PDF Form it 2106, Estimated Income Tax Payment Voucher for Fiduciaries 2022

What is the IT 2106 Form?

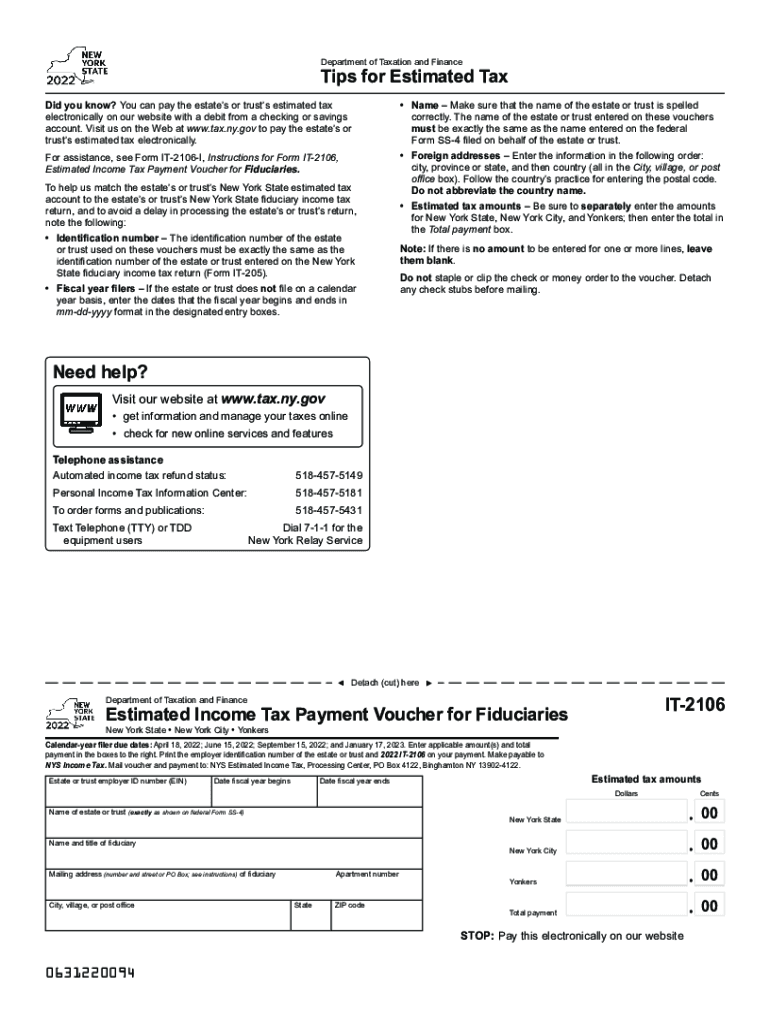

The IT 2106 form, also known as the Estimated Income Tax Payment Voucher for Fiduciaries, is a crucial document for fiduciaries managing estimated tax payments on behalf of estates or trusts in New York. This form is specifically designed to help fiduciaries report and remit estimated income taxes to the state, ensuring compliance with New York tax regulations. By using the IT 2106 form, fiduciaries can calculate and submit the appropriate estimated tax payments, which helps avoid penalties and interest for underpayment.

Steps to Complete the IT 2106 Form

Completing the IT 2106 form involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant financial data, including income, deductions, and credits related to the estate or trust.

- Calculate Estimated Tax Liability: Use the collected data to estimate the total tax liability for the year. This may involve using tax tables or software to assist in calculations.

- Fill Out the Form: Enter the calculated estimated tax amounts on the IT 2106 form, ensuring all fields are completed accurately.

- Review for Accuracy: Double-check all entries for correctness to prevent any errors that could lead to penalties.

- Submit the Form: Choose a submission method, either electronically or via mail, to send the completed form along with any payment due.

Legal Use of the IT 2106 Form

The IT 2106 form is legally binding when filled out and submitted according to New York state tax laws. It serves as an official record of the fiduciary's estimated tax payments and must be completed accurately to ensure compliance. The form is recognized by the New York State Department of Taxation and Finance, which means that proper submission can protect fiduciaries from potential legal issues related to tax obligations.

Filing Deadlines and Important Dates

Fiduciaries must adhere to specific deadlines when submitting the IT 2106 form. Generally, estimated tax payments are due quarterly, with deadlines typically falling on:

- April 15

- June 15

- September 15

- January 15 of the following year

It is crucial for fiduciaries to mark these dates on their calendars to ensure timely payments and avoid penalties.

Who Issues the IT 2106 Form?

The IT 2106 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance across the state. Fiduciaries can obtain the form directly from the department's website or through authorized tax professionals.

Examples of Using the IT 2106 Form

Fiduciaries may encounter various scenarios where the IT 2106 form is applicable:

- Managing an estate that generates income from investments or rental properties.

- Handling a trust that receives dividends or interest payments.

- Representing a deceased individual’s financial affairs that require ongoing tax payments.

In each case, the IT 2106 form helps ensure that estimated tax payments are calculated and submitted correctly, thereby fulfilling legal obligations.

Quick guide on how to complete pdf form it 2106 estimated income tax payment voucher for fiduciaries

Complete PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Manage PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries with ease

- Locate PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Choose how you would like to submit your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and eSign PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form it 2106 estimated income tax payment voucher for fiduciaries

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 2106 estimated income tax payment voucher for fiduciaries

The best way to generate an e-signature for your PDF file online

The best way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an e-signature for a PDF document on Android devices

People also ask

-

What is it 2106 and how does it relate to airSlate SignNow?

IT 2106 is a reference to a specific version of compliance standards essential for digital documentation. airSlate SignNow ensures that your eSigning processes align with these standards, providing a secure and trustworthy solution for your document management.

-

How does airSlate SignNow's pricing model work for it 2106 compliance?

airSlate SignNow offers flexible pricing plans tailored for businesses looking to meet IT 2106 standards. Our packages provide affordable solutions without compromising on features, ensuring you can stay compliant while managing costs effectively.

-

What are the key features of airSlate SignNow that support it 2106 compliance?

Key features of airSlate SignNow that support IT 2106 compliance include secure eSigning, document tracking, and audit trails. These functionalities not only enhance security but also provide users with the necessary documentation to demonstrate compliance during audits.

-

How can airSlate SignNow benefit my business in aligning with it 2106?

Using airSlate SignNow can streamline your document workflow and ensure that all signing processes meet IT 2106 requirements. By automating these processes, businesses can minimize errors, reduce paperwork, and ultimately increase efficiency across the organization.

-

Does airSlate SignNow integrate with other platforms to support it 2106?

Yes, airSlate SignNow integrates with various platforms like Google Workspace and Salesforce, making it easier to implement IT 2106 compliance across different systems. These integrations facilitate seamless document sharing and enhance overall productivity within your existing workflows.

-

What industries can benefit from it 2106 compliance using airSlate SignNow?

Multiple industries, including finance, healthcare, and legal, can benefit from IT 2106 compliance through airSlate SignNow. Our solution addresses specific regulatory needs, allowing businesses in these sectors to manage sensitive documents securely while ensuring adherence to industry standards.

-

Is there customer support available for questions about it 2106 and airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with inquiries related to IT 2106 compliance. Our team is here to help you navigate compliance challenges and optimize your document management experience.

Get more for PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries

- Louisiana motion continue 497308725 form

- Motion and order to continue rule date and temporary restraining order louisiana form

- Supervised probation form

- Louisiana act sale form

- Motion to correct minutes louisiana form

- Illegal sentence form

- Louisiana land donation form

- Cash sale louisiana 497308732 form

Find out other PDF Form IT 2106, Estimated Income Tax Payment Voucher For Fiduciaries

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now