MT Form 2 2022

What is the MT Form 2

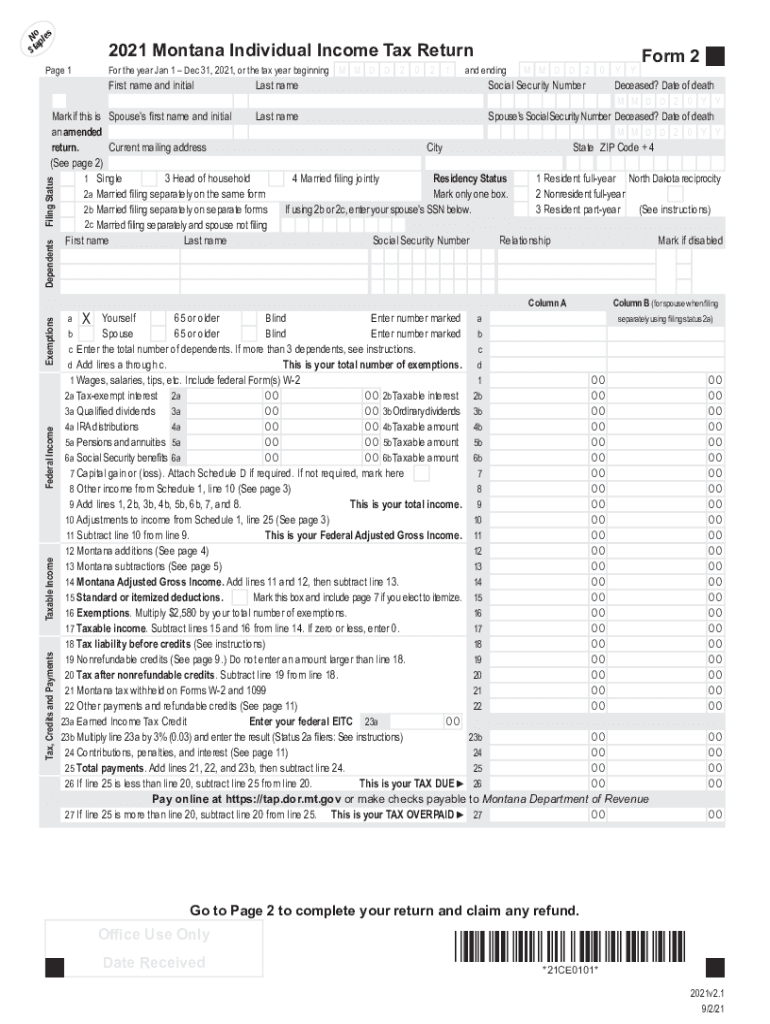

The Montana Form 2 is a state income tax form used by residents of Montana to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and are required to pay Montana state income tax. The form captures various income sources, deductions, and credits, ensuring that taxpayers accurately report their financial situation to the Montana Department of Revenue.

Steps to complete the MT Form 2

Completing the Montana Form 2 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends, in the appropriate sections.

- Claim any deductions and credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables or rates.

- Review the completed form for accuracy before submission.

Legal use of the MT Form 2

The Montana Form 2 is legally binding when completed correctly and submitted to the Montana Department of Revenue. To ensure compliance with state laws, it is crucial to provide accurate information and maintain supporting documentation. Electronic signatures are accepted, provided they meet the requirements outlined by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that e-filed forms are treated with the same legal weight as paper submissions.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with the Montana Form 2. The typical filing deadline for individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Montana Form 2 accurately, taxpayers should gather several key documents:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses, mortgage interest, and charitable contributions.

Form Submission Methods

The Montana Form 2 can be submitted through various methods:

- Online: Taxpayers can e-file their Form 2 through the Montana Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided on the form.

- In-Person: Taxpayers also have the option to deliver their forms directly to local tax offices.

Key elements of the MT Form 2

The Montana Form 2 includes several key elements that taxpayers must understand:

- Personal Information: This section requires basic identifying information.

- Income Reporting: Taxpayers must report all income sources, including wages and investment earnings.

- Deductions and Credits: This section allows taxpayers to claim eligible deductions and credits to lower their tax bill.

- Tax Calculation: The form includes a method for calculating total tax liability based on reported income and applicable rates.

Quick guide on how to complete mt form 2

Handle MT Form 2 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, since you can locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, amend, and eSign your documents quickly without delays. Manage MT Form 2 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign MT Form 2 with ease

- Obtain MT Form 2 and click on Get Form to begin.

- Utilize the resources we provide to finish your document.

- Highlight crucial sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign MT Form 2 and ensure effective communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mt form 2

Create this form in 5 minutes!

How to create an eSignature for the mt form 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the montana form 2 instructions for using airSlate SignNow?

The montana form 2 instructions provide a clear guideline on how to fill out and submit the form electronically using airSlate SignNow. By following these instructions, users can easily add their signatures and necessary information, ensuring compliance with state regulations.

-

How can airSlate SignNow help with the montana form 2 instructions?

airSlate SignNow simplifies the process of completing the montana form 2 instructions by allowing users to sign documents digitally. Our platform streamlines the document flow, making it easier to manage forms and obtain required signatures swiftly.

-

Are there any costs associated with following the montana form 2 instructions on airSlate SignNow?

airSlate SignNow offers various pricing plans, including affordable options that cater to different business needs. Utilizing the platform to follow the montana form 2 instructions provides value through time savings and increased efficiency.

-

What features does airSlate SignNow offer to assist with montana form 2 instructions?

airSlate SignNow includes features such as document templates, customizable fields, and an intuitive eSignature workflow to enhance your experience with the montana form 2 instructions. These tools simplify the document completion process and ensure accuracy.

-

Can I integrate airSlate SignNow with other applications while following montana form 2 instructions?

Yes, airSlate SignNow supports integration with various applications like Google Drive, Dropbox, and CRM systems. This feature allows you to efficiently manage your documentation related to the montana form 2 instructions without switching platforms.

-

What benefits does airSlate SignNow provide when completing montana form 2 instructions?

By using airSlate SignNow for montana form 2 instructions, you gain benefits such as improved efficiency, reduced processing times, and enhanced security for your documents. Our eSignature solution ensures that your forms are signed promptly and securely.

-

Is there customer support available for questions related to montana form 2 instructions on airSlate SignNow?

Absolutely! Our customer support team is available to assist with any questions related to montana form 2 instructions. You can signNow out via chat, email, or phone, ensuring you receive timely assistance.

Get more for MT Form 2

Find out other MT Form 2

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word