4868 Application for Automatic Extension of Time 2024-2026

What is the 4868 Application For Automatic Extension Of Time

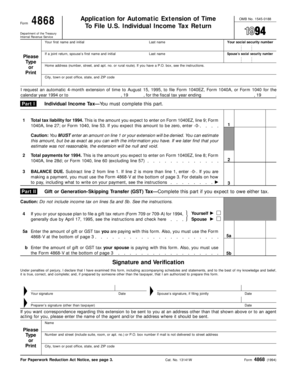

The 4868 Application For Automatic Extension Of Time is a form used by taxpayers in the United States to request an automatic extension for filing their federal income tax returns. By submitting this application, individuals can receive an additional six months to file their tax returns without incurring penalties for late filing, provided they pay any taxes owed by the original due date. This form is particularly useful for those who may need more time to gather necessary documentation or who are unable to meet the standard filing deadline.

Steps to complete the 4868 Application For Automatic Extension Of Time

Completing the 4868 Application For Automatic Extension Of Time involves several straightforward steps:

- Obtain the form: The form can be downloaded from the IRS website or accessed through tax preparation software.

- Provide your personal information: Fill in your name, address, and Social Security number or Employer Identification Number (EIN).

- Estimate your tax liability: Calculate your expected tax liability for the year and any payments made to date.

- Sign and date the form: Ensure that you sign and date the application to validate it.

- Submit the form: Send the completed form to the appropriate IRS address or file electronically using tax software.

Filing Deadlines / Important Dates

The deadline for submitting the 4868 Application For Automatic Extension Of Time is typically the same as the original tax return due date, which is usually April 15 for most taxpayers. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to submit the application on or before this date to avoid penalties. The extended deadline for filing your tax return, if the application is approved, is generally October 15.

Eligibility Criteria

To be eligible for the automatic extension provided by the 4868 Application, taxpayers must meet certain criteria:

- Taxpayers must be filing a federal income tax return.

- The application must be submitted by the original due date of the tax return.

- Any tax owed must be paid by the original due date to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The 4868 Application For Automatic Extension Of Time can be submitted through various methods:

- Online: Taxpayers can file electronically using tax preparation software that supports the form.

- Mail: The completed form can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Taxpayers may also be able to submit the form in person at designated IRS offices, though this is less common.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 4868 Application For Automatic Extension Of Time. It is important to follow these guidelines closely to ensure that the application is processed without issues. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on eligibility, filing requirements, and any additional documentation that may be necessary. Adhering to these guidelines helps prevent delays and ensures compliance with federal tax regulations.

Create this form in 5 minutes or less

Find and fill out the correct 4868 application for automatic extension of time

Create this form in 5 minutes!

How to create an eSignature for the 4868 application for automatic extension of time

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4868 Application For Automatic Extension Of Time?

The 4868 Application For Automatic Extension Of Time is a form used by taxpayers to request an extension for filing their federal income tax return. By submitting this application, you can gain an additional six months to file your return without incurring penalties. It's essential to understand the requirements and deadlines associated with this application.

-

How can airSlate SignNow help with the 4868 Application For Automatic Extension Of Time?

airSlate SignNow simplifies the process of completing and submitting the 4868 Application For Automatic Extension Of Time. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the IRS, ensuring a hassle-free experience. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 4868 Application For Automatic Extension Of Time?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage your documents, including the 4868 Application For Automatic Extension Of Time. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 4868 Application For Automatic Extension Of Time?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the 4868 Application For Automatic Extension Of Time. These features enhance your workflow, making it easier to manage your tax documents efficiently. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other applications for the 4868 Application For Automatic Extension Of Time?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow for the 4868 Application For Automatic Extension Of Time. Whether you use accounting software or CRM systems, our platform can connect with them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 4868 Application For Automatic Extension Of Time?

Using airSlate SignNow for the 4868 Application For Automatic Extension Of Time provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, allowing you to focus on other important tasks while we handle your tax extension needs.

-

Is airSlate SignNow secure for submitting the 4868 Application For Automatic Extension Of Time?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 4868 Application For Automatic Extension Of Time is submitted safely. We utilize advanced encryption and secure servers to protect your sensitive information. You can trust that your documents are in good hands with our platform.

Get more for 4868 Application For Automatic Extension Of Time

- Shop safety manual university of californiaoffice of the form

- Congressional relations government publishing office form

- Full time telework arrangement data form

- Full time telework arrangement annual review form

- Sustainable procurement concept and practical form

- Invitation no form

- 5 us code3111 acceptance of volunteer serviceus form

- Mv3644 47728554 form

Find out other 4868 Application For Automatic Extension Of Time

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself