Maryland Form 502

What is the Maryland Form 502

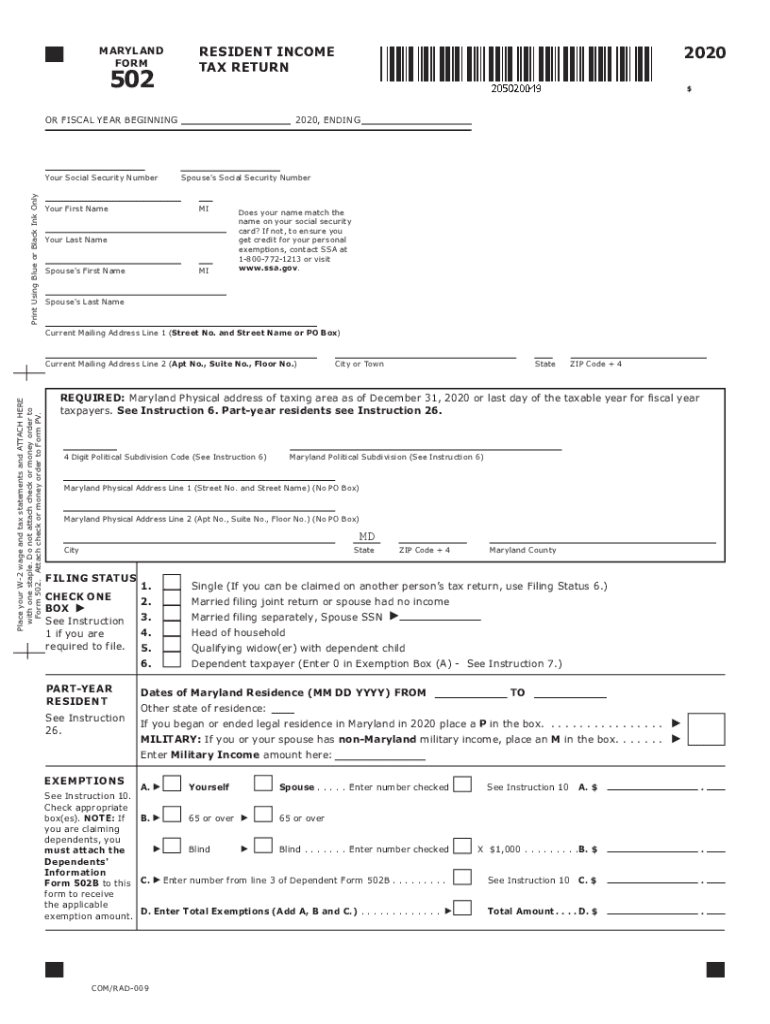

The Maryland Form 502 is the official resident income tax return form used by individuals to report their income and calculate their tax liability for the state of Maryland. This form is essential for residents who earn income and need to comply with state tax regulations. The form captures various sources of income, deductions, and credits that may apply to the taxpayer's situation. It is important for ensuring accurate reporting and compliance with Maryland tax laws.

Steps to complete the Maryland Form 502

Completing the Maryland Form 502 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information, such as your name, address, and Social Security number. Then, report your total income, making sure to include all applicable sources. After calculating your deductions and credits, determine your total tax liability. Finally, review the form for accuracy before submitting it.

How to obtain the Maryland Form 502

The Maryland Form 502 can be obtained through multiple channels. It is available for download on the Maryland State Comptroller's website, where taxpayers can access the most current version. Additionally, paper copies may be available at local tax offices and public libraries. For convenience, taxpayers may also request the form to be mailed to them by contacting the Maryland Comptroller’s office directly.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 502 are crucial for compliance. Generally, the form must be filed by April 15 for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which typically require filing a separate request. Keeping track of these important dates helps avoid penalties and interest on late submissions.

Legal use of the Maryland Form 502

The Maryland Form 502 must be completed in accordance with state laws to be considered legally valid. This includes ensuring all information is accurate and truthful, as providing false information can lead to penalties. Additionally, the form must be signed and dated by the taxpayer or their authorized representative. Utilizing electronic filing options through compliant platforms can enhance the legal standing of the submission, as these options often include built-in verification processes.

Required Documents

To successfully complete the Maryland Form 502, several documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation of any other income sources. Additionally, records of deductions, such as mortgage interest statements, property tax receipts, and charitable contributions, should be included. Having these documents organized and accessible simplifies the filing process and ensures accuracy.

Penalties for Non-Compliance

Failure to comply with Maryland tax regulations when filing the Form 502 can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for fraudulent claims. It is important for taxpayers to be aware of their obligations and to file on time to avoid these consequences. Understanding the potential penalties can motivate timely and accurate submissions.

Quick guide on how to complete 2020 maryland form 502

Easily Prepare Maryland Form 502 on Any Gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Maryland Form 502 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Maryland Form 502 effortlessly

- Locate Maryland Form 502 and click Obtain Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Finished button to save your modifications.

- Choose how you wish to share your form—via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Maryland Form 502 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What documents do I need to file my Maryland resident tax return?

To file your Maryland resident tax return, you will need your W-2 forms, 1099s, and any other income documentation. Additionally, gather your mortgage interest statements and property tax receipts if applicable. Having these documents ready will streamline the process of completing your Maryland resident tax return.

-

How can airSlate SignNow help me with my Maryland resident tax return?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending documents related to your Maryland resident tax return. You can securely share tax forms with your accountant or clients, ensuring a smooth filing process. Plus, our features facilitate fast and secure document management that’s essential during tax season.

-

What are the costs associated with filing a Maryland resident tax return?

The costs for filing a Maryland resident tax return can vary based on your tax situation and whether you use a tax preparer or software. Some platforms may charge a flat fee for e-filing services. Utilizing airSlate SignNow can minimize costs by simplifying document handling and allowing you to manage your documents efficiently.

-

What features does airSlate SignNow offer for Maryland resident tax returns?

airSlate SignNow provides features such as secure electronic signatures, document templates, and cloud storage that are ideal for managing your Maryland resident tax return. You can easily track the status of documents sent for signing and share them with relevant parties in real-time. These features enhance collaboration and improve your overall efficiency.

-

Is my personal information safe when using airSlate SignNow for my Maryland resident tax return?

Yes, airSlate SignNow prioritizes the security of your personal information while processing your Maryland resident tax return. We employ advanced encryption methods and comply with industry standards to ensure your data remains confidential. You can trust that your documents are secure while using our platform.

-

Can I integrate airSlate SignNow with other tax software for my Maryland resident tax return?

Absolutely! airSlate SignNow can integrate seamlessly with various tax software applications, allowing for a more streamlined process when filing your Maryland resident tax return. By connecting your preferred tools, you can enhance your workflow and make document handling easier and more efficient.

-

What are the benefits of eSigning my Maryland resident tax return documents?

E-signing your Maryland resident tax return documents simplifies the submission process, eliminating the need for printing and mailing. It speeds up the approval and filing time, allowing you to complete your paperwork quickly. Additionally, eSigning enhances security and provides an easily accessible digital file for your records.

Get more for Maryland Form 502

- 33 422 a seller of five or fewer parcels of land other than subdivided land in an form

- Free purchase agreement addendum ampampamp disclosures word form

- Wisconsin legislature chapter 709 form

- South carolina real estate agency disclosure charleston form

- South carolina dual agency consent form

- Alaska neutral licensee consent form rec4212

- Are you represented remax of kodiak form

- Maine real estate brokerage relationship disclosure form

Find out other Maryland Form 502

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation