Printable New York Form it 2106 Estimated Income Tax Payment Voucher for Fiduciaries 2021

What is the Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

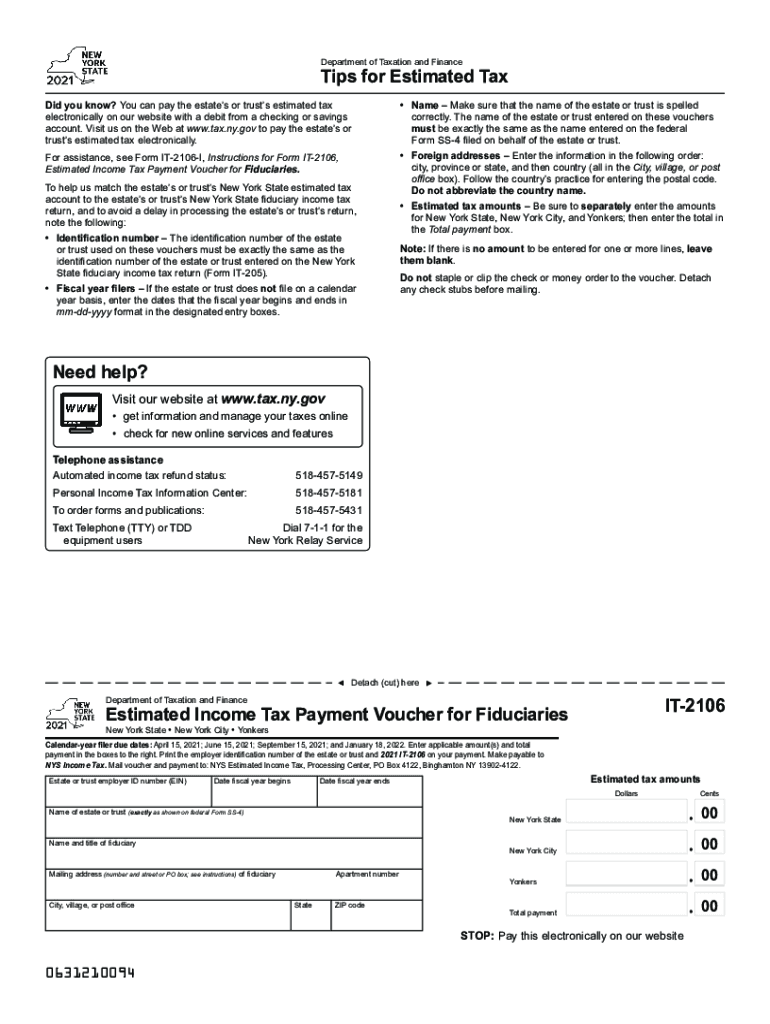

The Printable New York Form IT 2106 is an estimated income tax payment voucher specifically designed for fiduciaries. This form is essential for individuals or entities managing assets on behalf of others, such as trustees or executors. The IT 2106 allows fiduciaries to report and pay estimated taxes owed on income generated from these assets. It ensures compliance with New York State tax regulations, facilitating timely payments to avoid penalties.

How to use the Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

Using the IT 2106 form involves several straightforward steps. First, gather the necessary financial information related to the income generated from the managed assets. Next, accurately complete the form by entering the estimated income and calculating the tax owed. Once the form is filled out, it can be submitted along with the payment to the appropriate tax authority. It is crucial to keep a copy of the completed form for your records, as it serves as proof of payment.

Steps to complete the Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

Completing the IT 2106 form requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the IT 2106 form from the New York State Department of Taxation and Finance.

- Fill in the fiduciary's name, address, and identification number at the top of the form.

- Estimate the total income expected for the tax year and enter it in the designated field.

- Calculate the estimated tax liability based on the income reported.

- Submit the form along with the payment by the due date to avoid penalties.

Legal use of the Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

The IT 2106 form is legally recognized as a valid method for fiduciaries to report and pay estimated taxes in New York. To ensure its legal standing, it must be completed accurately and submitted on time. Compliance with state regulations is critical, as failure to use the form correctly can lead to penalties or interest on unpaid taxes. Additionally, maintaining records of submitted forms and payments is advisable for legal and tax purposes.

Key elements of the Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

Several key elements are essential for the proper use of the IT 2106 form:

- Identification Information: The fiduciary's name and identification number must be clearly stated.

- Estimated Income: Accurate reporting of expected income is crucial for tax calculations.

- Payment Amount: The calculated estimated tax payment should be clearly indicated.

- Submission Date: Timely submission is necessary to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IT 2106 form are critical for compliance. Generally, estimated tax payments are due quarterly. Specific due dates may vary, so it is essential to check the New York State Department of Taxation and Finance for the current year's deadlines. Missing these dates can result in penalties, making adherence to the schedule vital for fiduciaries managing tax obligations.

Quick guide on how to complete printable 2020 new york form it 2106 estimated income tax payment voucher for fiduciaries

Effortlessly prepare Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries on any device

Managing documents online has gained signNow traction among both businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the needed form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries with ease

- Find Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether via email, SMS, or an invitation link, or download it to your computer.

Put an end to lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries to ensure smooth communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 2106 estimated income tax payment voucher for fiduciaries

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 2106 estimated income tax payment voucher for fiduciaries

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the IT2106 form and why is it important?

The IT2106 form is a tax document used by individuals to calculate and report their New York State tax credits. Understanding the IT2106 form is crucial for accurate tax reporting and maximizing potential refunds. Utilizing airSlate SignNow can streamline the process of preparing and eSigning your IT2106 form.

-

How can airSlate SignNow help with the IT2106 form?

airSlate SignNow simplifies the preparation and signing process for the IT2106 form. Our platform allows you to easily upload, edit, and securely eSign your documents, ensuring compliance and reducing the risk of errors. This efficient tool saves you time and enhances better management of your tax documentation.

-

What are the pricing options for using airSlate SignNow for the IT2106 form?

airSlate SignNow offers various pricing plans to fit different business needs, starting with a free trial. For users specifically needing the IT2106 form and other tax documents, our plans include features like unlimited eSigning and document storage at competitive prices. Choose the plan that best suits your requirements for handling tax forms.

-

What features does airSlate SignNow provide for the IT2106 form?

Key features of airSlate SignNow for managing the IT2106 form include document templates, eSignature capabilities, and secure cloud storage. These features make it easy to customize your IT2106 form and keep it organized. Additionally, our platform supports various file formats and offers real-time notifications for document updates.

-

Is it safe to use airSlate SignNow for signing my IT2106 form?

Yes, using airSlate SignNow for your IT2106 form is completely safe. We employ top-notch security protocols, including encryption and secure access controls, to protect your sensitive tax information. You can trust our platform to securely manage your documents and personal data.

-

Can I integrate airSlate SignNow with other applications for the IT2106 form?

Absolutely, airSlate SignNow integrates seamlessly with various applications to streamline your workflow for the IT2106 form. This includes popular software like CRM systems, accounting applications, and cloud storage services. Integrating these tools can enhance your efficiency in managing and processing tax documents.

-

What are the benefits of using airSlate SignNow for the IT2106 form over traditional methods?

Using airSlate SignNow for the IT2106 form provides several benefits over traditional paper methods, including time savings, reduced errors, and improved tracking of document statuses. Digital signing eliminates the need for printing, scanning, and mailing, making the process more efficient. You also have the advantage of accessing your documents anytime, anywhere.

Get more for Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

- Blank will forms printable

- Sgp class roster notification of completion division of form

- Attachment for sportsperson westchester county clerk form

- Affidavit of sole heirship new york form

- New york state adoption forms drl 111

- Power of attorney new york statutory short form sell or

- Nysbathe revocable trust revisited form

- Saratoga county public defender form

Find out other Printable New York Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms