Printable New York Form it 256 Claim for Special Additional Mortgage Recording Tax Credit 2020

What is the Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit

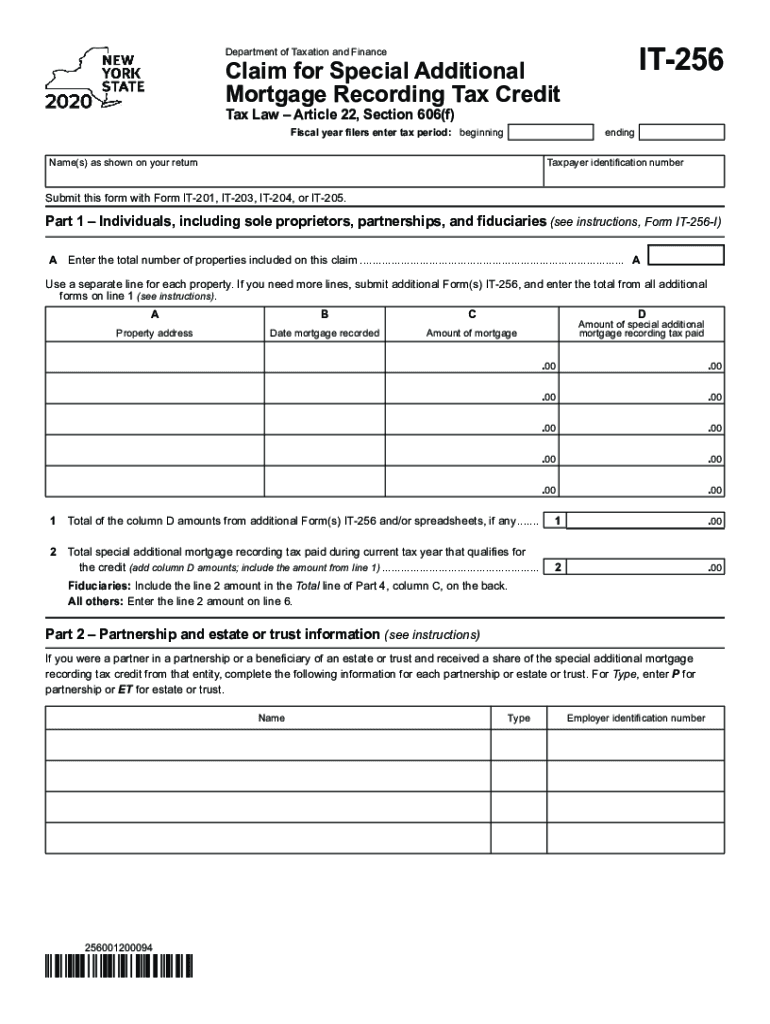

The Printable New York Form IT 256 is a tax form used to claim the Special Additional Mortgage Recording Tax Credit. This credit is available to eligible taxpayers who have incurred mortgage recording taxes on properties located in New York State. The purpose of the form is to provide a mechanism for taxpayers to receive a credit against their tax liability, effectively reducing the amount they owe to the state. Understanding the specifics of this form is crucial for homeowners and taxpayers looking to benefit from available tax credits related to their mortgage expenses.

Steps to complete the Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit

Completing the Printable New York Form IT 256 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of mortgage recording taxes paid. Next, fill out the form with your personal information, including your name, address, and Social Security number. Then, detail the amount of mortgage recording tax you are claiming as a credit. It is essential to double-check all entries for accuracy before submitting the form. Finally, sign and date the form, and prepare it for submission according to the guidelines provided by the New York State Department of Taxation and Finance.

Eligibility Criteria

To qualify for the Special Additional Mortgage Recording Tax Credit using Form IT 256, taxpayers must meet specific eligibility criteria. Primarily, the credit is available to individuals who have paid mortgage recording taxes on a qualifying property. The property must be located in New York State, and the mortgage must be for a purchase or refinancing of a primary residence. Additionally, there may be income limitations and other requirements that determine eligibility. It is advisable for taxpayers to review the criteria closely to ensure they qualify before filing the form.

Legal use of the Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit

The legal use of the Printable New York Form IT 256 is governed by state tax laws that outline the requirements for claiming the Special Additional Mortgage Recording Tax Credit. The form must be completed accurately and submitted within the designated filing period to be considered valid. Compliance with relevant tax regulations is essential, as improper use of the form can lead to penalties or disqualification from receiving the credit. Taxpayers should ensure they understand the legal implications of filing this form and maintain proper documentation to support their claims.

Filing Deadlines / Important Dates

Filing deadlines for the Printable New York Form IT 256 are crucial for taxpayers to observe. Typically, the form must be submitted by the due date of the tax return for the year in which the mortgage recording taxes were paid. Taxpayers should be aware of specific dates set by the New York State Department of Taxation and Finance to ensure timely submission. Missing these deadlines can result in the inability to claim the credit for that tax year, so keeping track of important dates is essential for all eligible taxpayers.

Form Submission Methods (Online / Mail / In-Person)

The Printable New York Form IT 256 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed online using the New York State Department of Taxation and Finance's electronic filing system, which is often the quickest option. Alternatively, taxpayers may choose to mail the completed form to the appropriate tax office. In-person submissions are also possible at designated tax offices, allowing for direct interaction with tax officials. Each method has its own set of guidelines and processing times, so taxpayers should select the option that best suits their needs.

Quick guide on how to complete printable 2020 new york form it 256 claim for special additional mortgage recording tax credit

Finish Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit smoothly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents promptly without delays. Manage Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit effortlessly

- Obtain Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 256 claim for special additional mortgage recording tax credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 256 claim for special additional mortgage recording tax credit

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it integrate with IT 256?

airSlate SignNow is a robust eSignature solution that allows businesses to send and sign documents efficiently. It integrates seamlessly with IT 256, enhancing the document management process by providing quick access to signature workflows, thereby streamlining operations and improving productivity.

-

What are the key features of airSlate SignNow related to IT 256?

Key features of airSlate SignNow in relation to IT 256 include customizable templates, automated reminders, and multi-party signing options. These features ensure that your document processes are aligned with the specific requirements of IT 256, making it easier for users to adopt the system in their daily work.

-

How can airSlate SignNow benefit my business when using IT 256?

Using airSlate SignNow alongside IT 256 can signNowly enhance your business efficiency by reducing the time spent on document handling. Benefits include faster turnaround times for contracts and agreements, improved accuracy in document processing, and a more professional image when dealing with clients.

-

Is there a pricing plan for airSlate SignNow tailored for IT 256 users?

Yes, airSlate SignNow offers competitive pricing plans that can be customized for IT 256 users. Whether you need a basic plan for small teams or an advanced solution for larger organizations, there are options available that guarantee cost-effectiveness without compromising on essential features.

-

What types of documents can I manage with airSlate SignNow in the context of IT 256?

With airSlate SignNow, you can manage a variety of documents relevant to IT 256, such as contracts, agreements, and internal reports. The platform is versatile, allowing for the secure signing and sharing of both legal and non-legal documents that help facilitate smoother operations.

-

Does airSlate SignNow comply with legal requirements related to IT 256?

Absolutely, airSlate SignNow is designed to comply with all relevant legal standards for eSignatures, making it fully compatible with IT 256 regulations. This ensures that your electronic documents hold the same legal weight as traditional paper signatures, providing peace of mind for businesses.

-

What integrations are available with airSlate SignNow for IT 256 users?

airSlate SignNow offers a range of integrations that complement the use of IT 256, including popular platforms like Salesforce, Google Drive, and Slack. These integrations facilitate a seamless workflow, allowing users to manage documents directly from their preferred tools without interruption.

Get more for Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit

- Annual report of the guardian hawaii state judiciary form

- Permits and inspections search directory form

- Free utah name change forms how to change your name in

- Address form

- Case no unredacted petition for name change form

- Full name of party filing document mailing address pdffiller form

- Petition to change name file name form

- Idaho petition for name change form

Find out other Printable New York Form IT 256 Claim For Special Additional Mortgage Recording Tax Credit

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online