Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit 2020

What is the 2020 Capital Investment Credit?

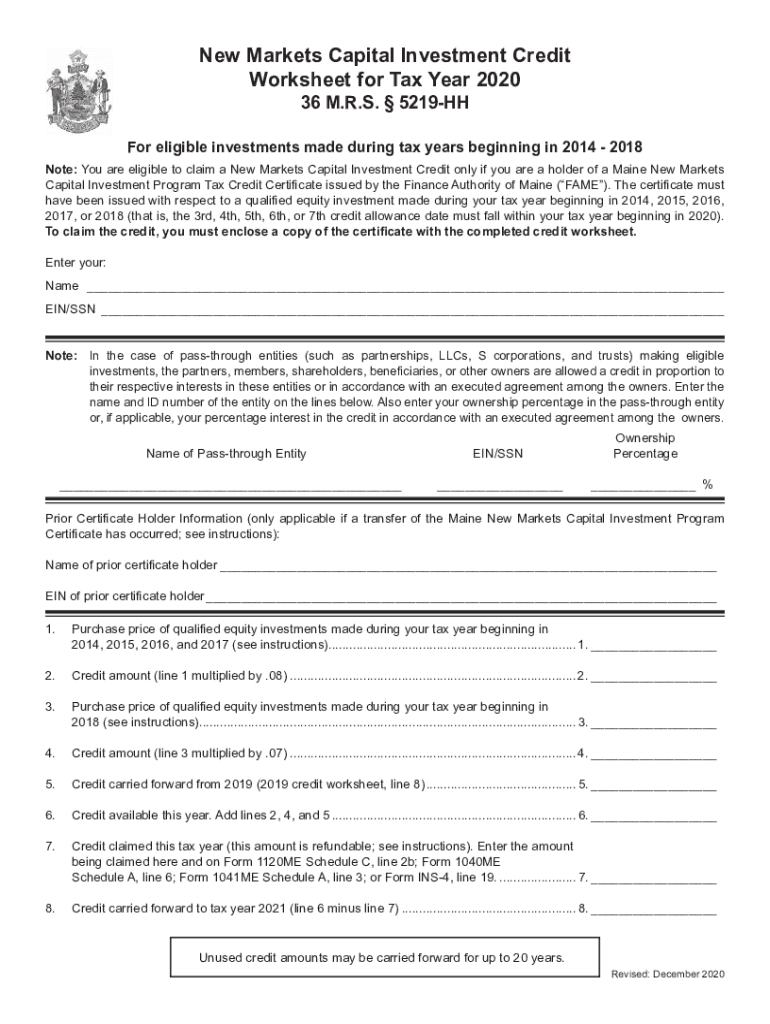

The 2020 capital investment credit is a tax incentive designed to encourage businesses to invest in certain qualified property and projects within the state of Maine. This credit allows eligible businesses to receive a percentage of their investment back as a tax credit, effectively reducing their overall tax liability. The Maine New Markets Capital Investment Credit specifically targets investments in low-income communities, aiming to stimulate economic growth and job creation in these areas.

Eligibility Criteria for the 2020 Capital Investment Credit

To qualify for the 2020 capital investment credit, businesses must meet specific criteria. Eligible entities typically include corporations, partnerships, and limited liability companies that invest in qualified property. The property must be used in the active conduct of a trade or business and must be located in designated low-income areas. Additionally, the investment must meet minimum thresholds set by the state, ensuring that the credit supports significant economic development activities.

Steps to Complete the 2020 Capital Investment Credit Form

Completing the 2020 capital investment credit form involves several key steps:

- Gather necessary documentation, including proof of investment and business identification.

- Fill out the form accurately, ensuring all required fields are completed.

- Include any supporting documents that demonstrate eligibility and investment details.

- Review the completed form for accuracy before submission.

- Submit the form by the designated deadline, either online or via mail.

Filing Deadlines for the 2020 Capital Investment Credit

It is essential to adhere to filing deadlines to ensure eligibility for the 2020 capital investment credit. Typically, forms must be submitted by a specific date, which is often aligned with the business's tax filing deadline. Businesses should check the Maine Revenue Services website or consult with a tax professional to confirm the exact dates and any potential extensions that may apply.

Legal Use of the 2020 Capital Investment Credit

The legal use of the 2020 capital investment credit is governed by state tax laws and regulations. To ensure compliance, businesses must follow the guidelines set forth by the Maine Revenue Services. This includes maintaining accurate records of investments, adhering to eligibility criteria, and submitting the form within the required timeframe. Non-compliance may result in penalties or disqualification from receiving the credit.

How to Obtain the 2020 Capital Investment Credit Form

The 2020 capital investment credit form can be obtained from the Maine Revenue Services website. It is available for download in a printable format, allowing businesses to fill it out manually or electronically. Additionally, businesses may consult with tax professionals to ensure they have the correct version of the form and understand the requirements for completion.

Quick guide on how to complete printable 2020 maine new markets capital investment credit new markets capital investment credit

Prepare Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit without hassle

- Find Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Edit and eSign Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 maine new markets capital investment credit new markets capital investment credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 maine new markets capital investment credit new markets capital investment credit

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the 2020 capital investment credit and how does it benefit businesses?

The 2020 capital investment credit is a tax incentive designed to encourage businesses to invest in qualifying capital assets. By utilizing this credit, companies can reduce their tax liabilities, making it easier to reinvest in operations and growth. This program is particularly beneficial for businesses looking to modernize their facilities or expand their capabilities.

-

How can airSlate SignNow help me with documentation for the 2020 capital investment credit?

AirSlate SignNow simplifies the documentation process for the 2020 capital investment credit by allowing businesses to electronically sign and store important documents securely. Our platform ensures compliance and facilitates fast processing, which can be crucial when claiming these credits. With our easy-to-use interface, managing your capital investment paperwork is more efficient than ever.

-

What features does airSlate SignNow offer that support claims related to the 2020 capital investment credit?

AirSlate SignNow provides features such as customizable templates and multi-party signing, which are essential for expediting the documentation needed for the 2020 capital investment credit. Additionally, our audit trail capabilities enhance transparency, ensuring that all actions taken on a document are recorded for compliance reasons. This helps businesses maintain thorough and accurate records when leveraging these credits.

-

Are there any pricing plans for airSlate SignNow that cater specifically to businesses seeking the 2020 capital investment credit?

Yes, airSlate SignNow offers various pricing plans designed to fit the needs of different businesses, including those looking to optimize their claims for the 2020 capital investment credit. Our plans are scalable, so whether you're a small business or a large corporation, you'll find a solution that balances cost-effectiveness with powerful features. You can start with a free trial to see how we can assist with your credit documentation.

-

How does airSlate SignNow integrate with other tools for better management of the 2020 capital investment credit?

AirSlate SignNow seamlessly integrates with various business tools like CRM systems and accounting software, enhancing your management of the 2020 capital investment credit. These integrations ensure that your documents and financial data are synchronized, making it easier to prepare for tax filings. This streamlined approach helps businesses stay organized and efficient when claiming their credits.

-

What peer support and resources are available for businesses claiming the 2020 capital investment credit through airSlate SignNow?

AirSlate SignNow provides robust customer support and resources to assist businesses with claiming the 2020 capital investment credit. Our help center features guides, tutorials, and live support options, allowing users to find answers quickly. We also offer a community platform where users can share experiences and tips about utilizing the capital investment credit effectively.

-

Is airSlate SignNow suitable for startups looking to utilize the 2020 capital investment credit?

Absolutely! AirSlate SignNow is perfectly tailored for startups that want to maximize their advantage with the 2020 capital investment credit. Our platform is user-friendly and designed to scale as your business grows, making it easy for startups to manage documentation without extensive resources. By adopting our solution, startups can ensure they don’t miss out on essential tax benefits.

Get more for Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit

- Background brief onlandlord oregon state legislature form

- State of oregon clients trust account open a clients form

- 72 hour notice of termination for nonpayment of rentoregon form

- Uae vat and excise tax in house community form

- Of 2 wyoming affidavit of collection of estate form

- Free wyoming real estate power of attorney form word

- Training acknowledgement form 17197456

- Do not resuscitate form edit fill create download appco

Find out other Printable Maine New Markets Capital Investment Credit New Markets Capital Investment Credit

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online