Worksheets for Tax Credits 2023Maine Revenue Services 2023

What is the Worksheets For Tax Credits 2023 Maine Revenue Services

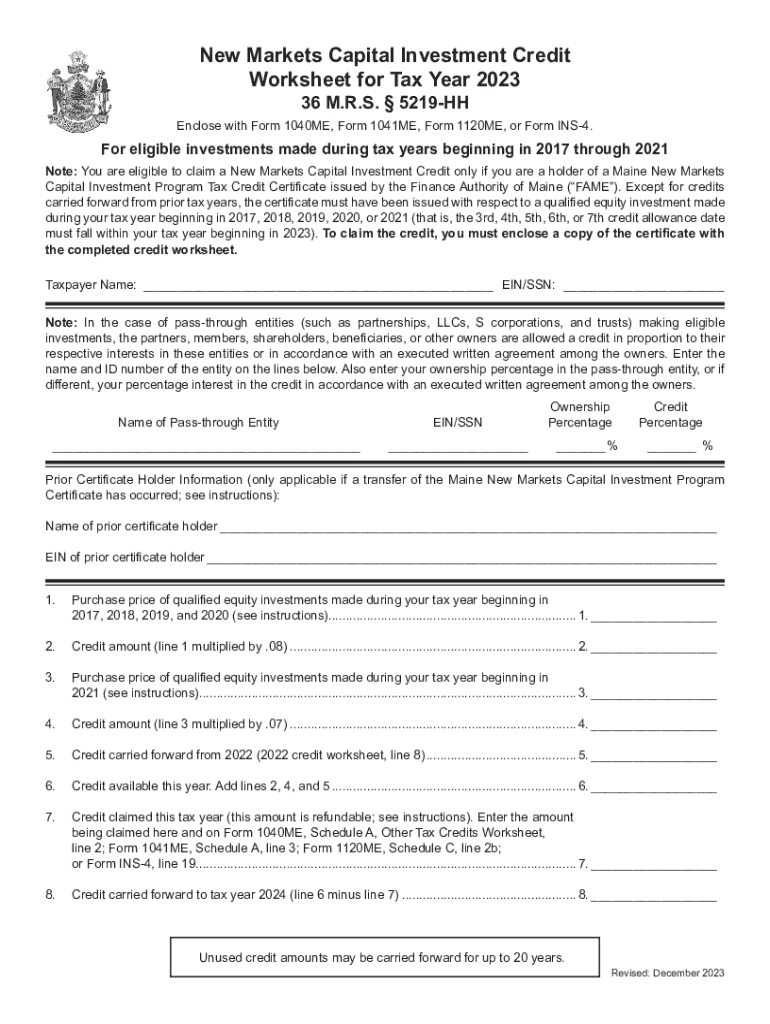

The Worksheets For Tax Credits 2023 provided by Maine Revenue Services are essential tools designed to assist individuals and businesses in calculating their eligibility for various tax credits available in the state. These worksheets simplify the process of determining the amount of credit one may qualify for, based on specific criteria set forth by state tax regulations. They are particularly useful for taxpayers looking to maximize their tax benefits while ensuring compliance with state laws.

How to use the Worksheets For Tax Credits 2023 Maine Revenue Services

Using the Worksheets For Tax Credits 2023 involves several straightforward steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, locate the appropriate worksheet that corresponds to the tax credit you are applying for. Follow the instructions carefully, filling out each section with accurate information. Be sure to double-check your calculations to ensure accuracy before submitting your forms. This process helps to streamline your tax filing and ensures that you receive any credits you are entitled to.

Steps to complete the Worksheets For Tax Credits 2023 Maine Revenue Services

Completing the Worksheets For Tax Credits 2023 requires careful attention to detail. Begin by identifying the specific tax credit you are applying for and downloading the corresponding worksheet. Fill in your personal information, including your name, address, and Social Security number. Next, input your financial data, such as income and deductions, as prompted by the worksheet. After completing all sections, review your entries for accuracy. Finally, sign and date the worksheet before submitting it along with your tax return to the Maine Revenue Services.

Eligibility Criteria for the Worksheets For Tax Credits 2023 Maine Revenue Services

Eligibility for the Worksheets For Tax Credits 2023 varies depending on the specific tax credit. Generally, individuals must meet certain income thresholds and residency requirements. Some credits may also have specific conditions related to age, family status, or employment. It is crucial to review the eligibility criteria outlined in the worksheets to determine if you qualify for the credits you are interested in claiming. Ensuring that you meet these criteria can prevent delays or denials in your tax credit applications.

Filing Deadlines / Important Dates for the Worksheets For Tax Credits 2023 Maine Revenue Services

Filing deadlines for the Worksheets For Tax Credits 2023 are aligned with the overall tax filing deadlines set by the Maine Revenue Services. Typically, individual tax returns must be filed by April 15 of the following year. However, specific credits may have additional deadlines or requirements that must be adhered to. It is important to stay informed about these dates to ensure timely submission and avoid penalties. Marking your calendar with these critical dates can help you manage your tax obligations effectively.

Required Documents for the Worksheets For Tax Credits 2023 Maine Revenue Services

To complete the Worksheets For Tax Credits 2023, several documents are typically required. These may include proof of income, such as W-2 forms or 1099 statements, documentation of any deductions or credits claimed in previous years, and identification documents such as your Social Security card. Additionally, any supporting documentation that verifies eligibility for specific credits should be gathered. Having these documents prepared in advance can facilitate a smoother filing process.

Quick guide on how to complete worksheets for tax credits 2023maine revenue services

Accomplish Worksheets For Tax Credits 2023Maine Revenue Services effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Worksheets For Tax Credits 2023Maine Revenue Services on any gadget with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The most efficient method to alter and electronically sign Worksheets For Tax Credits 2023Maine Revenue Services effortlessly

- Locate Worksheets For Tax Credits 2023Maine Revenue Services and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Worksheets For Tax Credits 2023Maine Revenue Services and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct worksheets for tax credits 2023maine revenue services

Create this form in 5 minutes!

How to create an eSignature for the worksheets for tax credits 2023maine revenue services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Worksheets For Tax Credits 2023 Maine Revenue Services?

Worksheets For Tax Credits 2023 Maine Revenue Services are designed to help businesses and individuals accurately claim tax credits and deductions. These worksheets provide structured formats approved by the Maine Revenue Services, ensuring compliance and accuracy when filing taxes.

-

How can I access Worksheets For Tax Credits 2023 Maine Revenue Services?

You can easily access Worksheets For Tax Credits 2023 Maine Revenue Services through the airSlate SignNow platform. Simply log in, navigate to the tax resources section, and download the worksheets you need for your tax filings.

-

Are there any costs associated with using Worksheets For Tax Credits 2023 Maine Revenue Services?

Using Worksheets For Tax Credits 2023 Maine Revenue Services is part of the airSlate SignNow subscription, which offers various pricing plans. You can choose a plan that fits your business needs and enjoy the benefits of eSigning and document management, ensuring you stay organized while filing taxes.

-

What are the benefits of using Worksheets For Tax Credits 2023 Maine Revenue Services?

The primary benefit of using Worksheets For Tax Credits 2023 Maine Revenue Services is that they streamline the process of claiming tax credits and deductions. Additionally, the worksheets are designed to minimize errors, making your tax experience smoother and potentially increasing your refund.

-

Can I integrate Worksheets For Tax Credits 2023 Maine Revenue Services with other software?

Yes, Worksheets For Tax Credits 2023 Maine Revenue Services can be integrated with various accounting and financial software through the airSlate SignNow APIs. This allows for seamless data transfer and easier management of tax documentation.

-

What features are included with Worksheets For Tax Credits 2023 Maine Revenue Services?

Worksheets For Tax Credits 2023 Maine Revenue Services include features like customizable templates, electronic signatures, and secure storage. These features ensure that you can manage your tax documentation efficiently and securely.

-

Who can benefit from Worksheets For Tax Credits 2023 Maine Revenue Services?

Individuals, businesses, and tax professionals can all benefit from Worksheets For Tax Credits 2023 Maine Revenue Services. These worksheets simplify the tax filing process, making it easier for anyone seeking to maximize their deductions and credits.

Get more for Worksheets For Tax Credits 2023Maine Revenue Services

- Usually made form

- Preauthorization form completedidaho secretary of state

- Notary public handbook idaho secretary of state idahogov form

- Js 44 fillable form fill online printable fillable blank

- This record was signed and sworn before me on form

- Before me and having been duly sworn did herein execute the above record for the purposes form

- Lessors agent if any form

- Before me a notary public personally appeared form

Find out other Worksheets For Tax Credits 2023Maine Revenue Services

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors