Form it 241 Claim for Clean Heating Fuel Credit Tax Year 2020

What is the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

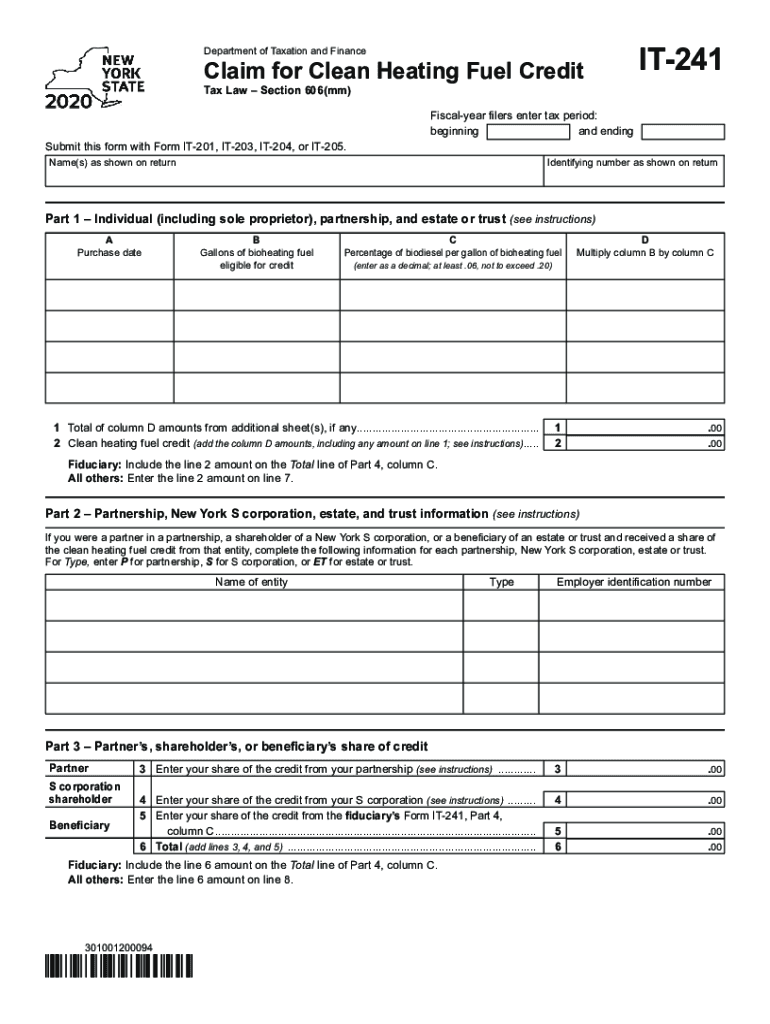

The Form IT 241 is a tax document used to claim the Clean Heating Fuel Credit in New York. This credit is designed to incentivize the use of clean heating fuels, which can help reduce environmental impact and promote cleaner energy sources. Taxpayers who have utilized eligible clean heating fuels during the tax year may qualify for this credit, which can lead to significant savings on their tax liabilities. Understanding the specific eligibility criteria and the benefits of this credit is crucial for taxpayers looking to maximize their tax benefits.

Steps to complete the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

Completing the Form IT 241 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your clean heating fuel usage, including receipts and invoices. Next, fill out the form by providing your personal information, including your name, address, and taxpayer identification number. Then, detail the amount of clean heating fuel purchased and the corresponding credit you are claiming. It's essential to review the form carefully for any errors before submission. Finally, submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

The legal use of the Form IT 241 is governed by specific regulations that dictate how and when the credit can be claimed. To be eligible, taxpayers must comply with the guidelines set forth by the New York State Department of Taxation and Finance. This includes ensuring that the clean heating fuels used meet the defined criteria and that all claims are substantiated with proper documentation. Failure to adhere to these regulations may result in penalties or disqualification from receiving the credit.

Eligibility Criteria

To qualify for the Clean Heating Fuel Credit using Form IT 241, taxpayers must meet certain eligibility criteria. This includes being a resident of New York State and having purchased eligible clean heating fuels during the tax year. The fuels must be used for residential heating purposes, and the taxpayer must provide proof of purchase. Additionally, there may be income limitations or other specific requirements that must be met to successfully claim the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 241 are critical to ensure that taxpayers can take advantage of the Clean Heating Fuel Credit. Typically, the form must be submitted by the same deadline as the taxpayer's annual income tax return. It is important to check for any updates or changes to these dates each tax year, as they can vary. Missing the deadline may result in the inability to claim the credit, so staying informed is essential for all eligible taxpayers.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form IT 241. The form can be filed online through the New York State Department of Taxation and Finance website, which often provides a streamlined process. Alternatively, taxpayers may choose to mail the completed form to the designated address provided in the instructions. In-person submissions may also be possible at local tax offices, allowing for direct assistance if needed. Each method has its own advantages, so taxpayers should choose the one that best suits their needs.

Quick guide on how to complete form it 241 claim for clean heating fuel credit tax year 2020

Complete Form IT 241 Claim For Clean Heating Fuel Credit Tax Year effortlessly on any device

Digital document management has gained popularity among corporations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools you require to generate, alter, and eSign your documents quickly and without delays. Handle Form IT 241 Claim For Clean Heating Fuel Credit Tax Year on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year with ease

- Obtain Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and then click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your modifications.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 241 claim for clean heating fuel credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 241 claim for clean heating fuel credit tax year 2020

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to it241?

airSlate SignNow is an intuitive eSigning platform that allows businesses to send, sign, and manage documents electronically. The it241 solution seamlessly integrates with airSlate SignNow, enhancing the document workflow process. With its user-friendly interface, it241 makes managing electronic signatures simpler than ever.

-

How much does airSlate SignNow cost, and what does it241 offer?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective choice. The it241 package includes access to premium features like advanced integrations and extensive document management capabilities. By choosing it241, users gain the most value for their investment in eSigning solutions.

-

What features does airSlate SignNow provide with the it241 integration?

The it241 integration with airSlate SignNow provides essential features such as customizable templates, real-time tracking of documents, and secure cloud storage. These features ensure that businesses can streamline their document workflows efficiently. With it241, users can also enjoy the ease of setting up automated reminders for signers.

-

What are the benefits of using airSlate SignNow in conjunction with it241?

Using airSlate SignNow along with it241 enhances the efficiency of document management by simplifying the eSigning process. Businesses can save time and reduce costs associated with printing and mailing documents. The combined solutions improve overall compliance and reduce the risk of errors in document handling.

-

Can I integrate airSlate SignNow with other applications using it241?

Yes, airSlate SignNow offers robust integration options that can be easily implemented with the it241 solution. This allows businesses to connect their existing systems and streamlines the eSigning process across different platforms. Integrating with CRM systems, project management tools, and other software enhances workflow efficiency.

-

Is airSlate SignNow secure, especially when using the it241 package?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents signed through the it241 integration are protected. The platform utilizes industry-leading encryption and complies with legal requirements to secure sensitive information. Users can confidently manage their documents knowing that their data is safe.

-

How easy is it to get started with airSlate SignNow and it241?

Getting started with airSlate SignNow and the it241 package is incredibly straightforward. After signing up, users can quickly set up their account and start sending documents for eSignature within minutes. The user-friendly interface and available resources make onboarding easy, even for those new to eSigning solutions.

Get more for Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- Idaho parental consent to name change minor form

- Idaho petition for name change minor form

- Cao d 1 6 petition for divorce no children form

- Free colorado last will and testament template pdf form

- Full name of party filing this document mailing address pdffiller form

- Duct leakage affidavit kootenai county form

- Idaho letter requesting publication form

- Idaho motion and affidavit for fee waiver form

Find out other Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation