Form it 203 B Nonresident and Part Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet Tax Year 2024-2026

Understanding the Form IT 203 B Nonresident and Part-Year Resident Income Allocation

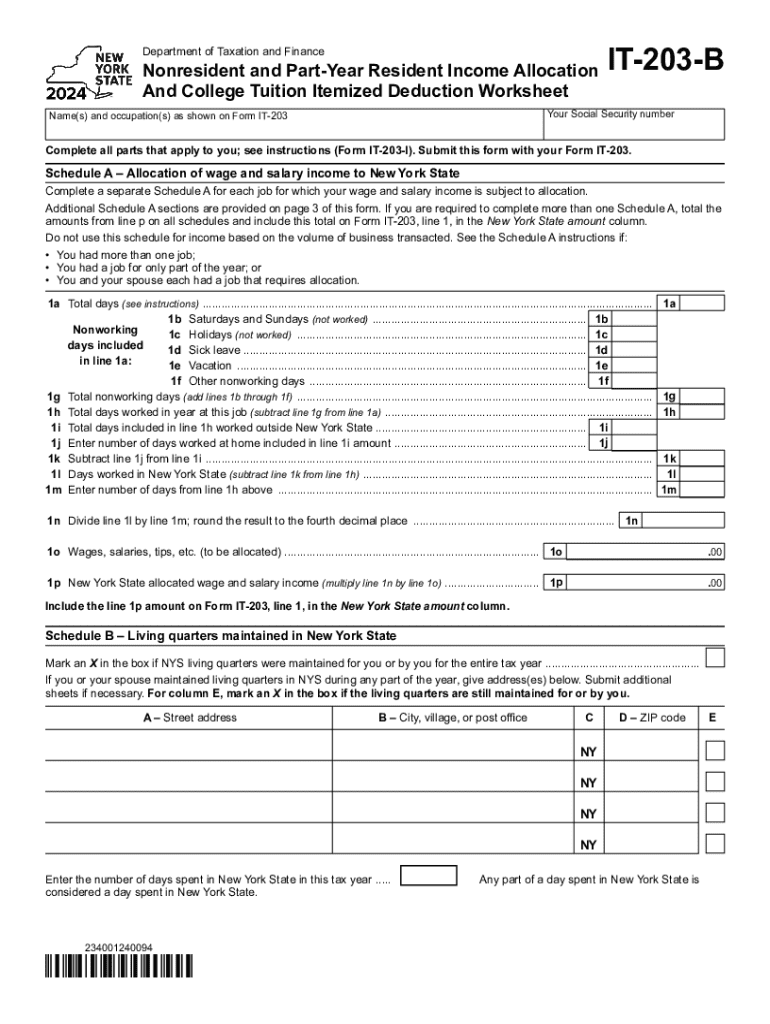

The Form IT 203 B is designed for nonresident and part-year resident taxpayers in New York. This form is essential for individuals who need to allocate their income and claim college tuition itemized deductions. It helps determine the amount of income earned within New York State, allowing for accurate tax calculations. The form is particularly relevant for those who may have earned income both inside and outside New York during the tax year.

How to Complete the Form IT 203 B

Completing the Form IT 203 B involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099s, and any records of income earned outside New York. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, both within and outside New York.

- Allocate your New York income by following the instructions provided on the form.

- Calculate any college tuition itemized deductions you are eligible for.

- Review your entries for accuracy before submission.

Obtaining the Form IT 203 B

The Form IT 203 B can be easily obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, paper copies may be available at local tax offices and libraries throughout New York State.

Key Elements of the Form IT 203 B

Several important elements make up the Form IT 203 B. These include:

- Personal identification details for the taxpayer.

- Income reporting sections for both New York and non-New York sources.

- Allocation methods for determining the taxable income within New York.

- Sections for claiming college tuition itemized deductions.

Understanding these elements is crucial for accurate completion and compliance with New York tax laws.

Filing Deadlines for the Form IT 203 B

Timely filing of the Form IT 203 B is essential to avoid penalties. The deadline typically aligns with the federal tax filing date, which is usually April fifteenth. If additional time is needed, taxpayers may request an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Eligibility Criteria for Using the Form IT 203 B

To qualify for using the Form IT 203 B, individuals must meet specific criteria. This includes being a nonresident or part-year resident of New York State during the tax year. Additionally, taxpayers must have earned income that requires allocation between New York and other states. Understanding these eligibility criteria helps ensure that the form is used correctly and that taxpayers receive any applicable deductions.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year 772079955

Create this form in 5 minutes!

How to create an eSignature for the form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year 772079955

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 203 b. feature in airSlate SignNow?

The 203 b. feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances efficiency by enabling users to send and eSign documents quickly and securely, making it ideal for businesses of all sizes.

-

How much does airSlate SignNow cost for the 203 b. feature?

The pricing for the 203 b. feature in airSlate SignNow is competitive and designed to fit various budgets. Users can choose from different subscription plans that offer flexibility and scalability based on their business needs.

-

What are the key benefits of using the 203 b. feature?

Using the 203 b. feature provides numerous benefits, including increased productivity and reduced turnaround times for document signing. It also enhances security and compliance, ensuring that your documents are handled safely and efficiently.

-

Can I integrate the 203 b. feature with other applications?

Yes, the 203 b. feature in airSlate SignNow can be easily integrated with various applications. This allows users to connect their existing workflows and enhance their document management processes seamlessly.

-

Is the 203 b. feature user-friendly for new users?

Absolutely! The 203 b. feature is designed with user-friendliness in mind, making it accessible for new users. With an intuitive interface, even those with minimal technical skills can navigate and utilize the feature effectively.

-

What types of documents can I send using the 203 b. feature?

You can send a wide variety of documents using the 203 b. feature, including contracts, agreements, and forms. This versatility makes it suitable for different industries and business needs.

-

How does the 203 b. feature ensure document security?

The 203 b. feature incorporates advanced security measures, including encryption and secure access controls. This ensures that your documents are protected throughout the signing process, giving you peace of mind.

Get more for Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year

Find out other Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now