New York Form it 241 Claim for Clean Heating Fuel Credit 2022

What is the New York Form IT 241 Claim For Clean Heating Fuel Credit

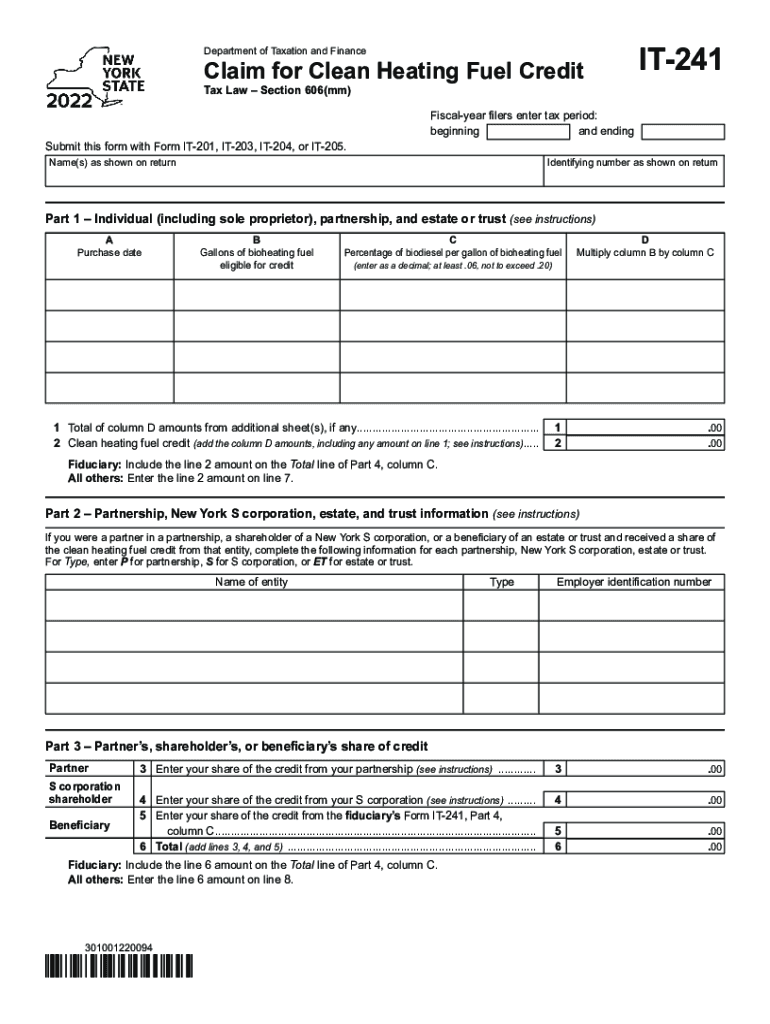

The New York Form IT 241 is a tax form used by residents to claim a credit for clean heating fuel. This credit is designed to incentivize the use of environmentally friendly heating options, such as biofuels and other clean energy sources. By submitting this form, taxpayers can reduce their overall tax liability, making it an important tool for those who invest in sustainable heating solutions.

How to use the New York Form IT 241 Claim For Clean Heating Fuel Credit

Using the New York Form IT 241 involves several steps. First, gather all necessary documentation, including proof of purchase for clean heating fuel. Next, fill out the form accurately, ensuring that all information aligns with your tax records. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the requirements set by the New York State Department of Taxation and Finance.

Steps to complete the New York Form IT 241 Claim For Clean Heating Fuel Credit

Completing the New York Form IT 241 requires careful attention to detail. Follow these steps:

- Obtain the form from the New York State Department of Taxation and Finance website or through authorized channels.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the clean heating fuel purchased, including the type and amount.

- Calculate the credit based on the amount of clean heating fuel used during the tax year.

- Attach any required documentation, such as receipts or invoices for the clean heating fuel.

- Review the form for accuracy before submitting it.

Eligibility Criteria for the New York Form IT 241 Claim For Clean Heating Fuel Credit

To qualify for the credit claimed on the New York Form IT 241, taxpayers must meet specific eligibility criteria. These include:

- Being a resident of New York State.

