Form it 241 Claim for Clean Heating Fuel Credit Tax Year 2024-2026

What is the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

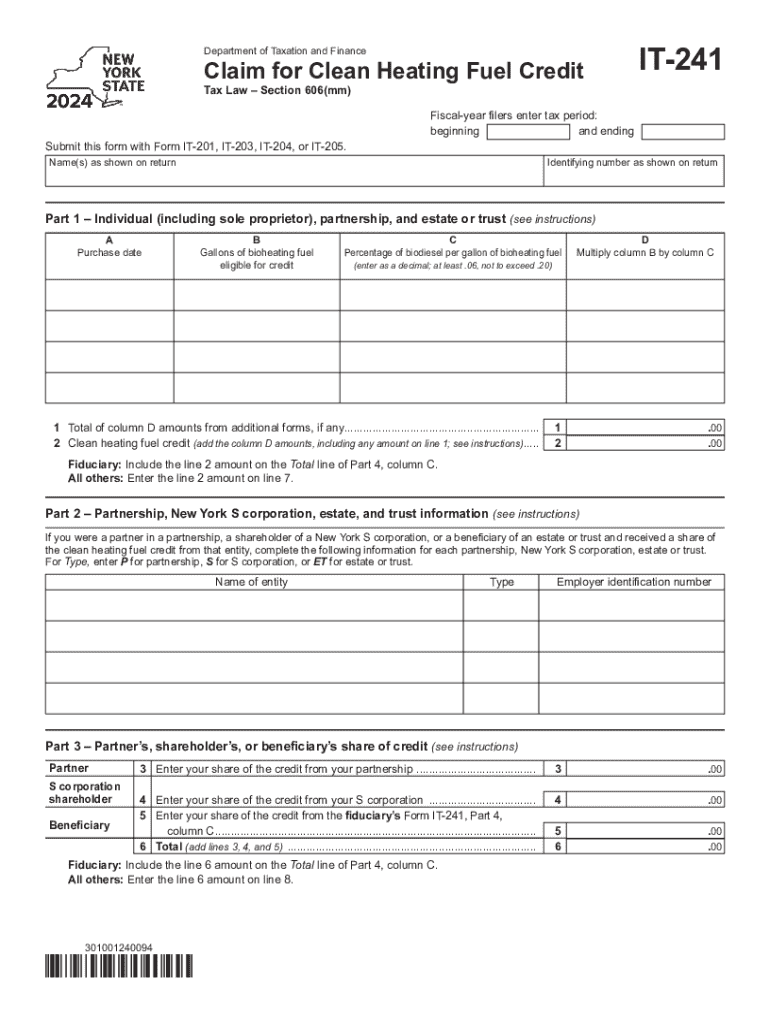

The Form IT 241 is a tax form used in New York State for claiming a credit for clean heating fuel. This credit is designed to encourage the use of clean heating technologies and fuels, which can contribute to environmental sustainability and energy efficiency. The form is applicable for the tax year in which the clean heating fuel was purchased and used. Taxpayers who qualify can reduce their overall tax liability by submitting this form with their annual tax return.

How to use the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

To use the Form IT 241, taxpayers must first determine their eligibility for the clean heating fuel credit. This involves reviewing the specific criteria outlined by the New York State Department of Taxation and Finance. Once eligibility is confirmed, individuals should complete the form by providing necessary details, such as the amount of clean heating fuel purchased and the associated costs. After filling out the form, it should be submitted along with the main tax return to ensure that the credit is applied correctly.

Steps to complete the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

Completing the Form IT 241 involves several key steps:

- Gather documentation of clean heating fuel purchases, including receipts and invoices.

- Review the eligibility criteria to ensure compliance with New York State regulations.

- Fill out the form, providing accurate information regarding the amount of clean heating fuel purchased and the total cost.

- Double-check all entries for accuracy to avoid processing delays.

- Attach the completed form to your annual tax return before submission.

Eligibility Criteria

To qualify for the clean heating fuel credit using Form IT 241, taxpayers must meet specific eligibility criteria. This includes being a resident of New York State and having purchased clean heating fuel that meets state-defined standards. Additionally, the fuel must be used for residential heating purposes. Taxpayers should also ensure that their income falls within the limits set by the state for claiming this credit. It is advisable to consult the latest guidelines from the New York State Department of Taxation and Finance for detailed eligibility requirements.

Required Documents

When filing Form IT 241, taxpayers must provide certain documents to support their claim. These documents typically include:

- Receipts or invoices for the clean heating fuel purchased.

- Proof of residency in New York State, such as a driver's license or utility bill.

- Any prior year tax returns if applicable, to verify income levels.

Having these documents ready can facilitate a smoother filing process and help ensure that the credit is processed without issues.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form IT 241. Typically, the form should be submitted along with the annual tax return by the due date, which is usually April fifteenth for most individuals. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or additional requirements that may arise in a given tax year.

Create this form in 5 minutes or less

Find and fill out the correct form it 241 claim for clean heating fuel credit tax year 772088709

Create this form in 5 minutes!

How to create an eSignature for the form it 241 claim for clean heating fuel credit tax year 772088709

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ny heating?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For companies in the ny heating industry, it streamlines the process of obtaining signatures on contracts and service agreements, enhancing operational efficiency.

-

How can airSlate SignNow benefit my ny heating business?

By using airSlate SignNow, your ny heating business can save time and reduce paperwork. The platform allows for quick document turnaround, ensuring that contracts are signed promptly, which can lead to faster service delivery and improved customer satisfaction.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, including options for small to large ny heating companies. Each plan provides access to essential features that help streamline document management and eSigning processes.

-

Is airSlate SignNow easy to integrate with other tools used in ny heating?

Yes, airSlate SignNow is designed to integrate seamlessly with various business tools commonly used in the ny heating industry. This includes CRM systems and project management software, allowing for a more cohesive workflow.

-

What features does airSlate SignNow offer for ny heating professionals?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage. These tools are particularly beneficial for ny heating professionals who need to manage multiple contracts and documents efficiently.

-

How secure is airSlate SignNow for handling sensitive ny heating documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all sensitive documents related to your ny heating business are protected during the signing process.

-

Can airSlate SignNow help with compliance in the ny heating industry?

Absolutely! airSlate SignNow helps ensure compliance by providing audit trails and secure document storage. This is crucial for ny heating businesses that must adhere to regulatory requirements and maintain accurate records.

Get more for Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

Find out other Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter