Montana Individual Income Tax Return Main Form 2024-2026

Understanding the Montana Individual Income Tax Return Main Form

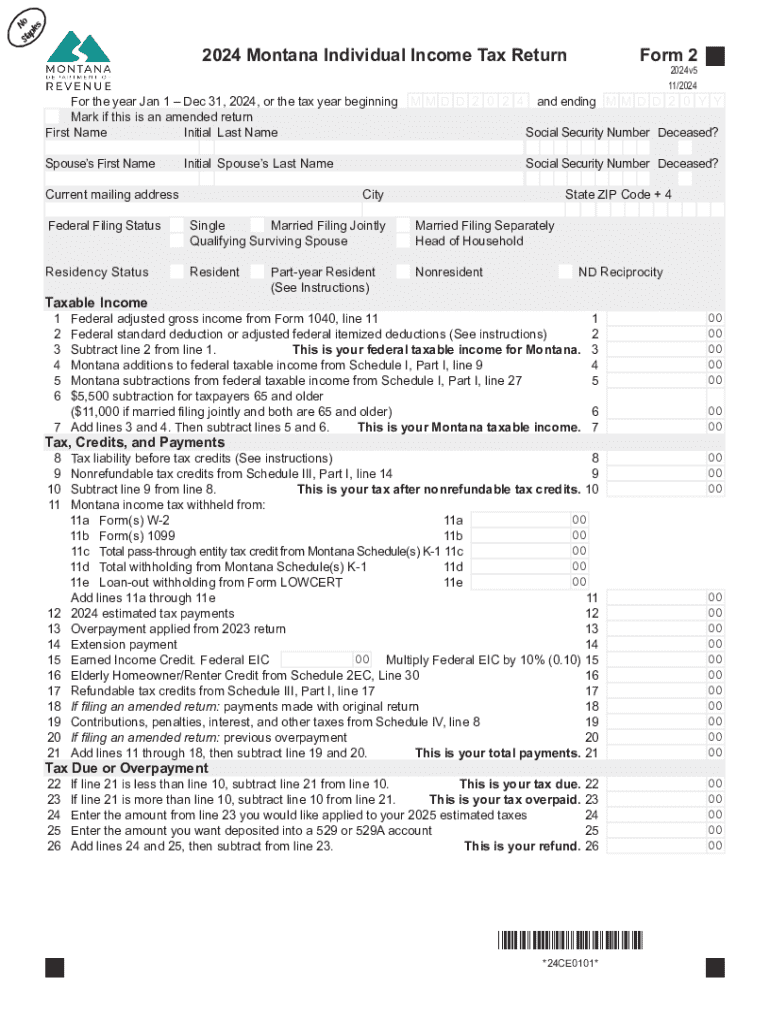

The Montana Individual Income Tax Return, commonly referred to as the 2024 Montana Form 2 tax, is the primary document used by residents to report their income and calculate their state tax obligations. This form is essential for individuals who earn income within the state and need to comply with Montana tax laws. It includes sections for reporting various types of income, deductions, and credits, which ultimately determine the amount of tax owed or the refund due.

Steps to Complete the Montana Individual Income Tax Return Main Form

Filling out the 2024 Montana Form 2 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Begin by entering personal information such as your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other sources of income.

- Calculate your deductions and credits, which can reduce your taxable income.

- Complete the tax calculation section to determine your total tax liability.

- Review the form for accuracy and ensure all required fields are filled out.

- Sign and date the form before submission.

Required Documents for Filing the Montana Individual Income Tax Return

To successfully complete the 2024 Montana Form 2, you will need to gather several important documents:

- W-2 forms from employers showing your annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Any relevant tax credit information, including education credits or child care expenses.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Montana Individual Income Tax Return. For the 2024 tax year, the deadline to submit the 2024 Montana Form 2 is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be mindful of any extensions that may apply if they need more time to file.

Form Submission Methods for the Montana Individual Income Tax Return

Taxpayers have several options for submitting the 2024 Montana Form 2:

- Online submission through the Montana Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, where assistance may be available.

Key Elements of the Montana Individual Income Tax Return Main Form

The 2024 Montana Form 2 consists of several key components that taxpayers must complete:

- Personal information section, including name and Social Security number.

- Income section where all sources of income are reported.

- Deductions and credits section to claim eligible expenses.

- Tax calculation section to determine the total tax owed.

- Signature section to validate the submission.

Create this form in 5 minutes or less

Find and fill out the correct montana individual income tax return main form

Create this form in 5 minutes!

How to create an eSignature for the montana individual income tax return main form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Montana Form 2 tax?

The 2024 Montana Form 2 tax is a state income tax form used by residents of Montana to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax laws and is typically due by April 15th each year. Understanding this form is crucial for accurate tax filing.

-

How can airSlate SignNow help with the 2024 Montana Form 2 tax?

airSlate SignNow provides a streamlined solution for electronically signing and sending the 2024 Montana Form 2 tax. Our platform simplifies the document management process, allowing users to complete their tax forms quickly and securely. This efficiency can save time and reduce the stress associated with tax season.

-

What are the pricing options for using airSlate SignNow for the 2024 Montana Form 2 tax?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial for new users. Our plans are designed to be cost-effective, ensuring that you can manage your 2024 Montana Form 2 tax without breaking the bank. Check our website for detailed pricing information and features included in each plan.

-

Are there any features specifically for the 2024 Montana Form 2 tax in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for the 2024 Montana Form 2 tax, such as customizable templates and automated reminders. These features help ensure that you never miss a deadline and that your forms are filled out correctly. Our user-friendly interface makes it easy to navigate through the tax preparation process.

-

Can I integrate airSlate SignNow with other tax software for the 2024 Montana Form 2 tax?

Absolutely! airSlate SignNow can be integrated with various tax software solutions to enhance your experience with the 2024 Montana Form 2 tax. This integration allows for seamless data transfer and ensures that all your information is up-to-date and accurate, making tax filing more efficient.

-

What are the benefits of using airSlate SignNow for the 2024 Montana Form 2 tax?

Using airSlate SignNow for the 2024 Montana Form 2 tax offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are securely stored and easily accessible. Additionally, the electronic signing process speeds up approvals and reduces paperwork.

-

Is airSlate SignNow compliant with Montana tax regulations for the 2024 Montana Form 2 tax?

Yes, airSlate SignNow is fully compliant with Montana tax regulations, ensuring that your 2024 Montana Form 2 tax submissions meet all legal requirements. We prioritize compliance and security, so you can trust that your documents are handled according to state laws. This compliance helps you avoid potential issues with tax authorities.

Get more for Montana Individual Income Tax Return Main Form

- Faa form 8710 11

- Office of the illinois secretary of state open competitive continuous examination program instruction sheet form

- 622 work form 2018 2019

- Illinois employment application 2018 2019 form

- Wds 1 2018 2019 form

- Form i 131 fillable 2016 2019

- Una guia para organizar corporaci nes domesticas cyberdrive form

- Teacherclassroom book order form illinois secretary of state

Find out other Montana Individual Income Tax Return Main Form

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now