- Purchasing qualified clean heating fuel during the tax year.

- Providing documentation that verifies the purchase and usage of the clean heating fuel.

- Filing the form within the designated tax filing period.

Required Documents for the New York Form IT 241 Claim For Clean Heating Fuel Credit

When preparing to submit the New York Form IT 241, it is essential to gather the following documents:

- Receipts or invoices for the clean heating fuel purchased.

- Proof of residency in New York State, such as a driver's license or utility bill.

- Any previous tax returns that may provide context for your claim.

Filing Deadlines for the New York Form IT 241 Claim For Clean Heating Fuel Credit

Filing deadlines for the New York Form IT 241 are crucial to ensure that taxpayers do not miss out on claiming their credit. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth of each year. However, it is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Quick guide on how to complete new york form it 241 claim for clean heating fuel credit

Complete New York Form IT 241 Claim For Clean Heating Fuel Credit effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly and without interruptions. Manage New York Form IT 241 Claim For Clean Heating Fuel Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign New York Form IT 241 Claim For Clean Heating Fuel Credit with ease

- Obtain New York Form IT 241 Claim For Clean Heating Fuel Credit and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign New York Form IT 241 Claim For Clean Heating Fuel Credit and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 241 claim for clean heating fuel credit

Create this form in 5 minutes!

How to create an eSignature for the new york form it 241 claim for clean heating fuel credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 241 form and why is it important?

The IT 241 form is a tax-related document that is crucial for accurate tax reporting and compliance. Understanding how to fill out and submit the IT 241 form can help streamline your tax process. Utilizing airSlate SignNow ensures that you can easily sign and send this document securely.

-

How can airSlate SignNow help with the IT 241 form?

airSlate SignNow provides a seamless platform for creating, signing, and managing the IT 241 form. Our solution simplifies the process, eliminating paper-based methods and allowing for faster submissions. This enhances workflow efficiency while ensuring compliance with legal standards.

-

What features does airSlate SignNow offer for handling the IT 241 form?

airSlate SignNow offers features such as eSigning, document templates, and real-time collaboration to effectively manage the IT 241 form. These tools facilitate quick edits, ensure accuracy, and improve overall turnaround time. The platform's user-friendly interface makes it accessible for all users.

-

Are there any costs associated with using airSlate SignNow for the IT 241 form?

Yes, airSlate SignNow offers various pricing plans tailored to businesses of all sizes. Pricing varies based on the features required and the volume of documents processed. Investing in a plan can save time and money when dealing with the IT 241 form and other documentation.

-

Can I integrate airSlate SignNow with other software when working on the IT 241 form?

Absolutely! airSlate SignNow can integrate with a variety of software applications, enhancing your experience with the IT 241 form. These integrations allow you to import data directly, manage workflows seamlessly, and maintain consistency across your documents.

-

Is airSlate SignNow secure for handling the IT 241 form?

Yes, security is a top priority for airSlate SignNow. We utilize advanced encryption methods and comply with industry standards to protect your data when dealing with the IT 241 form. You can trust that your sensitive information is kept secure throughout the entire signing process.

-

What are the benefits of using airSlate SignNow for the IT 241 form?

Using airSlate SignNow for the IT 241 form offers several benefits, including faster processing times and improved organization. Our platform reduces the risk of errors and enhances collaboration between teams. This leads to a more efficient overall experience when managing important documentation.

Get more for New York Form IT 241 Claim For Clean Heating Fuel Credit

- Non foreign affidavit under irc 1445 south carolina form

- Owners or sellers affidavit of no liens south carolina form

- South carolina affidavit form

- Complex will with credit shelter marital trust for large estates south carolina form

- Sc corporation 497325807 form

- South carolina dissolution package to dissolve limited liability company llc south carolina form

- Sc living trust form

- Living trust individual 497325810 form

Find out other New York Form IT 241 Claim For Clean Heating Fuel Credit

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word