Form it 256 Claim for Special Additional Mortgage 2023

What is the Form IT-256 Claim for Special Additional Mortgage

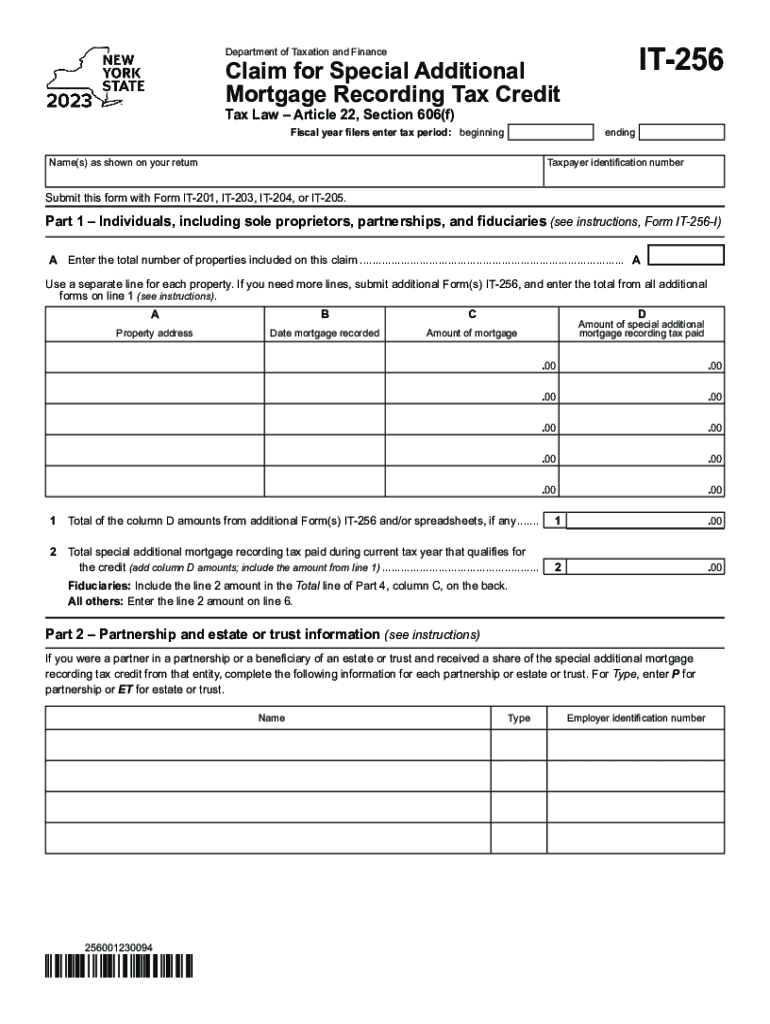

The Form IT-256 is a tax form used by taxpayers in New York to claim a special additional mortgage credit. This credit is designed to assist homeowners who have taken out a mortgage on their primary residence. The form allows eligible taxpayers to reduce their tax liability by claiming a credit based on their mortgage interest payments. Understanding the purpose of this form is essential for homeowners looking to maximize their tax benefits.

How to Use the Form IT-256 Claim for Special Additional Mortgage

To effectively use the Form IT-256, taxpayers should first ensure they meet the eligibility criteria. Once eligibility is confirmed, the form must be filled out accurately, providing necessary details such as the mortgage amount and interest paid. After completing the form, it should be submitted along with the taxpayer's annual tax return. It is important to retain copies of all documents for personal records and potential future audits.

Steps to Complete the Form IT-256 Claim for Special Additional Mortgage

Completing the Form IT-256 involves several key steps:

- Gather necessary information, including mortgage details and interest paid.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check calculations to confirm the accuracy of the claimed credit.

- Attach the completed form to your state tax return.

- Submit the return by the designated filing deadline.

Eligibility Criteria

To qualify for the special additional mortgage credit using Form IT-256, taxpayers must meet specific eligibility criteria. These include being a resident of New York, having a mortgage on a primary residence, and paying mortgage interest during the tax year. Additionally, taxpayers should ensure that their income does not exceed certain thresholds, which may affect the amount of credit available.

Required Documents

When completing the Form IT-256, taxpayers must provide supporting documentation. This typically includes:

- Mortgage statements showing interest paid during the tax year.

- Proof of residency, such as a utility bill or lease agreement.

- Any additional documentation required by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form IT-256. Generally, the form should be submitted along with the annual state tax return, which is typically due on April fifteenth. However, if taxpayers file for an extension, they should ensure that the form is included with the extended return submission to avoid penalties.

Quick guide on how to complete form it 256 claim for special additional mortgage

Effortlessly Prepare Form IT 256 Claim For Special Additional Mortgage on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly and without delays. Manage Form IT 256 Claim For Special Additional Mortgage on any platform with the airSlate SignNow Android or iOS applications and enhance your document-centric operations today.

How to Edit and eSign Form IT 256 Claim For Special Additional Mortgage with Ease

- Obtain Form IT 256 Claim For Special Additional Mortgage and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you'd like to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 256 Claim For Special Additional Mortgage to ensure effective communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 256 claim for special additional mortgage

Create this form in 5 minutes!

How to create an eSignature for the form it 256 claim for special additional mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 256 tax and how can airSlate SignNow help with it?

256 tax refers to a specific set of tax forms required for certain business filings. With airSlate SignNow, you can easily prepare, send, and electronically sign these documents, ensuring compliance while streamlining your workflow.

-

How much does airSlate SignNow cost for handling 256 tax documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs. By utilizing our platform for 256 tax documents, you save on traditional mailing costs and enhance efficiency, providing a cost-effective solution for your tax needs.

-

What features does airSlate SignNow offer for managing 256 tax forms?

airSlate SignNow includes features such as template creation, customizable signing workflows, and real-time tracking for your 256 tax documents. These capabilities help ensure that your forms are completed accurately and on time.

-

Can I integrate airSlate SignNow with other tools for 256 tax management?

Yes, airSlate SignNow integrates seamlessly with various software applications to assist with 256 tax management. Whether you're using accounting software or CRM systems, our platform can enhance your document workflow and improve overall efficiency.

-

What benefits does using airSlate SignNow for 256 tax documents provide?

Using airSlate SignNow for 256 tax documents streamlines the signing process and reduces turnaround time. Additionally, it increases security and compliance, ensuring your sensitive tax information is protected throughout the process.

-

Is airSlate SignNow compliant with regulations related to 256 tax documents?

Absolutely! airSlate SignNow adheres to the latest regulations in electronic signature law, ensuring complete compliance when handling 256 tax documents. Our platform meets legal standards, providing peace of mind to users.

-

How does airSlate SignNow enhance collaboration for 256 tax forms?

airSlate SignNow enhances collaboration by allowing multiple users to view, edit, and sign 256 tax forms simultaneously. This feature ensures that everyone involved in the process is up-to-date, facilitating better teamwork and communication.

Get more for Form IT 256 Claim For Special Additional Mortgage

- Cigna pharmacy fax form

- Ibew1141 form

- Combined mce bh provider pcc form bmc healthnet plan bmchp

- Asha s adult language cognitive communication evaluation template form

- Montana icpc form 1001

- Family reunification denmark in the usa form

- Signed agreement template form

- Signing bonus agreement template form

Find out other Form IT 256 Claim For Special Additional Mortgage

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy