Form it 203 B Nonresident and Part Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet Tax Year 2023

Understanding the IT 203 B Form for Nonresidents

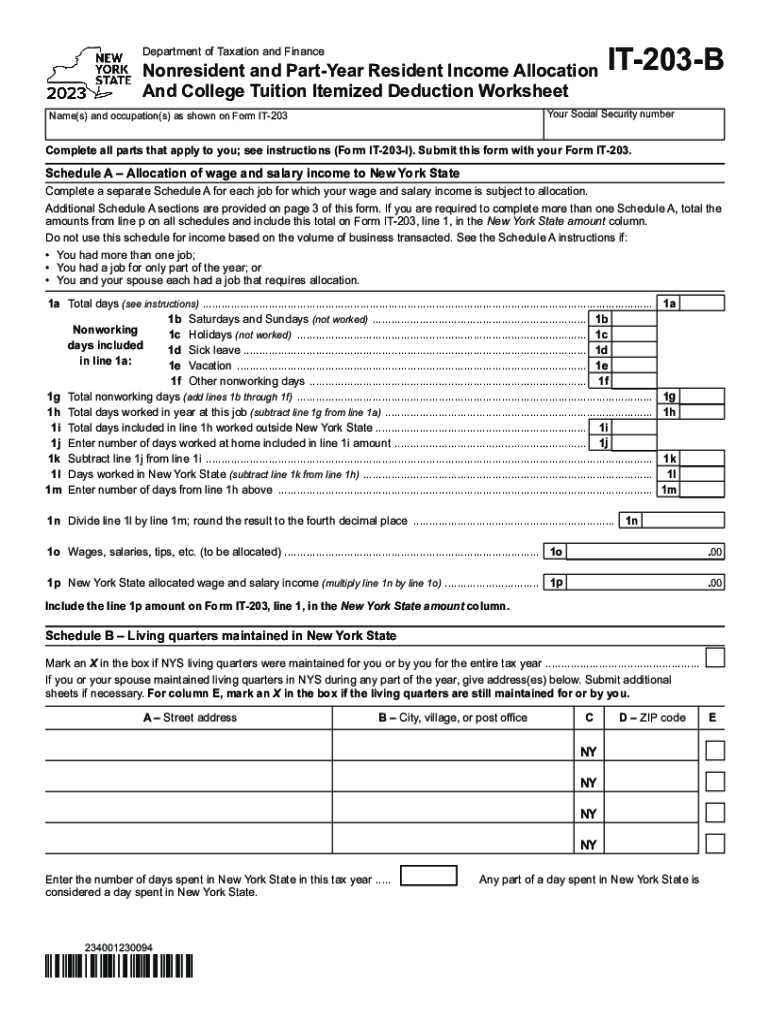

The IT 203 B form is designed for nonresident and part-year resident taxpayers in New York. It serves as an income allocation and college tuition itemized deduction worksheet. This form helps individuals accurately report their income earned in New York while allowing them to claim specific deductions related to college tuition. It is essential for those who do not reside in New York for the entire tax year but have income sourced from the state.

Steps to Complete the IT 203 B Form

Completing the IT 203 B form involves several key steps:

- Gather necessary documentation, including income statements and tuition receipts.

- Determine your residency status and the period for which you are filing.

- Calculate your total income earned in New York.

- Identify any allowable deductions, particularly those related to college tuition.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

Key Elements of the IT 203 B Form

The IT 203 B form includes several critical components:

- Personal Information: This section collects basic details about the taxpayer.

- Income Allocation: Taxpayers must report income earned in New York and allocate it appropriately.

- College Tuition Deductions: This part allows taxpayers to claim deductions for qualified college tuition expenses.

- Signature Section: A signature is required to validate the form and confirm the accuracy of the information provided.

Obtaining the IT 203 B Form

The IT 203 B form can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, many tax preparation software programs include the IT 203 B form, making it accessible for electronic completion.

Filing Deadlines for the IT 203 B Form

Taxpayers must be aware of the filing deadlines associated with the IT 203 B form. Generally, the form is due on the same date as the federal tax return, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these deadlines to avoid penalties.

Eligibility Criteria for the IT 203 B Form

To qualify for using the IT 203 B form, taxpayers must meet specific criteria:

- Be a nonresident or part-year resident of New York.

- Have income sourced from New York during the tax year.

- Be eligible to claim deductions for college tuition expenses.

Quick guide on how to complete form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year 701800106

Effortlessly Prepare Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Method to Edit and eSign Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year Without Stress

- Find Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Select relevant parts of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any chosen device. Edit and eSign Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year 701800106

Create this form in 5 minutes!

How to create an eSignature for the form it 203 b nonresident and part year resident income allocation and college tuition itemized deduction worksheet tax year 701800106

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the it 203 b instructions for signing documents with airSlate SignNow?

The it 203 b instructions for signing documents with airSlate SignNow involve a simple process where users upload their documents, add signers' information, and send for signatures. The platform guides you through each step, ensuring a seamless eSigning experience. You can check the status of your documents at any time through your dashboard.

-

How much does airSlate SignNow cost in relation to the it 203 b instructions?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be a cost-effective solution for all businesses. The it 203 b instructions are included in the standard features of all pricing tiers, making it accessible for individuals and enterprises alike. You can find detailed pricing information on our website.

-

What features does airSlate SignNow provide related to it 203 b instructions?

airSlate SignNow includes several features that align with the it 203 b instructions, such as document templates, online payment options, and audit trails. Users can easily customize their workflows and automate tasks, enhancing efficiency. These features make it easier to manage and track all signing activities.

-

How can airSlate SignNow streamline the it 203 b instructions process for businesses?

airSlate SignNow streamlines the it 203 b instructions by automating document workflows, allowing businesses to send, track, and manage documents effortlessly. This reduces the time spent on manual tasks and minimizes the risk of errors. Businesses can focus more on core activities while ensuring a smooth signing process.

-

Is airSlate SignNow compatible with other applications in implementing it 203 b instructions?

Yes, airSlate SignNow offers robust integrations with various applications, which can help in implementing the it 203 b instructions. You can connect with tools like Google Drive, Dropbox, and CRM systems to enhance document management. This compatibility ensures a seamless flow of information across platforms.

-

What are the benefits of using airSlate SignNow for it 203 b instructions?

Using airSlate SignNow for it 203 b instructions provides several benefits, including faster turnaround times, increased security, and reduced costs associated with traditional document signing. The platform is user-friendly, making it easy for clients and team members to navigate. Additionally, you benefit from compliance with legal standards in eSigning.

-

Can I access it 203 b instructions documentation through airSlate SignNow?

Absolutely! airSlate SignNow provides users with comprehensive documentation, including it 203 b instructions, readily available on the platform. This documentation is designed to assist users in understanding how to utilize the features effectively, ensuring a smooth signing and document management experience.

Get more for Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year

- Fr 4k form

- 4057 application for name andor address change date of birth andor social security correction or special mailing form

- 447 ncpdf south carolina department of motor vehicles form

- Purchasers statement of tax exemption form

- Sut 1 dmv form

- Vehicle certificate of ownership title application form

- Penndot photo identification card application for change form

- Cg 719s form

Find out other Form IT 203 B Nonresident And Part Year Resident Income Allocation And College Tuition Itemized Deduction Worksheet Tax Year

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF