Www Maine GovgovernormillsSeed Capital Investment Tax Credit Worksheet for Tax Year 2021

What is the Maine New Markets Tax?

The Maine New Markets Tax is a tax incentive designed to encourage investment in low-income communities within the state. This program allows investors to receive a tax credit for investing in qualified businesses and projects that contribute to economic development. The tax credit is intended to stimulate job creation and foster growth in areas that may be underserved or economically distressed.

Eligibility Criteria for the Maine New Markets Tax

To qualify for the Maine New Markets Tax, both the investor and the business must meet specific eligibility requirements. Investors typically need to be individuals or entities that make qualified equity investments in designated low-income communities. The businesses receiving the investment must operate within these communities and meet certain criteria, including revenue limitations and job creation targets.

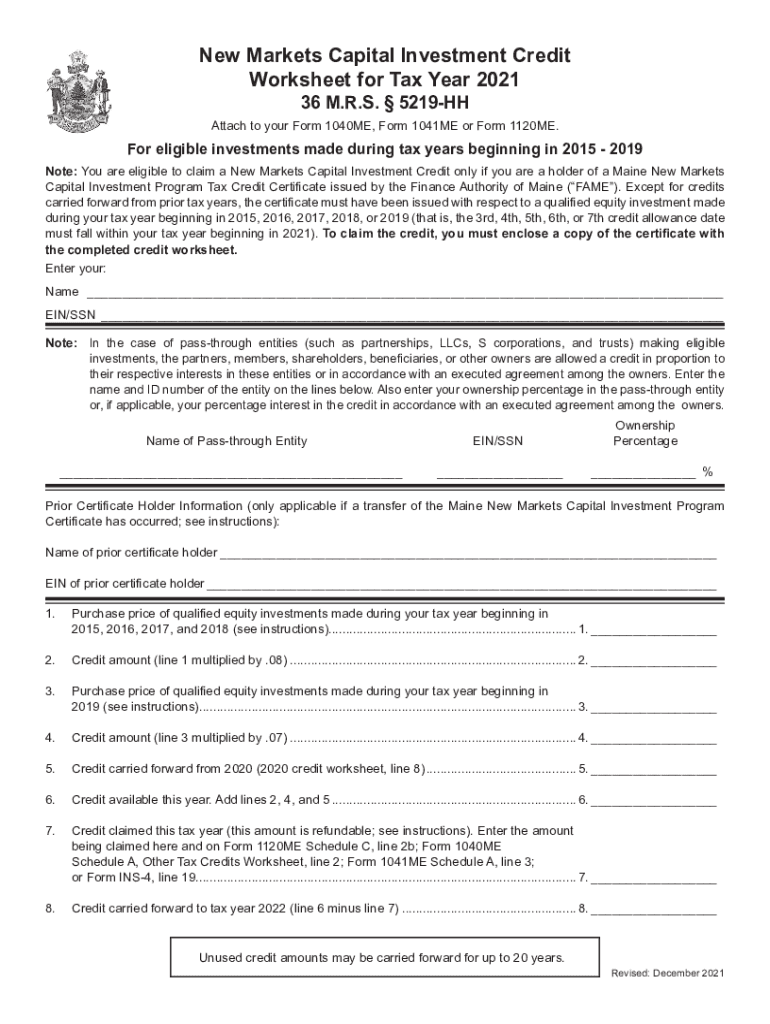

Steps to Complete the Maine New Markets Tax Worksheet

Completing the Maine New Markets Tax worksheet involves several key steps:

- Gather necessary documentation, including proof of investment and business eligibility.

- Fill out the worksheet accurately, ensuring all financial information is complete.

- Calculate the applicable tax credits based on your investment amount.

- Review the worksheet for accuracy before submission.

Required Documents for the Maine New Markets Tax

When applying for the Maine New Markets Tax credit, specific documents are essential to support your application. These may include:

- Proof of investment in a qualified business.

- Financial statements from the business.

- Documentation demonstrating the business's operations within a low-income community.

Filing Deadlines for the Maine New Markets Tax

It is crucial to be aware of the filing deadlines associated with the Maine New Markets Tax. Generally, the application must be submitted by a specific date each tax year to ensure eligibility for the tax credit. Keeping track of these deadlines helps avoid penalties and ensures timely processing of your application.

Form Submission Methods for the Maine New Markets Tax

The Maine New Markets Tax worksheet can be submitted through various methods, including online submission, mail, or in-person delivery. Each method has its own guidelines and processing times, so it is beneficial to choose the one that best suits your needs and ensures the fastest processing of your application.

Quick guide on how to complete wwwmainegovgovernormillsseed capital investment tax credit worksheet for tax year

Complete Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year on any device with airSlate SignNow Android or iOS applications and simplify any document-based process today.

The easiest way to alter and electronically sign Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year without hassle

- Locate Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant parts of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you’d like to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets your requirements in document management with a few clicks from any device of your choice. Edit and electronically sign Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwmainegovgovernormillsseed capital investment tax credit worksheet for tax year

Create this form in 5 minutes!

How to create an eSignature for the wwwmainegovgovernormillsseed capital investment tax credit worksheet for tax year

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

How to generate an e-signature for a PDF file on Android

People also ask

-

What is the maine new markets tax, and how does it work?

The Maine New Markets Tax is a tax credit program designed to encourage investments in eligible businesses within designated economically distressed areas of Maine. By providing signNow tax credits, it incentivizes investors to support local entrepreneurs, fostering job creation and economic growth.

-

How can airSlate SignNow help with documents related to the maine new markets tax?

airSlate SignNow streamlines the process of signing and managing documents necessary for the Maine New Markets Tax applications. With our secure eSigning solutions, businesses can quickly execute agreements and submit required paperwork, ensuring compliance and efficiency.

-

Is airSlate SignNow suitable for businesses applying for the maine new markets tax?

Yes, airSlate SignNow is tailored for businesses of all sizes looking to apply for the Maine New Markets Tax. Our platform provides essential tools like document templates and electronic signatures, which simplify the application process and ensure all necessary forms are completed correctly.

-

What features does airSlate SignNow offer that benefit businesses involved in the maine new markets tax?

AirSlate SignNow includes features such as customizable templates, in-app messaging, and detailed tracking of signatures, all of which are beneficial for businesses working on the Maine New Markets Tax applications. These features help maintain organization and enhance communication among stakeholders.

-

Are there any pricing plans specific for businesses interested in the maine new markets tax?

Our pricing plans for airSlate SignNow are flexible and designed to accommodate the needs of businesses pursuing the Maine New Markets Tax. Whether a start-up or an established enterprise, you can choose a plan that fits your budget and allows you to leverage our document management capabilities effectively.

-

What are the benefits of using airSlate SignNow for the maine new markets tax documentation?

Using airSlate SignNow for your Maine New Markets Tax documentation provides several benefits, including reduced turnaround time for signatures, enhanced security for sensitive information, and improved compliance with legal requirements. This leads to a more efficient application process and peace of mind for businesses.

-

Does airSlate SignNow integrate with other tools for managing maine new markets tax projects?

Yes, airSlate SignNow offers multiple integrations with popular business tools, making it easier to manage your Maine New Markets Tax projects. Whether it's CRMs or project management platforms, these integrations allow for seamless document flow and real-time collaboration among team members.

Get more for Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year

- Life documents 497319571 form

- General durable power of attorney for property and finances or financial effective upon disability new jersey form

- Essential legal life documents for baby boomers new jersey form

- General durable power of attorney for property and finances or financial effective immediately new jersey form

- Revocation of general durable power of attorney new jersey form

- Essential legal life documents for newlyweds new jersey form

- Nj legal documents 497319577 form

- Essential legal life documents for new parents new jersey form

Find out other Www maine govgovernormillsSeed Capital Investment Tax Credit Worksheet For Tax Year

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself