Form it 2106 Estimated Income Tax Payment Voucher for Fiduciaries Tax Year 2024

What is the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

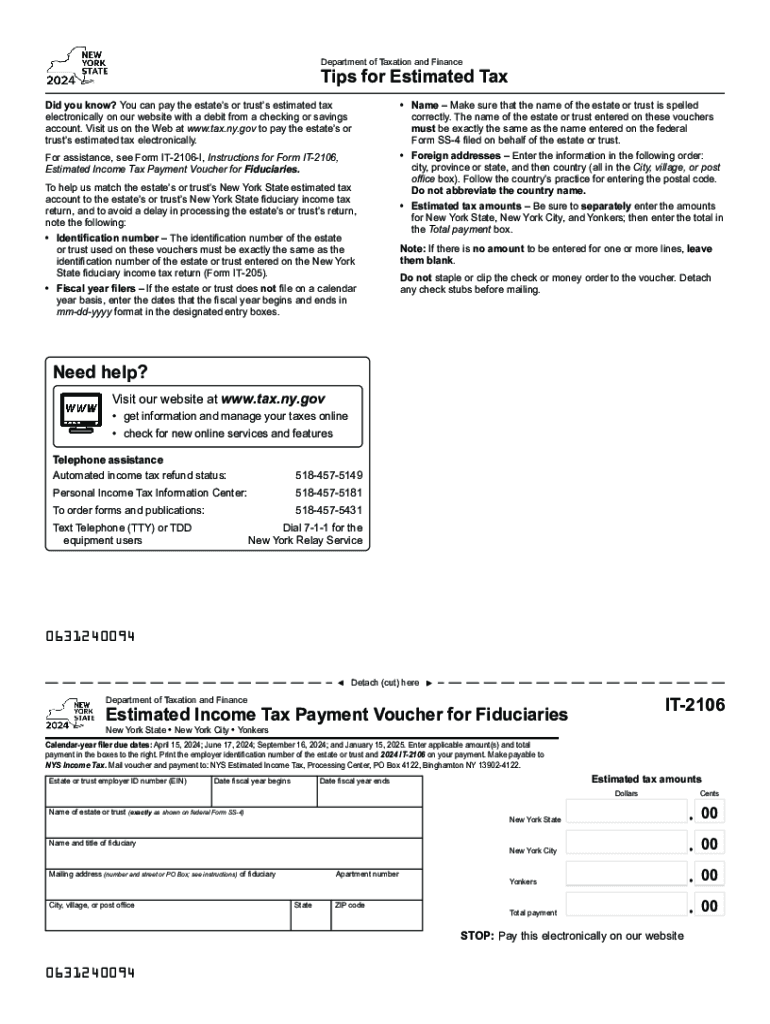

The Form IT 2106 is an estimated income tax payment voucher specifically designed for fiduciaries in New York. This form is utilized to report and remit estimated tax payments for estates and trusts. Fiduciaries are responsible for managing the financial affairs of these entities, and the IT 2106 ensures that they comply with state tax obligations. By using this form, fiduciaries can calculate the estimated tax due based on the income generated by the estate or trust, which is crucial for maintaining compliance with New York tax laws.

How to use the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

To effectively use the Form IT 2106, fiduciaries should first determine the estimated income for the tax year. This involves assessing all sources of income generated by the estate or trust. Once the estimated income is calculated, fiduciaries can apply the appropriate tax rates to determine the estimated tax liability. The completed form should then be submitted along with the payment to the New York State Department of Taxation and Finance. It is important to retain a copy of the form and payment for personal records.

Steps to complete the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

Completing the Form IT 2106 involves several key steps:

- Gather financial information regarding the estate or trust, including income statements and any deductions.

- Calculate the estimated income for the current tax year.

- Determine the applicable tax rate based on the estimated income.

- Fill out the form, ensuring all required fields are completed accurately.

- Submit the form along with the estimated payment to the appropriate tax authority.

Key elements of the Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

The Form IT 2106 includes several essential components that fiduciaries must complete:

- Identification information for the fiduciary, including name and address.

- Details about the estate or trust, such as its name and taxpayer identification number.

- Estimated income amount and the calculated tax due.

- Payment information, including the payment method and amount being submitted.

Filing Deadlines / Important Dates

Fiduciaries must adhere to specific deadlines when filing the Form IT 2106. Generally, estimated tax payments are due quarterly, with deadlines typically falling on April fifteenth, June fifteenth, September fifteenth, and January fifteenth of the following year. It is crucial for fiduciaries to remain aware of these dates to avoid penalties and ensure timely compliance with tax obligations.

Penalties for Non-Compliance

Failure to file the Form IT 2106 or remit the estimated tax payments on time can result in significant penalties. These may include interest on unpaid taxes and additional fines for late submissions. Fiduciaries should take care to meet all filing requirements to avoid these consequences and ensure the proper management of the estate or trust's financial responsibilities.

Create this form in 5 minutes or less

Find and fill out the correct form it 2106 estimated income tax payment voucher for fiduciaries tax year 708712262

Create this form in 5 minutes!

How to create an eSignature for the form it 2106 estimated income tax payment voucher for fiduciaries tax year 708712262

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY IT2106 estimated form?

The NY IT2106 estimated form is used by non-residents and part-year residents to report income earned in New York State. It helps taxpayers calculate their estimated tax liability for the year. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with the NY IT2106 estimated form?

airSlate SignNow simplifies the process of signing and sending the NY IT2106 estimated form electronically. Our platform allows users to easily fill out, eSign, and share documents securely. This streamlines tax preparation and ensures timely submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, including a free trial. Our plans are designed to be cost-effective, making it easy for users to manage documents like the NY IT2106 estimated form without breaking the bank. Check our website for detailed pricing information.

-

Are there any features specifically for tax documents like the NY IT2106 estimated?

Yes, airSlate SignNow includes features tailored for tax documents, such as templates for the NY IT2106 estimated form. Users can save time with pre-filled fields and automated workflows, ensuring that all necessary information is captured accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows users to manage their NY IT2106 estimated forms alongside other financial documents, enhancing productivity and organization.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents like the NY IT2106 estimated form offers numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our platform ensures that your documents are signed and stored securely, giving you peace of mind.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is compliant with various tax regulations, ensuring that your eSigned documents, including the NY IT2106 estimated form, meet legal standards. Our commitment to compliance helps users avoid potential issues with tax authorities.

Get more for Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

- Newly divorced individuals package washington form

- Contractors forms package washington

- Power of attorney for sale of motor vehicle washington form

- Wedding planning or consultant package washington form

- Hunting forms package washington

- Identity theft recovery package washington form

- Durable power attorney washington form

- Revocation of durable power of attorney for health care washington form

Find out other Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors