Form it 631 Claim for Security Officer Training Tax Credit Tax 2022

What is the Form IT-631 Claim For Security Officer Training Tax Credit Tax

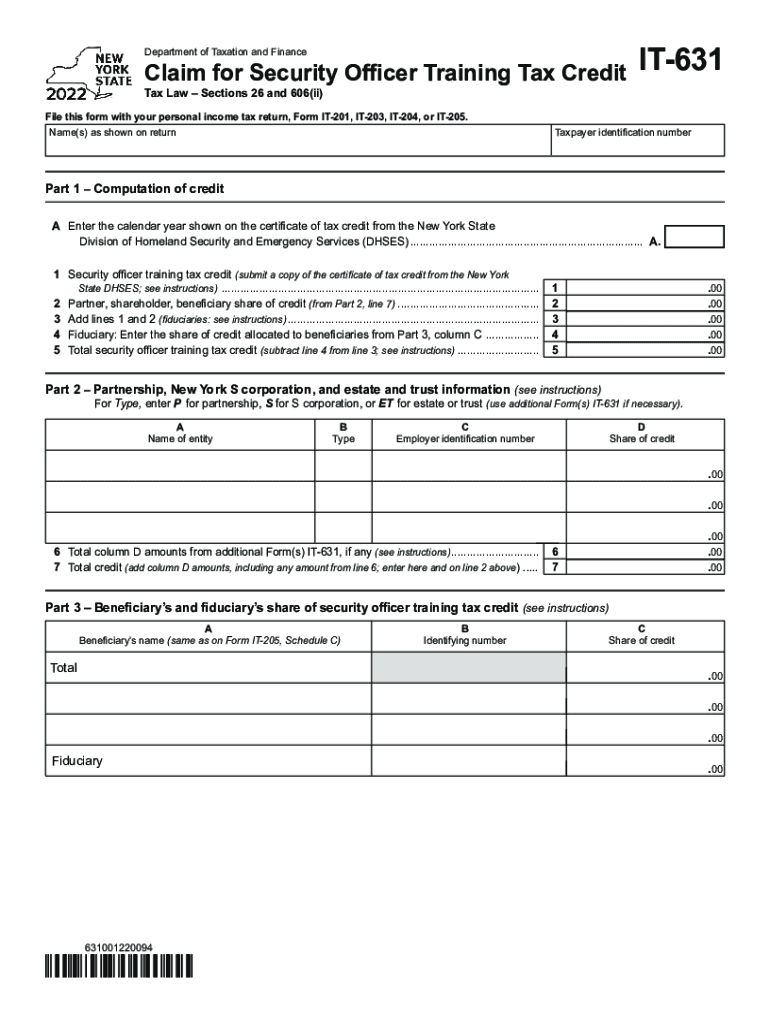

The Form IT-631 is a tax document used in the United States that allows businesses to claim a tax credit for expenses related to security officer training. This form is specifically designed for employers who invest in training their security personnel, enabling them to receive a financial benefit from their investment. By completing the IT-631, businesses can reduce their tax liability, making it an essential tool for those in the security industry.

Steps to complete the Form IT-631 Claim For Security Officer Training Tax Credit Tax

Completing the Form IT-631 involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all necessary documentation related to the training expenses incurred for security officers. This may include receipts, invoices, and training certificates. Next, fill out the form by providing detailed information about the business, the training conducted, and the associated costs. It is crucial to double-check all entries for accuracy before submission. Finally, file the completed form with the appropriate tax authority, either electronically or via mail, depending on your preference.

Eligibility Criteria

To qualify for the tax credit associated with the Form IT-631, businesses must meet specific eligibility criteria. Primarily, the training must be conducted for security officers employed by the business. Additionally, the training should enhance the skills necessary for their roles, aligning with industry standards. Employers must also ensure that the training expenses are documented thoroughly to support the claim. Understanding these criteria is vital for businesses looking to benefit from this tax credit.

