Form it 256 Claim for Special Additional Mortgage Recording 2022

What is the Form IT 256 Claim For Special Additional Mortgage Recording

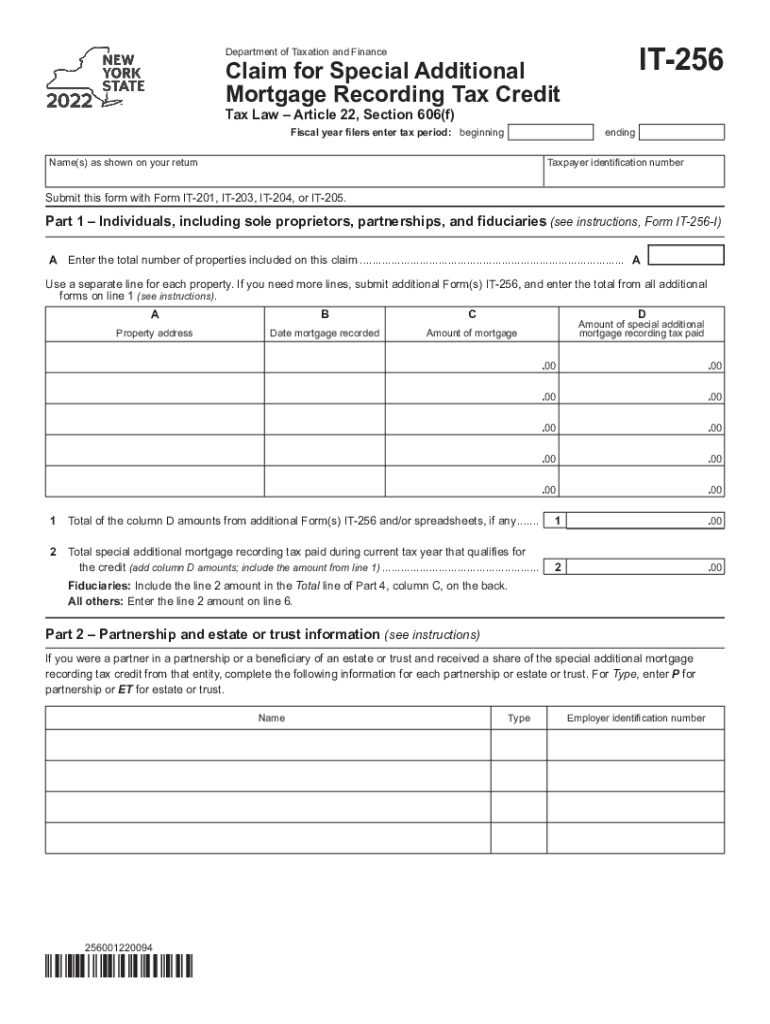

The Form IT 256 is a key document used in the United States for claiming special additional mortgage recording tax credits. This form is specifically designed for taxpayers who have incurred certain mortgage recording taxes when acquiring or refinancing property. By submitting this form, individuals can potentially reduce their tax liability, making it an essential tool for homeowners and real estate investors alike.

How to use the Form IT 256 Claim For Special Additional Mortgage Recording

Using the Form IT 256 involves several straightforward steps. First, gather all necessary information, including details about the mortgage and the property. Next, accurately fill out the form, ensuring that all sections are completed. After completing the form, review it for accuracy and compliance with IRS guidelines. Finally, submit the form to the appropriate tax authority, either electronically or via mail, depending on your preference and the requirements of your state.

Steps to complete the Form IT 256 Claim For Special Additional Mortgage Recording

Completing the Form IT 256 requires careful attention to detail. Follow these steps to ensure accuracy:

- Provide personal information, including your name, address, and taxpayer identification number.

- Detail the mortgage information, including the amount and date of recording.

- Calculate the eligible amount for the special additional mortgage recording tax credit.

- Sign and date the form, confirming the information is true and complete.

Legal use of the Form IT 256 Claim For Special Additional Mortgage Recording

The legal use of the Form IT 256 is governed by specific regulations set forth by the IRS and state tax authorities. To ensure compliance, it is essential to follow all guidelines related to eligibility, documentation, and submission. The form must be submitted within the designated filing deadlines to avoid penalties. Additionally, maintaining accurate records of the mortgage transaction and any related documents is crucial for legal protection and verification purposes.

Eligibility Criteria

To be eligible to use the Form IT 256, taxpayers must meet certain criteria. Typically, this includes having a valid mortgage that qualifies for the special additional mortgage recording tax credit. Eligibility may also depend on the type of property and the purpose of the mortgage, such as whether it is for a primary residence or an investment property. It is important to review the specific requirements outlined by the IRS and local tax authorities to confirm eligibility before filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 256 are critical to ensure timely processing and to avoid penalties. Generally, the form must be submitted during the tax year in which the mortgage recording occurred. Specific dates may vary by state, so it is advisable to check local regulations for exact filing deadlines. Keeping track of these dates can help taxpayers take full advantage of the available tax credits and avoid any complications with their tax filings.

Quick guide on how to complete form it 256 claim for special additional mortgage recording

Manage Form IT 256 Claim For Special Additional Mortgage Recording effortlessly on any device

Digital document management has gained signNow traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without interruptions. Manage Form IT 256 Claim For Special Additional Mortgage Recording on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form IT 256 Claim For Special Additional Mortgage Recording with ease

- Locate Form IT 256 Claim For Special Additional Mortgage Recording and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs seamlessly from any device of your choosing. Modify and eSign Form IT 256 Claim For Special Additional Mortgage Recording to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 256 claim for special additional mortgage recording

Create this form in 5 minutes!

How to create an eSignature for the form it 256 claim for special additional mortgage recording

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 256?

airSlate SignNow is a powerful eSigning solution that facilitates the secure signing and management of documents. It incorporates the features of 'it 256' to ensure compliance and enhance document workflow efficiency. By utilizing airSlate SignNow, businesses can seamlessly integrate it 256 capabilities into their operations.

-

What are the pricing options for airSlate SignNow and does it include it 256 features?

airSlate SignNow offers a variety of pricing plans to suit different business needs, all of which include essential features aligned with it 256. Each plan is designed to provide value whether you are a small business or a large enterprise. Select a plan that best meets your requirements and budget while benefiting from the it 256 integration.

-

How can airSlate SignNow enhance my business processes?

By implementing airSlate SignNow, businesses can signNowly streamline their document management processes. The platform's alignment with it 256 enables better compliance and security during document transactions. This ultimately leads to faster turnaround times, reduced costs, and improved overall efficiency.

-

What key features does airSlate SignNow offer that support it 256 compliance?

airSlate SignNow provides a suite of features that ensure documents meet it 256 compliance. Some key features include secure eSigning, advanced authentication options, and clear audit trails. These tools help maintain document integrity and compliance throughout the signing process.

-

Can airSlate SignNow integrate with my existing software tools?

Yes, airSlate SignNow is designed to seamlessly integrate with various software applications you may already be using. Whether it's CRM systems, cloud storage, or other essential business tools, airSlate SignNow enhances these systems while adhering to it 256 standards. This integration makes it easier to manage documents without disrupting your existing workflows.

-

Is airSlate SignNow suitable for enterprises needing it 256 compliance?

Absolutely, airSlate SignNow is ideal for enterprises seeking to comply with it 256 regulations. Its robust features cater to the complex needs of large organizations while ensuring legal compliance and security. Companies can trust airSlate SignNow to safeguard their important documents throughout the signing process.

-

How does airSlate SignNow ensure document security when using it 256?

airSlate SignNow employs advanced security measures to protect documents, crucial for meeting it 256 standards. Features like encryption, secure access protocols, and authentication ensure that sensitive information remains protected. This commitment to security provides peace of mind for businesses handling confidential documents.

Get more for Form IT 256 Claim For Special Additional Mortgage Recording

- Residential lease renewal agreement south carolina form

- 1 year separation form

- South carolina purchase form

- South carolina decree divorce form

- Sc assignment 497325748 form

- Assignment of lease from lessor with notice of assignment south carolina form

- Abandoned property letter form

- Guaranty or guarantee of payment of rent south carolina form

Find out other Form IT 256 Claim For Special Additional Mortgage Recording

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF