Form it 203 B Nonresident and Part Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet Tax Year 2022

What is the Form IT 203 B?

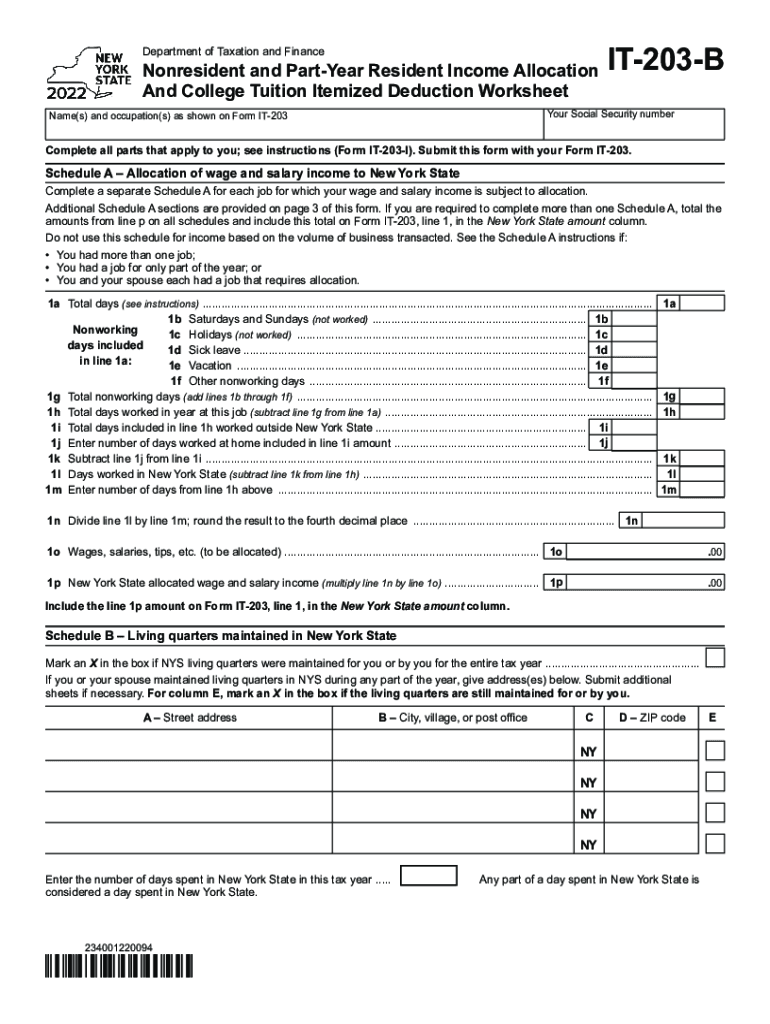

The Form IT 203 B is designed for nonresidents and part-year residents of New York who need to allocate their income for tax purposes. This form allows individuals to claim itemized deductions related to college tuition expenses. It is essential for accurately reporting income earned in New York while ensuring compliance with state tax regulations. Understanding the specifics of this form can help taxpayers maximize their deductions and minimize their tax liabilities.

Steps to Complete the Form IT 203 B

Completing the Form IT 203 B involves several key steps:

- Gather necessary documentation, including income statements and records of college tuition payments.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income earned in New York and any other relevant income sources.

- Allocate your income based on the time spent as a resident versus nonresident in New York.

- Detail your college tuition expenses to claim the appropriate deductions.

- Review the completed form for accuracy before submission.

Legal Use of the Form IT 203 B

The Form IT 203 B is legally recognized by the New York State Department of Taxation and Finance. Proper completion of this form ensures that taxpayers meet their obligations under state tax laws. It is crucial to adhere to the guidelines set forth by the state to avoid penalties and ensure that deductions are valid. Additionally, the form must be submitted by the designated filing deadline to maintain compliance.

Key Elements of the Form IT 203 B

Several key elements must be included when filling out the Form IT 203 B:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income earned in New York and other states.

- Deductions: Specific college tuition expenses that qualify for itemization.

- Residency Status: Clear indication of the periods spent as a resident or nonresident.

Eligibility Criteria for the Form IT 203 B

To be eligible to use the Form IT 203 B, individuals must meet specific criteria:

- Be a nonresident or part-year resident of New York State.

- Have earned income in New York during the tax year.

- Have incurred college tuition expenses that qualify for deductions.

Filing Deadlines for the Form IT 203 B

It is important to be aware of the filing deadlines associated with the Form IT 203 B. Typically, the form must be submitted by the same deadline as the federal income tax return, which is usually April fifteenth. However, if you are unable to file by this date, you may request an extension, but it is essential to pay any taxes owed by the original deadline to avoid penalties.

Quick guide on how to complete form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year

Complete Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year with ease

- Find Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 203 b and how does it relate to airSlate SignNow?

The it 203 b is a designation that refers to the streamlined process of managing digital signatures and document workflows. With airSlate SignNow, you can leverage the it 203 b to enhance your business document management through efficient eSigning solutions.

-

How much does airSlate SignNow cost for small businesses looking to utilize the it 203 b?

airSlate SignNow offers flexible pricing plans tailored for small businesses, allowing you to maximize the potential of the it 203 b. Plans typically start at a low monthly fee, giving you access to essential features that streamline your document signing process.

-

What features does airSlate SignNow offer for optimizing the it 203 b?

airSlate SignNow provides various features that optimize the it 203 b, including customizable templates, real-time notifications, and comprehensive audit trails. These features ensure that your document workflows are efficient, secure, and easy to manage.

-

How can using airSlate SignNow improve my team's productivity regarding the it 203 b?

By utilizing airSlate SignNow in line with the it 203 b, your team can signNowly reduce the time spent on document management tasks. The platform streamlines eSigning processes, ensuring that your team focuses on core business functions rather than administrative burdens.

-

Does airSlate SignNow provide integrations that enhance the it 203 b experience?

Yes, airSlate SignNow offers powerful integrations with various applications and platforms that complement the it 203 b. This allows you seamlessly to connect your preferred tools, enhancing your overall document workflow and efficiency.

-

What are the benefits of using airSlate SignNow with the it 203 b for compliance?

Using airSlate SignNow with the it 203 b ensures that your document signing processes adhere to compliance standards. The platform incorporates secure encryption and verification features that help safeguard your documents and confirm legal validity, minimizing compliance risks.

-

Is it easy to set up airSlate SignNow for businesses looking into the it 203 b?

Absolutely! Setting up airSlate SignNow for the it 203 b is a quick and user-friendly process. The platform guides you through the steps, enabling you to start creating, sending, and signing documents in no time.

Get more for Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year

- Residential lease renewal agreement south carolina form

- 1 year separation form

- South carolina purchase form

- South carolina decree divorce form

- Sc assignment 497325748 form

- Assignment of lease from lessor with notice of assignment south carolina form

- Abandoned property letter form

- Guaranty or guarantee of payment of rent south carolina form

Find out other Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online