4506 T March Form

What is the 4506 T March

The 4506 T form, specifically the March 2019 version, is a request for the Internal Revenue Service (IRS) to provide a transcript of a taxpayer's tax return. This form is often used by lenders, financial institutions, or other entities that require verification of income or tax information. It allows the requester to obtain a summary of the taxpayer's return, including adjusted gross income and filing status, which can be essential for loan applications or financial assessments.

How to use the 4506 T March

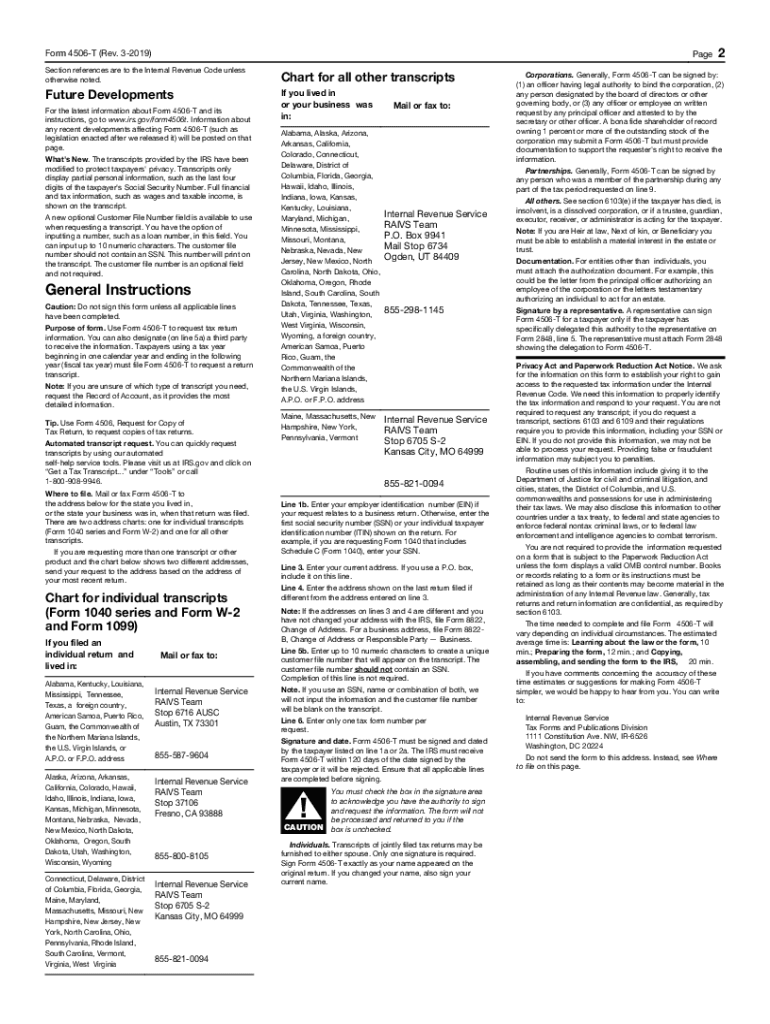

To use the 4506 T form effectively, the requester must fill out the necessary information, including the taxpayer's name, Social Security number, and the type of transcript needed. The form must then be signed by the taxpayer to authorize the IRS to release the information. It is crucial to ensure that all details are accurate to avoid delays in processing. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the specific requirements of the requesting party.

Steps to complete the 4506 T March

Completing the 4506 T form involves several key steps:

- Obtain the latest version of the 4506 T form from the IRS website.

- Fill in the taxpayer's name, Social Security number, and address.

- Indicate the type of transcript required, such as a tax return transcript or wage and income transcript.

- Provide the year(s) for which the transcript is requested.

- Sign and date the form to authorize the release of information.

- Submit the form to the IRS via the appropriate method.

Legal use of the 4506 T March

The 4506 T form is legally binding when used correctly, as it grants the IRS permission to disclose sensitive taxpayer information. It is important for all parties involved to understand that misuse of this form can lead to legal consequences. The form must be filled out with accurate information and submitted according to IRS guidelines to ensure compliance with federal regulations. Proper use is essential for maintaining the integrity of the information shared and protecting taxpayer privacy.

IRS Guidelines

The IRS has established specific guidelines for using the 4506 T form. Requesters must ensure that they are using the most current version of the form, which is updated periodically. The IRS also outlines the acceptable methods for submitting the form, including electronic submission options for certain requests. Additionally, guidelines specify how long it may take to process requests and the types of transcripts available, ensuring that users are informed about the process and expected timelines.

Required Documents

When submitting the 4506 T form, certain documents may be required to verify identity and support the request. Typically, this includes a form of identification, such as a driver's license or Social Security card, especially if the form is submitted by someone other than the taxpayer. Additionally, any supporting documentation that clarifies the purpose of the request may also be beneficial. Ensuring that all required documents are included can help expedite the processing of the request.

Quick guide on how to complete 4506 t march 2019

Effortlessly complete 4506 T March on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle 4506 T March on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to edit and electronically sign 4506 T March with ease

- Obtain 4506 T March and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign 4506 T March to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506 t march 2019

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the 4506 T form March 2019, and why is it important?

The 4506 T form March 2019 is a tax document that allows taxpayers to request a transcript of their tax return from the IRS. This form is crucial for verifying income for loan applications or other financial transactions. By utilizing airSlate SignNow, businesses can easily eSign and send this form to obtain necessary financial documentation swiftly.

-

How does airSlate SignNow streamline the 4506 T form March 2019 submission process?

airSlate SignNow simplifies the submission of the 4506 T form March 2019 by enabling users to eSign documents securely and send them electronically. This eliminates the need for printing, scanning, or mailing physical copies, thus saving time and ensuring faster processing by the IRS. Our platform also provides real-time tracking of document status.

-

What pricing plans does airSlate SignNow offer for handling the 4506 T form March 2019?

airSlate SignNow offers several pricing plans designed to accommodate various business needs. Our packages provide competitive rates for unlimited eSigning, document templates, and integration features, making it a cost-effective solution for managing the 4506 T form March 2019. Interested users can explore our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools for processing the 4506 T form March 2019?

Yes, airSlate SignNow easily integrates with popular applications, allowing users to manage the 4506 T form March 2019 as part of broader workflows. Integrations with CRM systems, document management tools, and payment processing platforms ensure seamless collaboration and data transfer. This enhances efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the 4506 T form March 2019?

Using airSlate SignNow for the 4506 T form March 2019 provides numerous benefits, including enhanced security, audit trails, and compliance with legal eSignature standards. Your documents are encrypted in transit and at rest, ensuring sensitive information remains protected. Additionally, the user-friendly interface makes it easy for anyone to navigate.

-

How long does it take to process the 4506 T form March 2019 with airSlate SignNow?

The processing time for the 4506 T form March 2019 can vary based on IRS response times, but using airSlate SignNow can speed up the initial submission phase. By eSigning and sending your form digitally, you reduce wait times related to traditional mail services. For prompt updates, you can track the status of your submissions within the platform.

-

Is there customer support available for users of airSlate SignNow handling the 4506 T form March 2019?

Absolutely! airSlate SignNow provides robust customer support to assist users with any inquiries regarding the 4506 T form March 2019. Our support team is available through various channels, including live chat, email, and phone, ensuring you receive the assistance you need at any stage of the document signing process.

Get more for 4506 T March

- Online birth certificate copy form

- Fillable online azdhs pm form 3141 con 8 1 07 final

- Cw 5 form

- Application for renewal clinical lab license for labs out of california lab 144 ros form

- Asw weekly tracking log california board of behavioral bbs ca form

- Claim of inaccuracy ca dept of justice form 8706

- Na 960y sar korean california department of social services cdss ca form

- Mc210a form

Find out other 4506 T March

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free