New York Income Allocation 2020

What is the New York Income Allocation

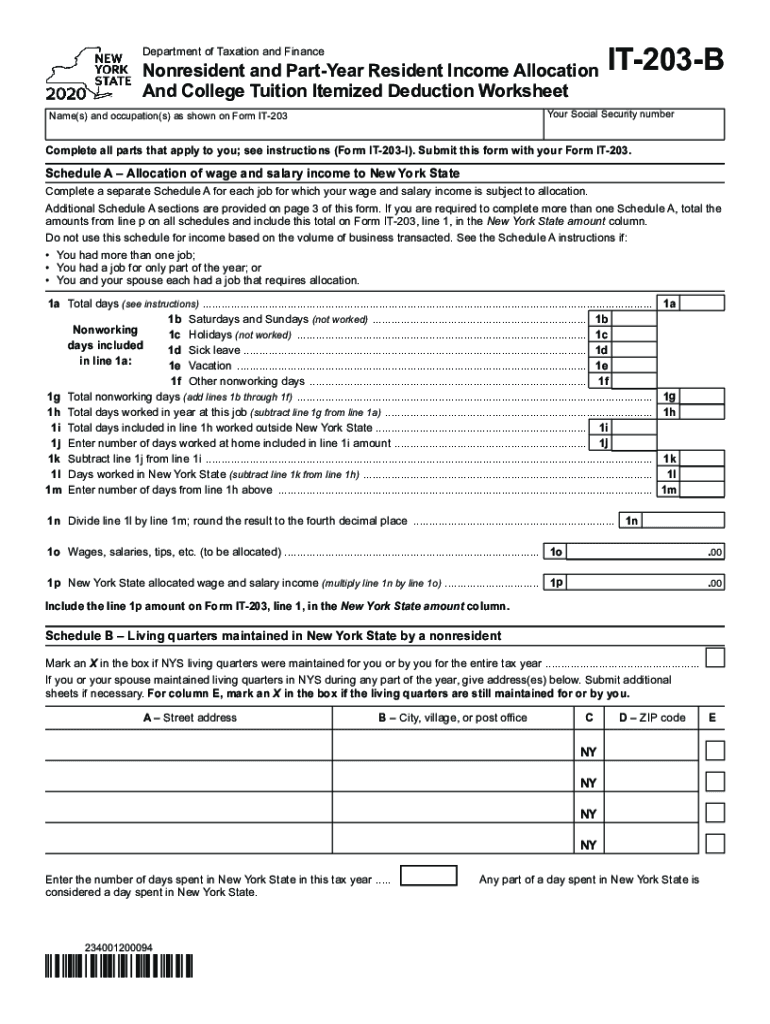

The New York Income Allocation, specifically the IT-203-B form, is utilized by part-year residents and non-residents of New York State to allocate income earned within the state versus income earned outside of it. This form is essential for accurately reporting income and ensuring compliance with state tax laws. It helps determine the appropriate amount of tax owed to New York based on the income sourced from the state during the tax year.

Steps to complete the New York Income Allocation

Completing the IT-203-B form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms and any other income statements. Next, determine the total income earned while a resident of New York and the total income earned while residing outside the state. You will then need to fill out the allocation worksheet, detailing the income earned in New York and the corresponding deductions. Finally, review the completed form for accuracy before submitting it with your New York State tax return.

Key elements of the New York Income Allocation

The IT-203-B form includes several critical elements that taxpayers must understand. These elements include the allocation of income, which distinguishes between income earned in New York and income earned elsewhere. The form also requires details about specific deductions and credits that may apply, such as the New York standard deduction or itemized deductions. Additionally, the form includes sections for reporting any tax credits that may reduce overall tax liability.

Legal use of the New York Income Allocation

The legal use of the IT-203-B form is governed by New York State tax laws, which require accurate reporting of income for tax purposes. When completed correctly, this form serves as a legally binding document that reflects a taxpayer's income allocation for the year. It is crucial to adhere to state regulations regarding eSignature and electronic submissions to ensure that the form is considered valid by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IT-203-B form. Generally, the form is due on the same date as the federal tax return, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines, especially for those who may qualify for extensions or other special circumstances.

Form Submission Methods (Online / Mail / In-Person)

The IT-203-B form can be submitted through various methods to accommodate different taxpayer preferences. Taxpayers can choose to file the form online using the New York State Department of Taxation and Finance's e-filing system, which offers a secure and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate address provided by the state or submitted in person at designated tax offices. Each submission method has specific requirements and processing times that should be considered.

Quick guide on how to complete new york income allocation

Complete New York Income Allocation with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage New York Income Allocation on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign New York Income Allocation seamlessly

- Find New York Income Allocation and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign New York Income Allocation and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york income allocation

Create this form in 5 minutes!

How to create an eSignature for the new york income allocation

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the it 203b feature in airSlate SignNow?

The it 203b feature in airSlate SignNow allows businesses to streamline their document signing process efficiently. Through this feature, users can create templates that simplify repetitive signing tasks, saving time and increasing productivity. By utilizing it 203b, you can ensure a smoother workflow and enhance your team's collaboration.

-

How does the it 203b pricing model work?

airSlate SignNow offers a competitive pricing model for its it 203b feature, designed to fit various business sizes. Pricing is based on the number of users and specific features required, ensuring you only pay for what you need. This flexibility makes it 203b an attractive option for startups and established businesses alike.

-

What are the main benefits of using it 203b?

Using it 203b comes with several benefits, including enhanced document security and improved workflow efficiency. It allows you to easily track document status and ensures all signatures are collected in a timely manner. Additionally, it 203b enhances your customers' experience with a professional and fast signing process.

-

Can I integrate it 203b with other software solutions?

Yes, airSlate SignNow's it 203b can be seamlessly integrated with various third-party applications like CRMs and project management tools. This interoperability helps streamline your workflows and centralize document management. These integrations enhance the overall functionality of it 203b within your existing infrastructure.

-

Is it 203b suitable for small businesses?

Absolutely! The it 203b feature is particularly well-suited for small businesses that need cost-effective eSigning solutions. With its user-friendly interface and scalability, small businesses can leverage it 203b to enhance their operations without incurring high costs. It's an ideal way for them to improve efficiency and customer satisfaction.

-

What types of documents can I manage with it 203b?

You can manage a wide variety of documents with it 203b, including contracts, agreements, and forms. airSlate SignNow supports various file formats, ensuring that you can handle all your essential documents in one platform. This versatility makes it 203b a comprehensive tool for your eSigning needs.

-

How secure is the it 203b feature?

The it 203b feature emphasizes security, with robust measures to protect your sensitive documents. airSlate SignNow employs encryption and user authentication protocols to ensure that your data remains secure throughout the signing process. This commitment to security allows you to confidently use it 203b for all your eSigning needs.

Get more for New York Income Allocation

Find out other New York Income Allocation

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now