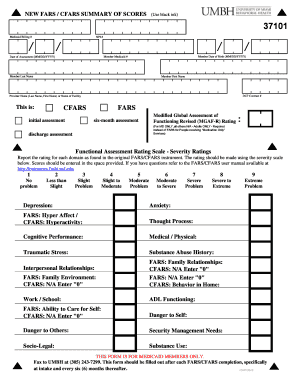

Cfars Form

What is the CFARS?

The CFARS, or Comprehensive Financial Accountability Reporting System, is a crucial document used in various financial reporting contexts. It is designed to ensure transparency and accountability in financial transactions and reporting. The CFARS form is often utilized by organizations to compile and submit financial information, ensuring compliance with federal and state regulations. Understanding the CFARS is essential for those involved in financial reporting, as it provides a structured way to present financial data.

How to Use the CFARS

Using the CFARS involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and data relevant to the reporting period. Next, access the CFARS form online or download the CFARS form PDF. Fill out the form carefully, ensuring that all entries are accurate and reflect the financial activities for the specified period. Once completed, review the form for any errors before submitting it through the designated channels, whether online or via mail.

Steps to Complete the CFARS

Completing the CFARS requires attention to detail and adherence to specific guidelines. Here are the steps to follow:

- Gather relevant financial documents, including income statements and balance sheets.

- Access the CFARS form online or download the CFARS form blank for manual completion.

- Fill in the required fields, ensuring all information is accurate and up-to-date.

- Double-check entries for any mistakes or omissions.

- Submit the completed CFARS form through the appropriate method, ensuring you meet any deadlines.

Legal Use of the CFARS

The legal use of the CFARS is governed by various federal and state regulations. It is essential to ensure that the information reported is accurate and complies with the relevant laws. Failure to adhere to these regulations can result in penalties or legal repercussions. The CFARS must be completed in accordance with the guidelines set forth by governing bodies, ensuring that all financial data is reported transparently and responsibly.

Required Documents

To complete the CFARS, several documents are typically required. These may include:

- Financial statements such as income statements and balance sheets.

- Tax documents relevant to the reporting period.

- Any additional documentation that supports the financial data being reported.

Having these documents ready will facilitate a smoother completion process and ensure that the CFARS is filled out accurately.

Form Submission Methods

The CFARS can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission via a designated portal.

- Mailing a hard copy of the completed CFARS form to the appropriate office.

- In-person submission at designated locations, if applicable.

It is important to verify the preferred submission method to ensure compliance and timely processing of the form.

Quick guide on how to complete cfars

Complete Cfars effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Cfars on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Cfars with ease

- Locate Cfars and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhaustive form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and eSign Cfars and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cfars

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is cfars login and how do I access it?

The cfars login is the gateway to access your airSlate SignNow account, where you can manage your documents and eSignatures. To log in, simply visit the SignNow website and enter your credentials. If you are new, you can register and then use the cfars login to access your account.

-

Is there a cost associated with using the cfars login?

Using the cfars login itself is free; however, accessing advanced features may require a subscription. airSlate SignNow offers tiered pricing plans, so you can choose one that fits your business needs. Review the pricing details on our website to find a plan suited for you.

-

What features can I access through cfars login?

Upon logging in through the cfars login, users can send documents, collect eSignatures, and track document status. Additionally, you can use templates, integrate with various applications, and manage your account settings directly from your dashboard. Explore all these features once you log in to maximize your productivity.

-

How does cfars login enhance document security?

The cfars login ensures secure access to your airSlate SignNow account through encrypted connections and multi-factor authentication. This helps protect your sensitive documents from unauthorized access. You can rest assured that your data is secure when using the cfars login.

-

Can I integrate other applications with my cfars login?

Yes, airSlate SignNow allows integration with various third-party applications, enhancing its functionality. After you access your account via the cfars login, you can connect to tools like Google Drive, Salesforce, and more. Check our integration options to streamline your workflows.

-

What benefits do I gain from using the cfars login feature?

Using the cfars login feature provides you with a streamlined experience for managing and signing documents. It allows for easy document sharing, status tracking, and access to eSigning features. Overall, it enhances your productivity by simplifying document workflows.

-

What should I do if I forget my cfars login credentials?

If you forget your cfars login credentials, simply click on the 'Forgot Password?' link on the login page. You will receive an email with instructions to reset your password. It's a quick and easy process to regain access to your account.

Get more for Cfars

- 50 free independent contractor agreement forms amp templates

- Tuition payment agreement form

- 33 free bill pay checklists amp bill calendars pdf word amp excel form

- 40 free certificate of conformance templates ampamp forms

- 40 free certificate of conformance templates ampamp forms52246 15 certificate of conformanceacquisitiongov40 free certificate

- Partmaterialnumbers form

- First new apartment checklist 40 essential templates form

- Ideas for writing an accommodation request letterenforcement guidance on reasonable accommodation and undue employee and form

Find out other Cfars

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document