Form it 203 TM Group Return for Nonresident Athletic Team Members Tax Year 2024-2026

What is the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

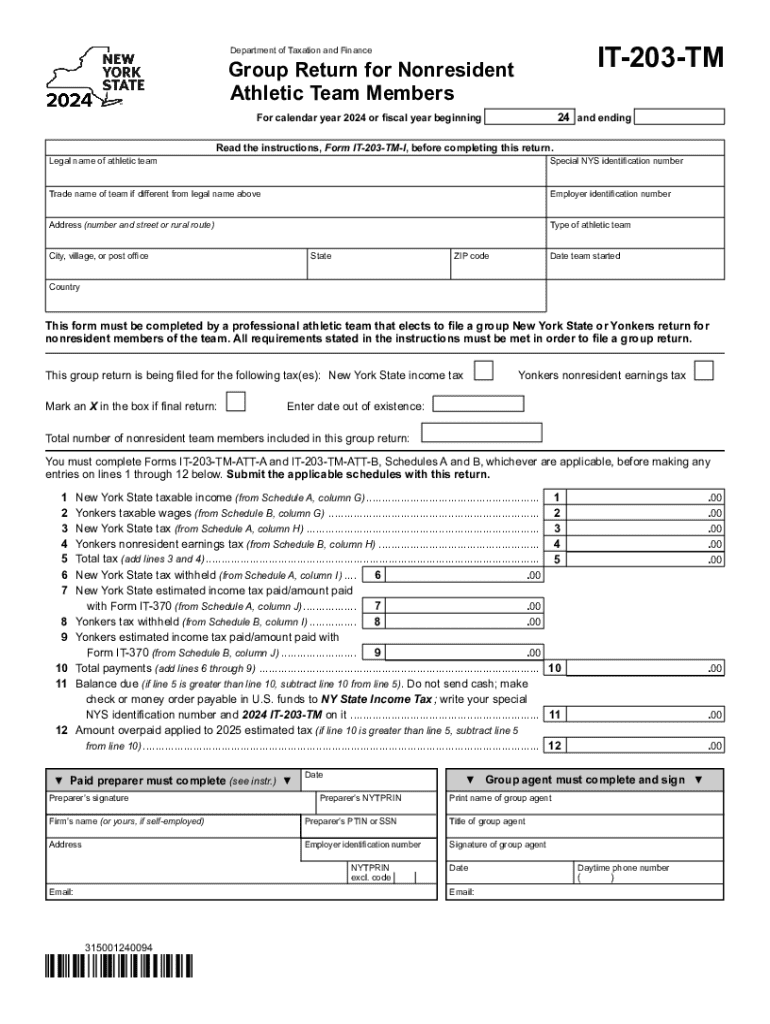

The Form IT 203 TM Group Return for Nonresident Athletic Team Members is a specific tax form used by athletic teams composed of nonresident members participating in events in the United States. This form allows teams to report and pay taxes on income earned by their members during the tax year. It is particularly relevant for teams that may not have a permanent establishment in the U.S. but still generate income through competitions or events held within the country. By using this form, teams ensure compliance with U.S. tax laws while simplifying the tax filing process for their nonresident members.

How to use the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

To effectively use the Form IT 203 TM Group Return, teams must gather all necessary financial information related to their nonresident members' earnings during the tax year. This includes details about the events participated in, the income generated, and any applicable deductions. Teams should accurately fill out the form, ensuring that all required fields are completed. Once the form is filled, it must be submitted to the appropriate tax authority, typically the state where the events occurred. Proper usage of this form helps teams fulfill their tax obligations while minimizing the risk of penalties.

Steps to complete the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

Completing the Form IT 203 TM involves several key steps:

- Gather necessary documentation: Collect all financial records related to nonresident members' earnings.

- Fill out the form: Enter all required information accurately, including member details and income amounts.

- Review for accuracy: Double-check all entries to ensure there are no mistakes or omissions.

- Submit the form: Send the completed form to the relevant tax authority by the specified deadline.

Following these steps helps ensure a smooth filing process and compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 TM are crucial to avoid penalties. Typically, the form must be submitted by the 15th day of the third month following the end of the tax year. For example, if the tax year ends on December 31, the deadline would be March 15 of the following year. It is essential for teams to be aware of these dates and plan accordingly to ensure timely submission.

Eligibility Criteria

To be eligible to use the Form IT 203 TM, teams must consist of nonresident athletic members who earn income from participating in events within the United States. Additionally, the income must be directly related to their athletic activities. Teams should verify that all members meet these criteria before filing to ensure compliance with tax regulations.

Key elements of the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

The key elements of the Form IT 203 TM include:

- Identification of the athletic team and its members.

- Details of income earned by each member during the tax year.

- Applicable deductions and credits that may reduce taxable income.

- Signature of the authorized representative of the team.

Each of these components plays a vital role in accurately reporting the team's tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 tm group return for nonresident athletic team members tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm group return for nonresident athletic team members tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

The Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year is a tax form used by athletic teams to report income earned by nonresident members. This form simplifies the tax filing process for teams, ensuring compliance with state tax regulations. By using this form, teams can efficiently manage their tax obligations while minimizing errors.

-

How can airSlate SignNow help with the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. Our solution streamlines the document management process, allowing teams to focus on their athletic performance rather than paperwork. With our platform, you can ensure timely submissions and secure handling of sensitive information.

-

What are the pricing options for using airSlate SignNow for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, including those handling the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. Our plans are designed to be cost-effective, ensuring that teams of all sizes can access our services without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow offer for managing the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. These features enhance the efficiency of your tax filing process, allowing for quick edits and real-time updates. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Is airSlate SignNow compliant with regulations for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

Yes, airSlate SignNow is fully compliant with all relevant regulations regarding the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. We prioritize data security and compliance, ensuring that your documents are handled according to legal standards. Our platform is regularly updated to reflect any changes in tax regulations, providing peace of mind for users.

-

Can I integrate airSlate SignNow with other software for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

Absolutely! airSlate SignNow offers seamless integrations with various software applications that can assist in managing the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. This allows you to streamline your workflow and enhance productivity by connecting with tools you already use. Our integration capabilities ensure that all your data remains synchronized and accessible.

-

What are the benefits of using airSlate SignNow for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

Using airSlate SignNow for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the signing and submission process, reducing the likelihood of errors. Additionally, you can track the status of your documents in real-time, ensuring that everything is submitted on time.

Get more for Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

- Usda rural housing servicetenant recertification form

- Arkansas tobacco quitline fax referral form fax number 1 888 healthy arkansas

- Apostillecertification order instructions nevada secretary of form

- Medical records release raleigh neurology associates form

- Multimodal dangerous goods form 255040206

- Www kcgov usview2701in the matter of the guardianship of kcgov us form

- Form mo cr credit for income taxes paid to other states or political subdivisions

- Software testing agreement template form

Find out other Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile