Montana Individual Income Tax Return 2020

What is the Montana Individual Income Tax Return

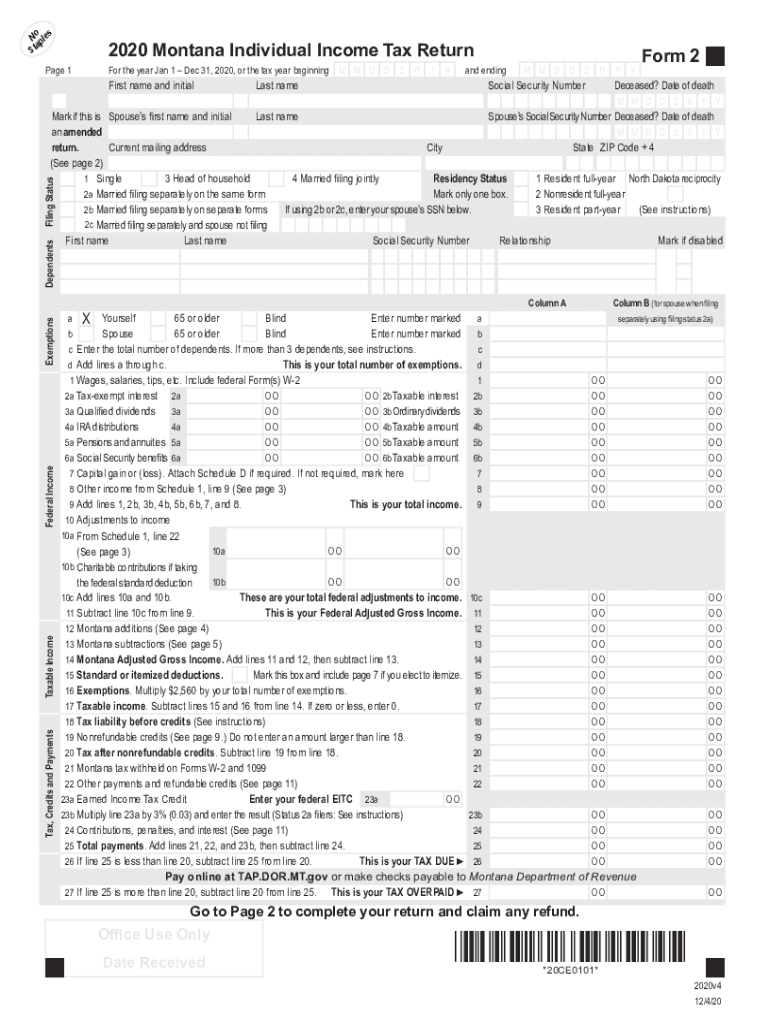

The Montana Individual Income Tax Return, commonly referred to as Montana Form 2, is a crucial document for residents of Montana who need to report their income and calculate their tax liability. This form is designed for individuals, including those who are self-employed, to ensure that they comply with state tax laws. The form captures various income sources, deductions, and credits available to taxpayers, which ultimately determines the amount of tax owed or the refund due. Understanding the purpose and structure of this form is essential for accurate tax reporting.

Steps to Complete the Montana Individual Income Tax Return

Completing the Montana Individual Income Tax Return involves several key steps that ensure accuracy and compliance with state regulations. Here’s a simplified process:

- Gather all necessary documentation, including W-2s, 1099s, and records of other income.

- Determine your filing status, which can impact your tax rates and available deductions.

- Fill out the form by entering your personal information, income details, and any applicable deductions.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission.

Legal Use of the Montana Individual Income Tax Return

The Montana Individual Income Tax Return is legally binding when completed accurately and submitted on time. To ensure that the form is recognized as valid, taxpayers must adhere to the guidelines set forth by the Montana Department of Revenue. This includes providing truthful information and signing the form, either electronically or by hand. Compliance with these legal requirements is essential to avoid potential penalties or audits.

Form Submission Methods

Taxpayers have multiple options for submitting their Montana Individual Income Tax Return. These methods include:

- Online Submission: Many taxpayers opt to file electronically through authorized e-filing platforms, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the Montana Department of Revenue. Be sure to send it well before the deadline to ensure timely processing.

- In-Person: Some individuals may choose to submit their forms in person at local tax offices, where assistance may also be available.

Required Documents

To successfully complete the Montana Individual Income Tax Return, taxpayers must gather several key documents. These typically include:

- W-2 forms from employers.

- 1099 forms for other income sources, such as freelance work or investments.

- Records of any deductions or credits claimed, such as charitable contributions or education expenses.

- Identification documents, including Social Security numbers for all individuals listed on the return.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for taxpayers. The Montana Individual Income Tax Return typically has a filing deadline of April 15 each year, aligning with federal tax deadlines. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may apply for, which can provide additional time for filing but may require payment of estimated taxes owed.

Quick guide on how to complete 2020 montana individual income tax return

Finish Montana Individual Income Tax Return effortlessly on any gadget

Digital document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Handle Montana Individual Income Tax Return on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign Montana Individual Income Tax Return with ease

- Obtain Montana Individual Income Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically supplies for that aim.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Alter and eSign Montana Individual Income Tax Return and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 montana individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 montana individual income tax return

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What are the Montana Form 2 instructions provided by airSlate SignNow?

The Montana Form 2 instructions facilitate the completion of vital documents by guiding users on proper filling techniques. With airSlate SignNow, you can easily access these instructions while eSigning forms, ensuring compliance and accuracy during the process.

-

How does airSlate SignNow simplify the Montana Form 2 submission process?

airSlate SignNow streamlines the Montana Form 2 submission process by offering intuitive eSigning tools and automated workflows. Users can quickly fill out the form, add signatures, and send it directly from the platform, saving both time and effort.

-

Is there a cost associated with using airSlate SignNow for Montana Form 2 instructions?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to different business sizes and needs. Investing in our platform provides users with valuable features related to Montana Form 2 instructions and enhances overall document management.

-

What features does airSlate SignNow offer for managing Montana Form 2?

airSlate SignNow comes equipped with various features to assist with Montana Form 2 management, including custom templates, reusable fields, and secure cloud storage. These tools make it easier to meet application deadlines while maintaining document integrity.

-

Can I integrate airSlate SignNow with other software to assist with Montana Form 2 instructions?

Absolutely! airSlate SignNow offers multiple integrations with popular software like Google Drive, Dropbox, and CRM systems. This connectivity allows you to access and manage your Montana Form 2 instructions seamlessly alongside other documents.

-

What benefits can I expect when using airSlate SignNow for Montana Form 2 instructions?

By using airSlate SignNow for Montana Form 2 instructions, users can benefit from improved efficiency, faster turnaround times, and digital security for sensitive documents. The platform ensures that your forms are completed correctly, minimizing the risk of errors.

-

Is airSlate SignNow user-friendly for those unfamiliar with Montana Form 2 instructions?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those who are unfamiliar with Montana Form 2 instructions. Our step-by-step guidance and intuitive interface help users navigate the process effortlessly.

Get more for Montana Individual Income Tax Return

- Written revocation of will florida form

- Florida persons form

- Notice to beneficiaries of being named in will florida form

- Estate planning questionnaire and worksheets florida form

- Document locator and personal information package including burial information form florida

- Florida copy form

- Florida will form

- Injury workers compensation 497303537 form

Find out other Montana Individual Income Tax Return

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form