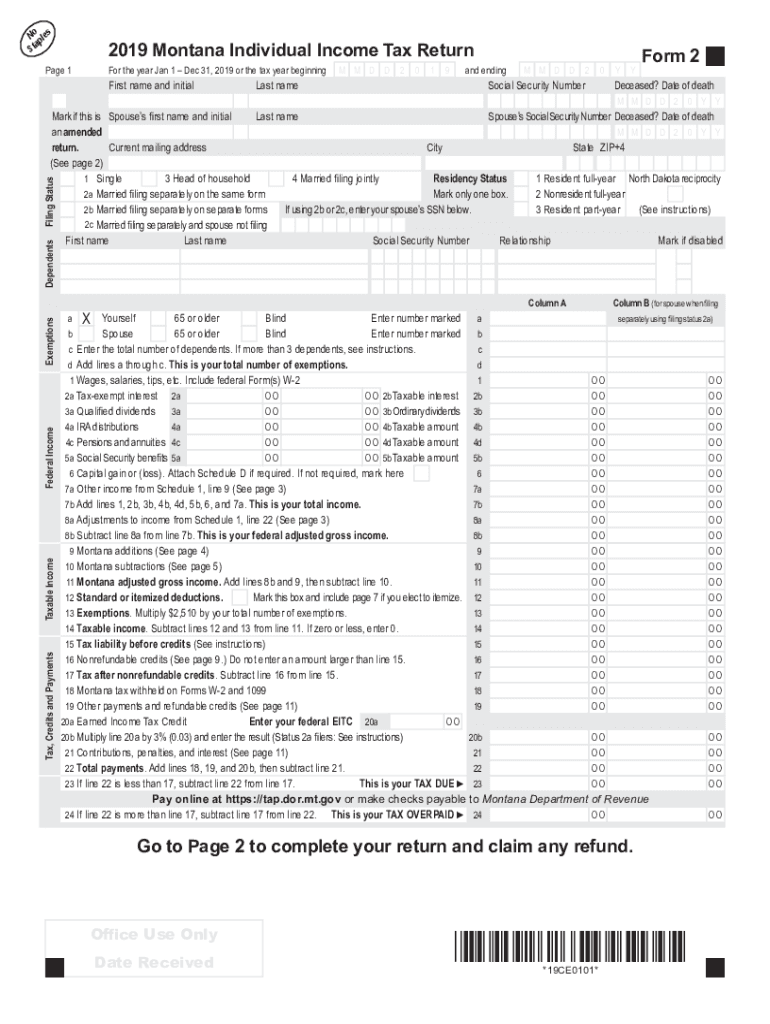

Form 2 Instructions Montana Individual Income Tax Form 2 2019

What is the Form 2 Instructions Montana Individual Income Tax Form 2

The Form 2 Instructions Montana Individual Income Tax Form 2 is a crucial document for individuals filing their state income taxes in Montana. This form provides detailed guidance on how to accurately complete the Montana Individual Income Tax Form 2, ensuring compliance with state tax regulations. It outlines the necessary steps, required information, and specific calculations needed to determine tax liability. Understanding these instructions is essential for taxpayers to avoid errors and potential penalties.

Steps to complete the Form 2 Instructions Montana Individual Income Tax Form 2

Completing the Form 2 Instructions Montana Individual Income Tax Form 2 involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, review the instructions carefully to understand the information required for each section of the form. Follow the outlined steps to input your income, deductions, and credits accurately. After filling out the form, double-check all entries for accuracy before submission. Lastly, ensure that you sign and date the form as required.

How to obtain the Form 2 Instructions Montana Individual Income Tax Form 2

The Form 2 Instructions Montana Individual Income Tax Form 2 can be obtained through several channels. Taxpayers can download the form directly from the Montana Department of Revenue's official website. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you are accessing the most current version of the form to comply with any recent changes in tax laws.

Legal use of the Form 2 Instructions Montana Individual Income Tax Form 2

The legal use of the Form 2 Instructions Montana Individual Income Tax Form 2 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated filing deadline. Additionally, any required signatures must be included to ensure the form's legal standing. Using electronic tools to complete and submit the form is permissible, provided that the eSignature meets the necessary legal standards set forth by state regulations.

Required Documents

When filling out the Form 2 Instructions Montana Individual Income Tax Form 2, several documents are required to ensure accurate reporting. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Documentation of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready will streamline the completion process and help ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2 Instructions Montana Individual Income Tax Form 2 are critical for compliance. Generally, the deadline for submitting individual income tax returns in Montana is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and the importance of timely filing to avoid penalties.

Digital vs. Paper Version

Taxpayers have the option to complete the Form 2 Instructions Montana Individual Income Tax Form 2 either digitally or on paper. The digital version offers advantages such as ease of use, automatic calculations, and the ability to submit electronically. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or lack access to digital tools. Regardless of the method chosen, it is essential to ensure that all information is accurate and complete to avoid complications.

Quick guide on how to complete form 2 instructions montana individual income tax form 2

Effortlessly prepare Form 2 Instructions Montana Individual Income Tax Form 2 on any device

Digital document management has become popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Form 2 Instructions Montana Individual Income Tax Form 2 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to modify and electronically sign Form 2 Instructions Montana Individual Income Tax Form 2 with ease

- Find Form 2 Instructions Montana Individual Income Tax Form 2 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Alter and electronically sign Form 2 Instructions Montana Individual Income Tax Form 2 to ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2 instructions montana individual income tax form 2

Create this form in 5 minutes!

How to create an eSignature for the form 2 instructions montana individual income tax form 2

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What are the Form 2 Instructions Montana Individual Income Tax Form 2?

The Form 2 Instructions Montana Individual Income Tax Form 2 are guidelines provided by the state of Montana to ensure accurate completion of the Individual Income Tax Form 2. These instructions detail how to fill out the form correctly, including the necessary information and any supporting documentation required for your tax filing.

-

How can airSlate SignNow help with the Form 2 instructions?

airSlate SignNow provides a user-friendly platform that simplifies the process of filling out the Form 2 Instructions Montana Individual Income Tax Form 2. With eSignature capabilities, you can easily sign and send your completed forms directly from our platform, ensuring a streamlined and efficient filing process.

-

Is there a cost associated with using airSlate SignNow for Form 2 submissions?

Yes, there is a pricing structure in place for using airSlate SignNow, but it is designed to be cost-effective. By utilizing our features for submitting the Form 2 Instructions Montana Individual Income Tax Form 2, you can save time and reduce the hassle of traditional paper processes.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow offers a range of features that enhance document management, including customizable templates, automated workflows, and secure eSignature options. These tools make it easier to follow the Form 2 Instructions Montana Individual Income Tax Form 2 and ensure accuracy in your tax filings.

-

Can I integrate airSlate SignNow with other applications for tax purposes?

Yes, airSlate SignNow offers integrations with numerous applications, making it easy to manage your tax forms efficiently. This includes seamless connections with accounting software and document storage platforms, simplifying access to the Form 2 Instructions Montana Individual Income Tax Form 2.

-

What benefits can I gain from using airSlate SignNow for Form 2 filings?

Using airSlate SignNow for your Form 2 filings provides numerous benefits, such as increased accuracy, reduced processing time, and improved compliance. Our platform streamlines the process outlined in the Form 2 Instructions Montana Individual Income Tax Form 2, allowing you to focus on other important tasks.

-

How secure is airSlate SignNow for submitting tax documents?

airSlate SignNow prioritizes the security of your documents, employing advanced encryption and secure data storage practices. When using our platform for the Form 2 Instructions Montana Individual Income Tax Form 2, you can be confident that your sensitive information is protected.

Get more for Form 2 Instructions Montana Individual Income Tax Form 2

- Oregon deq waste tire carrier permit renewal application deq state or form

- Oregon business change in status form

- Facility and on street permit application city of salem cityofsalem form

- Employee electric vehicle charging application print oregon form

- Foreign limited liability company oregon secretary of state form

- Individual history form oregongov

- Electrical license application mail application with form

- City of canyon lake business license application form

Find out other Form 2 Instructions Montana Individual Income Tax Form 2

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement