Credit Claim Forms for Corporations Current Year Tax NY Gov 2022

What is the Maine New Markets Tax?

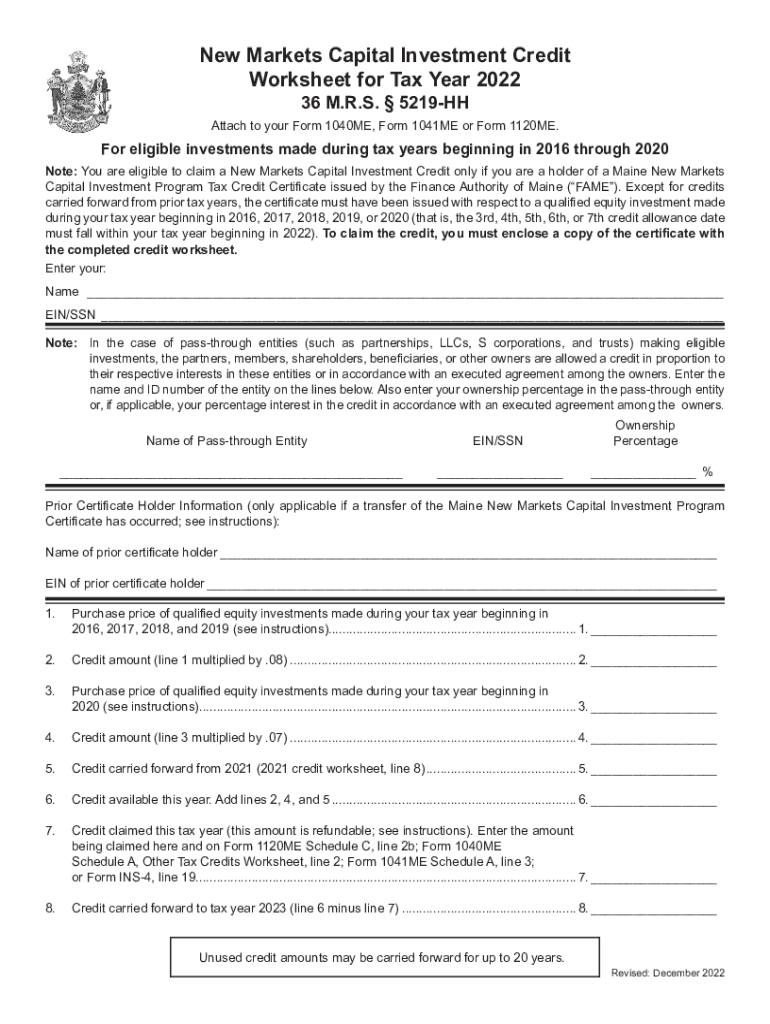

The Maine New Markets Tax is a state-level tax incentive program designed to stimulate economic growth in economically distressed areas of Maine. This program offers tax credits to investors who provide capital to qualified businesses located in these designated areas. The tax credits can significantly reduce the investor's state income tax liability, encouraging investment in local businesses that may otherwise struggle to secure funding.

Eligibility Criteria for the Maine New Markets Tax

To qualify for the Maine New Markets Tax, both the investor and the business must meet specific criteria. Investors must be individuals or entities subject to Maine state income tax. The businesses receiving the investment must be located in a qualified low-income community and operate within certain sectors, such as manufacturing, retail, or services. Additionally, the business must demonstrate a potential for job creation and economic development in the area.

Steps to Complete the Maine New Markets Tax Application

Completing the application for the Maine New Markets Tax involves several key steps:

- Determine eligibility by reviewing the criteria for both investors and businesses.

- Gather necessary documentation, including financial statements and business plans.

- Complete the application form, ensuring all required information is accurately provided.

- Submit the application to the appropriate state department for review.

- Await approval and receive notification of tax credit allocation.

Filing Deadlines for the Maine New Markets Tax

It is essential to adhere to specific filing deadlines to ensure eligibility for the Maine New Markets Tax credits. Typically, applications must be submitted by a designated date each year, which is announced by the state. Investors should also be aware of deadlines related to tax filings to claim the credits on their state income tax returns.

Required Documents for the Maine New Markets Tax

When applying for the Maine New Markets Tax, several documents are necessary to support the application. These may include:

- Proof of investment, such as bank statements or investment agreements.

- Business financial statements, including balance sheets and income statements.

- Documentation proving the business operates in a qualified low-income community.

- A detailed business plan outlining the use of funds and expected economic impact.

Form Submission Methods for the Maine New Markets Tax

Applications for the Maine New Markets Tax can typically be submitted through various methods, including online submission via the state’s tax portal, mailing a physical application, or in-person submission at designated state offices. Each method has its own guidelines, so it is important to follow the instructions provided by the state to ensure proper processing.

Quick guide on how to complete credit claim forms for corporations current year taxnygov

Prepare Credit Claim Forms For Corporations current Year Tax NY gov effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Manage Credit Claim Forms For Corporations current Year Tax NY gov on any device using airSlate SignNow apps for Android or iOS and enhance any document-focused task today.

How to alter and electronically sign Credit Claim Forms For Corporations current Year Tax NY gov with ease

- Find Credit Claim Forms For Corporations current Year Tax NY gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), sharing a link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Credit Claim Forms For Corporations current Year Tax NY gov and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit claim forms for corporations current year taxnygov

Create this form in 5 minutes!

How to create an eSignature for the credit claim forms for corporations current year taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine New Markets Tax and how does it work?

The Maine New Markets Tax is a tax credit program designed to stimulate investment in low-income areas of Maine. Businesses that invest in qualified projects can receive signNow tax credits, encouraging economic growth and job creation. This program is beneficial for businesses looking for financial incentives to expand operations in designated rural regions of Maine.

-

How can airSlate SignNow facilitate the Maine New Markets Tax application process?

AirSlate SignNow streamlines the documentation process required for applying for the Maine New Markets Tax. The platform allows users to easily send and eSign necessary forms, ensuring that all documentation is completed accurately and efficiently. This reduces administrative delays and helps businesses take advantage of the tax credits faster.

-

What features does airSlate SignNow offer to support businesses applying for the Maine New Markets Tax?

AirSlate SignNow offers features such as template creation for important tax documents, secure cloud storage, and user tracking capabilities. These tools ensure that businesses can manage their paperwork related to the Maine New Markets Tax effectively and securely. By simplifying the process, airSlate SignNow helps maximize the benefits of the tax program.

-

Are there any costs associated with using airSlate SignNow for Maine New Markets Tax documentation?

Yes, airSlate SignNow offers a range of pricing plans to fit different business needs and budgets, including options that provide access to features specifically useful for Maine New Markets Tax documentation. With competitive pricing, the platform enables businesses to manage their tax applications affordably. Investing in airSlate SignNow can ultimately lead to savings through tax credits.

-

Can airSlate SignNow integrate with other software for managing Maine New Markets Tax?

Absolutely! AirSlate SignNow integrates seamlessly with various financial and accounting software that can aid businesses in managing their Maine New Markets Tax applications. These integrations help ensure that all relevant financial data is easily accessible and correctly documented, streamlining the overall process for businesses.

-

What benefits can businesses expect from using airSlate SignNow for Maine New Markets Tax applications?

Using airSlate SignNow can signNowly reduce the time spent on paperwork related to the Maine New Markets Tax. The electronic signing and document management features facilitate faster approvals and help secure tax benefits promptly. Businesses can also enjoy improved organization and compliance, reducing the risk of errors in their applications.

-

Is there customer support available for users of airSlate SignNow focused on Maine New Markets Tax?

Yes, airSlate SignNow provides robust customer support for all users, including those specifically navigating the Maine New Markets Tax application process. Whether you need help with technical issues or guidance on document preparation, knowledgeable support staff are available to assist. This ensures users can fully leverage the platform for their tax needs.

Get more for Credit Claim Forms For Corporations current Year Tax NY gov

- South dakota release lien form

- Agreed written termination of lease by landlord and tenant south dakota form

- Sd release lien 497326243 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497326244 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for nonresidential property 497326245 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497326246 form

- Sd provisions form

- South dakota payment form

Find out other Credit Claim Forms For Corporations current Year Tax NY gov

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation