Form it 241 Claim for Clean Heating Fuel Credit Tax Year 2023

Understanding the IT 241 Form for Clean Heating Fuel Credit

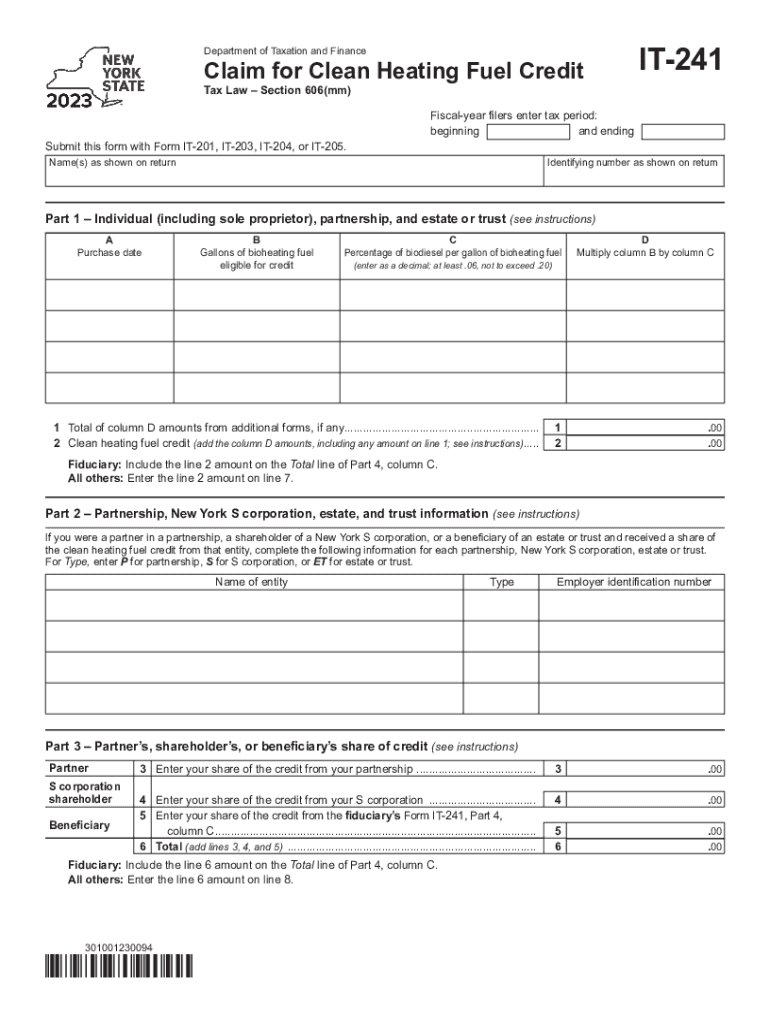

The IT 241 form, officially known as the Claim for Clean Heating Fuel Credit, is a tax form used in New York State. This form allows taxpayers to claim a credit for the purchase of clean heating fuel, which is essential for promoting environmentally friendly heating solutions. The credit is designed to encourage the use of cleaner fuel alternatives, contributing to a reduction in greenhouse gas emissions. It is particularly relevant for homeowners and businesses that utilize qualifying heating fuels, such as biofuels and other clean energy sources.

Steps to Complete the IT 241 Form

Completing the IT 241 form involves several key steps to ensure accuracy and compliance. Taxpayers should follow these guidelines:

- Gather necessary documentation, including receipts for clean heating fuel purchases.

- Fill out personal information, such as name, address, and Social Security number.

- Indicate the type and amount of clean heating fuel purchased during the tax year.

- Calculate the credit amount based on the provided guidelines and instructions.

- Review the completed form for any errors before submission.

By following these steps, taxpayers can ensure they accurately claim their credit for clean heating fuel.

Eligibility Criteria for the IT 241 Form

To qualify for the clean heating fuel credit using the IT 241 form, taxpayers must meet specific eligibility criteria. These include:

- Purchasing clean heating fuel that meets state-defined standards.

- Being a resident of New York State or operating a business within the state.

- Filing a New York State tax return for the applicable tax year.

Understanding these criteria is crucial for taxpayers to determine their eligibility for the credit.

How to Obtain the IT 241 Form

Taxpayers can obtain the IT 241 form through several convenient methods. The form is available:

- Online through the New York State Department of Taxation and Finance website.

- At local tax offices or government buildings.

- By requesting a paper form to be mailed directly to them.

Having access to the form ensures that taxpayers can easily proceed with their claims for the clean heating fuel credit.

Filing Deadlines for the IT 241 Form

It is essential for taxpayers to be aware of the filing deadlines associated with the IT 241 form. Typically, the form must be submitted along with the New York State tax return by the tax filing deadline, which is usually April fifteenth. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Being mindful of these dates helps taxpayers avoid penalties and ensures timely processing of their claims.

Key Elements of the IT 241 Form

The IT 241 form includes several key elements that taxpayers must complete accurately. These elements consist of:

- Identification section for the taxpayer.

- Details regarding the type and amount of clean heating fuel purchased.

- Calculation section for determining the credit amount.

- Signature and date fields to validate the submission.

Each section must be filled out carefully to ensure a successful claim for the clean heating fuel credit.

Quick guide on how to complete form it 241 claim for clean heating fuel credit tax year

Effortlessly Prepare Form IT 241 Claim For Clean Heating Fuel Credit Tax Year on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage Form IT 241 Claim For Clean Heating Fuel Credit Tax Year on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year with ease

- Find Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year to guarantee outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 241 claim for clean heating fuel credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 241 claim for clean heating fuel credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 241 form and why is it important?

The it 241 form is a tax form used for reporting specific income and calculating the necessary state taxes. Understanding the it 241 form is crucial for ensuring compliance with tax regulations and potentially minimizing tax liabilities for your business.

-

How can airSlate SignNow help me with the it 241 form?

AirSlate SignNow provides a streamlined solution for signing and sending the it 241 form electronically. This minimizes the hassle of paper documentation and ensures a secure, efficient method for managing your tax forms.

-

What are the pricing options for using airSlate SignNow with the it 241 form?

AirSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Depending on your usage, these plans can help you save time and costs while handling the it 241 form and other documents.

-

Does airSlate SignNow offer features specifically for tax documents like the it 241 form?

Yes, airSlate SignNow includes features tailored for handling tax documents such as the it 241 form. With customizable templates, request signatures, and automated workflows, you can manage your tax paperwork more efficiently.

-

Can I integrate airSlate SignNow with my accounting software for the it 241 form?

Certainly! AirSlate SignNow easily integrates with popular accounting software that can help manage the it 241 form. This integration allows for seamless data transfer, ensuring your documents are up-to-date and reducing the risk of errors.

-

Is airSlate SignNow secure for handling sensitive documents like the it 241 form?

Absolutely! AirSlate SignNow employs state-of-the-art security measures to protect your sensitive documents, including the it 241 form. With encryption and secure access controls, you can be confident that your information is safe.

-

What are the benefits of using airSlate SignNow for the it 241 form compared to traditional methods?

Using airSlate SignNow for the it 241 form offers numerous benefits over traditional methods, such as faster processing times, reduced paperwork, and enhanced tracking of document status. This leads to a more efficient workflow and less stress during tax season.

Get more for Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- Eprepaid order form tnt

- Mississippi quitclaim deed from individual to individual form

- Residential rental application form web 295 ca

- Relinquishment counseling colorado form

- Addition of property form lockton affinity habitat for humanity

- Westside credit services tenant screening application form 5504107

- Mosquito control proposal amp service agreement auto mist system form

- What is the ncpdp provider id form

Find out other Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template