax Credit

The Form IT-631 can be submitted through various methods, ensuring flexibility for businesses. The submission options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form along with the business's tax return to the appropriate address.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete form it 631 claim for security officer training tax credit

Complete Form IT 631 Claim For Security Officer Training Tax Credit effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents rapidly without any delays. Handle Form IT 631 Claim For Security Officer Training Tax Credit on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign Form IT 631 Claim For Security Officer Training Tax Credit with ease

- Locate Form IT 631 Claim For Security Officer Training Tax Credit and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form IT 631 Claim For Security Officer Training Tax Credit and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 631 claim for security officer training tax credit

Create this form in 5 minutes!

How to create an eSignature for the form it 631 claim for security officer training tax credit

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is NY 631 in relation to airSlate SignNow?

NY 631 refers to a specific tax form used by businesses in New York. With airSlate SignNow, users can efficiently eSign and manage their NY 631 forms, ensuring compliance and timely submissions.

-

How does airSlate SignNow help with document management for NY 631?

airSlate SignNow streamlines document management by allowing users to upload, eSign, and share NY 631 forms securely. This eliminates the need for printing and mailing, making the process faster and more efficient.

-

Is airSlate SignNow cost-effective for managing NY 631 forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses handling NY 631 forms. With various pricing tiers, users can choose a plan that fits their needs while saving on printing and postage costs.

-

What features does airSlate SignNow offer for NY 631 eSignature?

airSlate SignNow provides features such as customizable templates, secure eSigning, and tracking capabilities specifically for NY 631 forms. These features enhance ease of use and ensure that documents are completed correctly.

-

Can I integrate airSlate SignNow with other applications while handling NY 631?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM and accounting software, making it easier to manage NY 631 forms along with your other business processes.

-

What are the benefits of using airSlate SignNow for NY 631 submissions?

Using airSlate SignNow for NY 631 submissions increases efficiency, reduces errors, and accelerates turnaround times. It also provides a secure platform for sensitive documents, ensuring compliance with state requirements.

-

Is airSlate SignNow easy to use for our team managing NY 631?

Yes, airSlate SignNow is designed with user-friendliness in mind. Team members can quickly learn how to navigate the platform and manage NY 631 forms without extensive training.

Get more for Form IT 631 Claim For Security Officer Training Tax Credit

- Quitclaim deed trust to individual california form

- Ca joint tenants form

- Warranty deed for husband and wife to three individuals as joint tenants california form

- Quitclaim deed for three individuals to two individuals as tenants in common california form

- Ca condominium form

- Deed joint tenants form

- Ca quitclaim deed 497299582 form

- Grant deed from a trust to llc california form

Find out other Form IT 631 Claim For Security Officer Training Tax Credit

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF