New York Form it 256 Claim for Special Additional 2024-2026

What is the New York Form IT 256 Claim For Special Additional

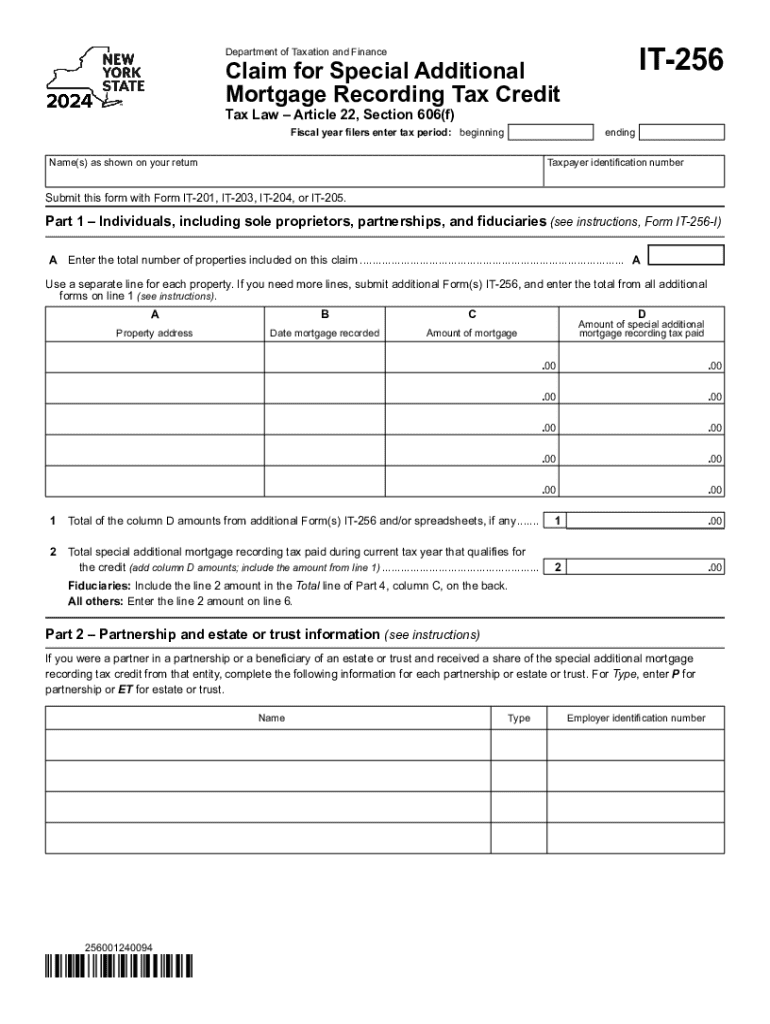

The New York Form IT 256, known as the Claim For Special Additional, is a tax form used by eligible taxpayers to claim a special additional credit. This credit is designed to provide financial relief to certain individuals and businesses that meet specific criteria set by the New York State Department of Taxation and Finance. The form allows taxpayers to report their eligibility and calculate the amount of credit they can claim on their state tax return.

How to use the New York Form IT 256 Claim For Special Additional

To use the New York Form IT 256, taxpayers must first determine their eligibility for the special additional credit. This involves reviewing the requirements outlined by the New York State Department of Taxation and Finance. Once eligibility is confirmed, taxpayers can complete the form by providing necessary personal information, income details, and any other required data. After filling out the form, it should be submitted along with the New York State tax return to ensure the credit is applied correctly.

Steps to complete the New York Form IT 256 Claim For Special Additional

Completing the New York Form IT 256 involves several key steps:

- Gather all necessary documentation, including income statements and any previous tax returns.

- Review the eligibility criteria for the special additional credit to confirm qualification.

- Fill out the form accurately, providing all required information such as personal details and income sources.

- Double-check the completed form for accuracy and completeness.

- Submit the form with your New York State tax return by the designated deadline.

Eligibility Criteria

Eligibility for the New York Form IT 256 Claim For Special Additional is based on specific criteria established by the state. Generally, taxpayers must meet income thresholds and other conditions related to their filing status. For instance, certain credits may only be available to individuals or businesses that operate within New York State or meet particular operational requirements. It is important for taxpayers to review the most current eligibility guidelines to ensure compliance.

Required Documents

When completing the New York Form IT 256, taxpayers should prepare several documents to support their claim. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Prior year tax returns to establish a history of filings.

- Documentation related to any deductions or credits claimed in prior years.

- Any additional forms or schedules that may be required based on individual circumstances.

Form Submission Methods

Taxpayers have several options for submitting the New York Form IT 256. The form can be filed:

- Online through the New York State Department of Taxation and Finance website, if applicable.

- By mail, sending the completed form along with the state tax return to the appropriate address.

- In-person at designated tax offices, although this option may vary based on local regulations and availability.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 256 claim for special additional

Create this form in 5 minutes!

How to create an eSignature for the new york form it 256 claim for special additional

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York Form IT 256 Claim For Special Additional?

The New York Form IT 256 Claim For Special Additional is a tax form used by eligible taxpayers to claim additional credits. This form helps individuals maximize their tax benefits by providing specific deductions related to special circumstances. Understanding how to properly fill out this form can lead to signNow savings.

-

How can airSlate SignNow help with the New York Form IT 256 Claim For Special Additional?

airSlate SignNow streamlines the process of completing and submitting the New York Form IT 256 Claim For Special Additional. Our platform allows users to easily fill out, eSign, and send the form securely. This ensures that your claim is submitted accurately and on time, maximizing your potential benefits.

-

What features does airSlate SignNow offer for managing the New York Form IT 256 Claim For Special Additional?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the New York Form IT 256 Claim For Special Additional. These tools simplify the process, making it easier to manage your tax documents efficiently. Additionally, our user-friendly interface ensures a smooth experience.

-

Is there a cost associated with using airSlate SignNow for the New York Form IT 256 Claim For Special Additional?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those who need to file the New York Form IT 256 Claim For Special Additional. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for the New York Form IT 256 Claim For Special Additional?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with the New York Form IT 256 Claim For Special Additional. This integration allows for easy data transfer and document management, making the entire process more efficient.

-

What are the benefits of using airSlate SignNow for my New York Form IT 256 Claim For Special Additional?

Using airSlate SignNow for your New York Form IT 256 Claim For Special Additional provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that your documents are handled securely and efficiently, allowing you to focus on maximizing your tax benefits without the hassle of traditional paperwork.

-

How secure is airSlate SignNow when handling the New York Form IT 256 Claim For Special Additional?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information when handling the New York Form IT 256 Claim For Special Additional. You can trust that your documents are safe and secure throughout the entire process.

Get more for New York Form IT 256 Claim For Special Additional

- Ia landlord form

- Unconditional waiver and release of lien upon final payment iowa form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497305012 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497305013 form

- Iowa notice cure form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497305015 form

- Business credit application iowa form

- Individual credit application iowa form

Find out other New York Form IT 256 Claim For Special Additional

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now