Form it 203 TM Group Return for Nonresident Athletic Team Members Tax Year 2022

What is the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

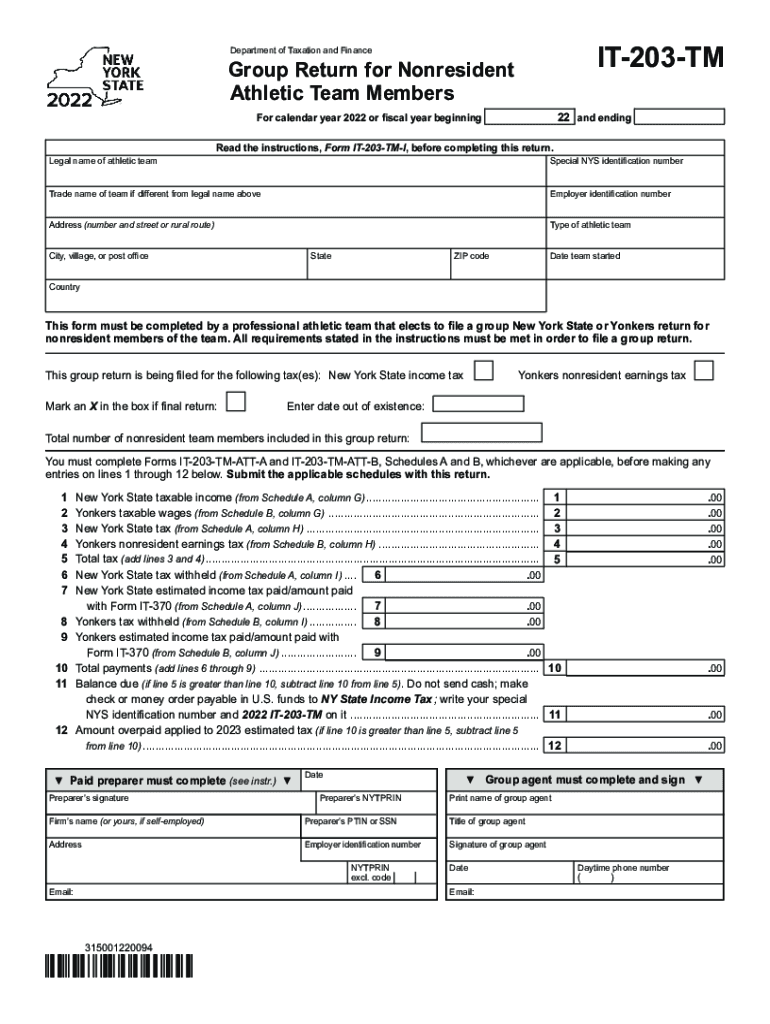

The Form IT 203 TM Group Return for Nonresident Athletic Team Members is a tax document specifically designed for nonresident athletes who participate in events in the United States. This form allows athletic teams to report the income earned by their nonresident members during a specific tax year. It simplifies the tax filing process for these individuals, ensuring compliance with U.S. tax laws while addressing the unique circumstances of nonresident athletes.

How to use the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

Using the Form IT 203 TM involves several key steps. First, the team must gather the necessary information about each nonresident member, including their income and tax identification details. Next, the team should ensure that all members meet the eligibility criteria for filing this group return. Once the information is compiled, the form can be completed, either digitally or on paper, before being submitted to the appropriate tax authority.

Steps to complete the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

Completing the Form IT 203 TM requires careful attention to detail. Here are the essential steps:

- Collect personal and income information for each nonresident athlete.

- Verify that all athletes meet the eligibility requirements for the group return.

- Fill out the form, ensuring accuracy in reporting income and tax details.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the designated tax authority.

Legal use of the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

The legal use of the Form IT 203 TM is governed by U.S. tax laws that dictate how nonresident income should be reported. This form is recognized by the IRS and complies with relevant regulations, making it a legitimate method for nonresident athletes to fulfill their tax obligations. Proper completion and submission of this form help avoid potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 203 TM. Typically, the form must be submitted by the due date for the tax year in which the income was earned. For most taxpayers, this is usually April fifteenth of the following year. However, specific deadlines may vary based on individual circumstances or extensions granted by the IRS.

Required Documents

To successfully complete the Form IT 203 TM, several documents are necessary:

- Income statements for each nonresident athlete, such as W-2s or 1099s.

- Tax identification numbers for all athletes included in the group return.

- Any relevant documentation supporting deductions or credits claimed.

Quick guide on how to complete form it 203 tm group return for nonresident athletic team members tax year 2022

Complete Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year on any device with airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

How to modify and eSign Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year effortlessly

- Obtain Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 tm group return for nonresident athletic team members tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm group return for nonresident athletic team members tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

The Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year is designed specifically for nonresident athletes participating in team events in New York. This form allows teams to file a single tax return for multiple athletes, simplifying the process and ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow provides an easy-to-use platform for eSigning and managing the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. Users can securely send, sign, and track documents, eliminating the hassle of manual paperwork and streamlining the filing process.

-

What features does airSlate SignNow offer for managing Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow offers features such as document templates, electronic signatures, and integration with various applications to facilitate the completion of the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. Additionally, users can enjoy document storage and secure sharing options, all within a user-friendly interface.

-

Is airSlate SignNow cost-effective for handling Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

Yes, airSlate SignNow is a cost-effective solution for managing the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. With competitive pricing plans and various subscription options, you can select a package that fits your budget while still accessing a comprehensive set of features.

-

How does airSlate SignNow ensure the security of the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow employs advanced security measures, including data encryption and secure servers, to protect your information while managing the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. Users can confidently eSign and share sensitive documents without fearing data bsignNowes or unauthorized access.

-

Can I integrate airSlate SignNow with other software for my Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your workflow tools when managing the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year. This integration helps you streamline processes and enhances productivity across your team's document management tasks.

-

What are the benefits of using airSlate SignNow for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year?

Using airSlate SignNow for the Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year provides benefits such as increased efficiency, reduced paper usage, and improved collaboration among team members. Additionally, the platform simplifies the tracking and management of signatures, making it easier than ever to comply with tax regulations.

Get more for Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

- Legal last will and testament form for a widow or widower with adult and minor children south dakota

- Legal last will and testament form for divorced and remarried person with mine yours and ours children south dakota

- Legal last will and testament form with all property to trust called a pour over will south dakota

- Written revocation of will south dakota form

- Last will and testament for other persons south dakota form

- Notice to beneficiaries of being named in will south dakota form

- Estate planning questionnaire and worksheets south dakota form

- Document locator and personal information package including burial information form south dakota

Find out other Form IT 203 TM Group Return For Nonresident Athletic Team Members Tax Year

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe