Form it 203 GR Group Return for Nonresident Partners Tax Year 2020

What is the Form IT 203 GR Group Return For Nonresident Partners Tax Year

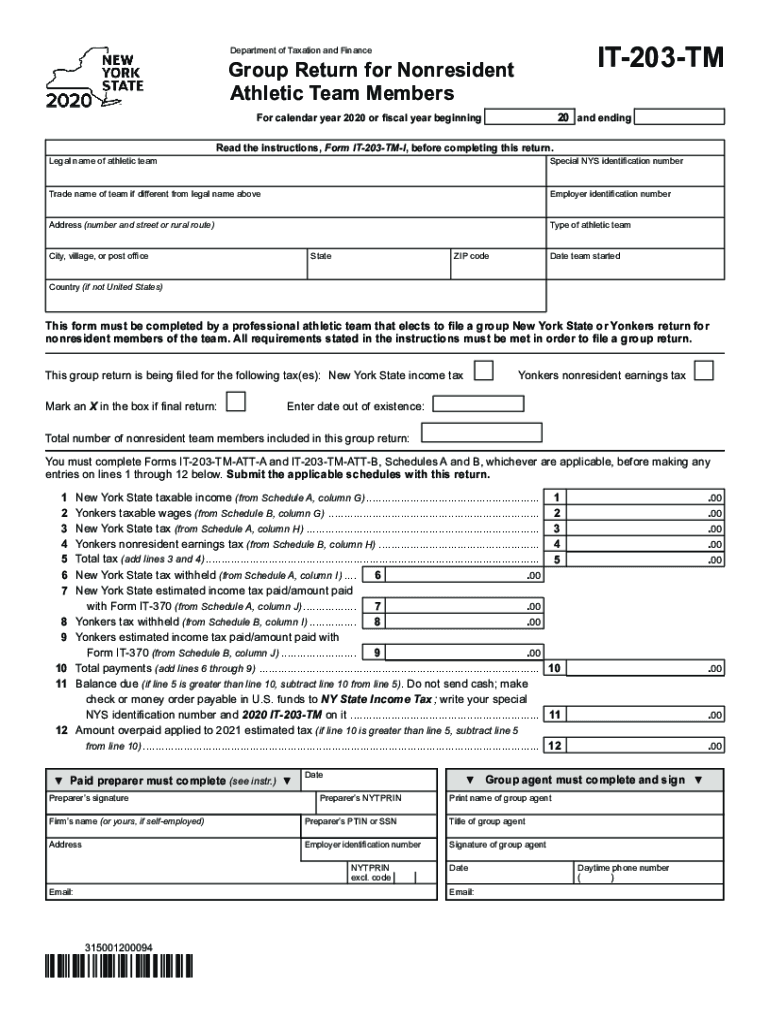

The Form IT 203 GR Group Return For Nonresident Partners Tax Year is a tax document specifically designed for partnerships that include nonresident partners. This form allows partnerships to file a single tax return on behalf of all nonresident partners, simplifying the tax reporting process. It ensures that tax obligations are met while providing a streamlined approach for both the partnership and its partners. By using this form, partnerships can report income, deductions, and credits attributable to their nonresident partners for the specified tax year.

Steps to Complete the Form IT 203 GR Group Return For Nonresident Partners Tax Year

Completing the Form IT 203 GR involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information related to the partnership and its nonresident partners. This includes income statements, expense reports, and any relevant tax documents. Next, accurately fill out each section of the form, ensuring that all income and deductions are reported correctly. It is essential to double-check calculations and ensure that all required signatures are included. Finally, submit the completed form by the designated filing deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 GR are crucial for compliance. Typically, the form must be filed by the 15th day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due by March 15. It is important to stay informed about any changes to deadlines or extensions that may apply, as these can impact the filing process.

Legal Use of the Form IT 203 GR Group Return For Nonresident Partners Tax Year

The legal use of the Form IT 203 GR is governed by tax regulations that require accurate reporting of income and deductions for nonresident partners. This form must be completed in accordance with the guidelines set forth by the Internal Revenue Service (IRS) and state tax authorities. Proper use of the form ensures that partnerships fulfill their tax obligations while minimizing the risk of audits or penalties. Additionally, utilizing eSignature solutions can enhance the legal validity of the form, ensuring that all signatures meet compliance standards.

Key Elements of the Form IT 203 GR Group Return For Nonresident Partners Tax Year

Key elements of the Form IT 203 GR include sections for reporting partnership income, deductions, and credits. It also requires detailed information about each nonresident partner, including their share of income and any applicable tax liabilities. Ensuring that all sections are completed accurately is vital for compliance and for providing a clear picture of the partnership's financial activities during the tax year. Additionally, the form may require attachments or supplementary documentation to support the reported figures.

How to Obtain the Form IT 203 GR Group Return For Nonresident Partners Tax Year

The Form IT 203 GR can be obtained through the official state tax authority website or by contacting the appropriate tax office directly. Many states provide downloadable PDF versions of the form, which can be filled out electronically or printed for manual completion. It is advisable to ensure that the most current version of the form is used, as tax regulations and requirements may change from year to year.

Quick guide on how to complete form it 203 gr group return for nonresident partners tax year

Complete Form IT 203 GR Group Return For Nonresident Partners Tax Year effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form IT 203 GR Group Return For Nonresident Partners Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Form IT 203 GR Group Return For Nonresident Partners Tax Year with ease

- Find Form IT 203 GR Group Return For Nonresident Partners Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or black out confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you'd like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiresome form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 203 GR Group Return For Nonresident Partners Tax Year and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 gr group return for nonresident partners tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr group return for nonresident partners tax year

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form IT 203 GR Group Return For Nonresident Partners Tax Year?

Form IT 203 GR Group Return For Nonresident Partners Tax Year is a tax document used by partnerships with nonresident partners to report income to New York State. This form enables partnerships to file a consolidated return, simplifying tax obligations. Understanding this form is crucial for compliance and ensuring accurate reporting.

-

How does airSlate SignNow help with Form IT 203 GR Group Return For Nonresident Partners Tax Year?

airSlate SignNow offers an efficient solution for electronically signing and submitting the Form IT 203 GR Group Return For Nonresident Partners Tax Year. Our platform streamlines the process, making it easier to manage document workflows and stay compliant with tax regulations. With our user-friendly interface, you can focus on your business while we handle the paperwork.

-

What features does airSlate SignNow provide for handling tax documents?

airSlate SignNow includes features such as eSigning, document templates, and secure storage specifically suited for tax documents like Form IT 203 GR Group Return For Nonresident Partners Tax Year. Our solution allows you to create, send, and track your documents effortlessly while ensuring they are legally binding. Additionally, our platform supports compliance with various regulations.

-

Is airSlate SignNow a cost-effective solution for tax document management?

Absolutely! AirSlate SignNow is designed to be a cost-effective solution for managing tax documents, including Form IT 203 GR Group Return For Nonresident Partners Tax Year. With competitive pricing plans and no hidden fees, you can efficiently handle your tax documentation without breaking the bank. Save time and resources while ensuring compliance.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, making it easier to manage your Form IT 203 GR Group Return For Nonresident Partners Tax Year. Our integrations streamline your workflow, ensuring that all your documents are synchronized across platforms. This connectivity enhances overall efficiency, especially during tax season.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption standards to protect sensitive documents like the Form IT 203 GR Group Return For Nonresident Partners Tax Year. You can be confident that your information is safe while using our service, ensuring compliance and peace of mind during the filing process.

-

What support does airSlate SignNow offer for users preparing tax documents?

AirSlate SignNow provides comprehensive support for users preparing tax documents, including the Form IT 203 GR Group Return For Nonresident Partners Tax Year. Our support team is available to assist with any questions or technical issues. Additionally, we offer resources and tutorials to help you navigate the platform effectively.

Get more for Form IT 203 GR Group Return For Nonresident Partners Tax Year

- Form 49 citationmgl c 2106 commonwealth of

- 7 questions to ask your attorney before starting a business form

- Frequently asked questions mdcourtsgov form

- Lawgics maryland wills ampamp trusts worksheet copyright form

- Me maine notarial certificates form

- Maine power of attorney revocation form

- Jis code cag form

- Pc 650 petition for appointment of limited guardian of minor form

Find out other Form IT 203 GR Group Return For Nonresident Partners Tax Year

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document