Required Documents

When filing the Form IT-631, several documents are required to substantiate the claim. Employers should collect training receipts, invoices detailing the costs, and any relevant training certificates for the security officers. Additionally, a record of the training sessions, including dates and topics covered, may be necessary to validate the claim. Having these documents organized and readily available can streamline the filing process and enhance the credibility of the submission.

Form Submission Methods (Online / Mail / In-Person)

The Form IT-631 can be submitted through various methods, providing flexibility for businesses. Employers may choose to file the form online, which is often the quickest method, allowing for immediate processing. Alternatively, the form can be mailed to the appropriate tax authority, ensuring that all required documentation is included. In-person submissions may also be possible at designated tax offices, offering another option for those who prefer face-to-face interactions.

Legal use of the Form IT-631 Claim For Security Officer Training Tax Credit Tax

Understanding the legal use of the Form IT-631 is essential for compliance and to ensure that the tax credit is claimed correctly. The form must be filled out in accordance with IRS guidelines and state regulations. It is important to maintain accurate records of all training expenses and to ensure that the training provided meets the necessary standards. Using the form legally not only protects the business from potential audits but also maximizes the benefits of the tax credit.

Quick guide on how to complete form it 631 claim for security officer training tax credit tax

Complete Form IT 631 Claim For Security Officer Training Tax Credit Tax effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form IT 631 Claim For Security Officer Training Tax Credit Tax on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and eSign Form IT 631 Claim For Security Officer Training Tax Credit Tax with ease

- Locate Form IT 631 Claim For Security Officer Training Tax Credit Tax and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 631 Claim For Security Officer Training Tax Credit Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 631 claim for security officer training tax credit tax

Create this form in 5 minutes!

How to create an eSignature for the form it 631 claim for security officer training tax credit tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NY 631 and how does it relate to airSlate SignNow?

NY 631 refers to a specific type of document or form that businesses in New York need to submit. The airSlate SignNow platform simplifies the process of signing and managing NY 631 documents, ensuring compliance and efficient workflow.

-

How much does airSlate SignNow cost for handling NY 631 documents?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including those that require NY 631 document management. You can choose a plan that fits your budget while benefiting from essential features designed for seamless eSigning.

-

What features does airSlate SignNow offer for NY 631 document processing?

airSlate SignNow provides tools such as customizable templates and automated workflows tailored for NY 631. This makes it easier for businesses to prepare, send, and sign necessary documents quickly and securely.

-

What are the benefits of using airSlate SignNow for NY 631 documents?

Using airSlate SignNow for managing NY 631 documents streamlines your operations, reduces paper usage, and accelerates the signing process. This leads to improved efficiency and faster contract turnaround times.

-

Can I integrate airSlate SignNow with other software for NY 631 processing?

Yes, airSlate SignNow supports integrations with various applications to help streamline your NY 631 document management. Popular integrations include CRM platforms, cloud storage services, and project management tools.

-

Is airSlate SignNow compliant with legal requirements for NY 631 documents?

Absolutely! airSlate SignNow is compliant with all legal standards necessary for eSigning NY 631 documents. This ensures that all signatures are legally binding and secure, providing peace of mind for businesses.

-

How does airSlate SignNow enhance the security of NY 631 documents?

airSlate SignNow includes robust security features such as encryption, secure storage, and user authentication to protect your NY 631 documents. Your sensitive information remains secure throughout the signing process.

Get more for Form IT 631 Claim For Security Officer Training Tax Credit Tax

- South dakota business 497326495 form

- South dakota property 497326496 form

- New resident guide south dakota form

- Release of mortgage by lender by corporate lender south dakota form

- Release of mortgage by lender individual lender or holder south dakota form

- Partial release of property from mortgage for corporation south dakota form

- Partial release of property from mortgage by individual holder south dakota form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy south dakota form

Find out other Form IT 631 Claim For Security Officer Training Tax Credit Tax

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free