Business Axes for Hotels and R Kansas Department of Revenue 2021-2026

Understanding the Business Axes for Hotels and Kansas Department of Revenue

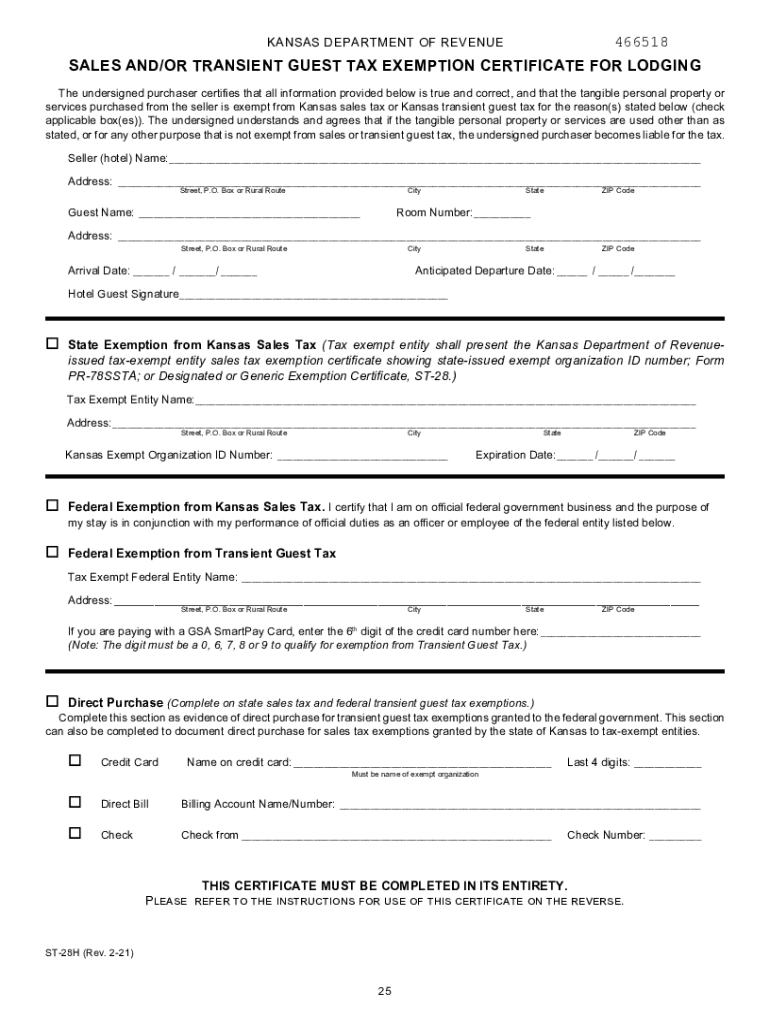

The Business Axes for Hotels and Kansas Department of Revenue form is essential for businesses operating within the hospitality sector in Kansas. This form helps in reporting and managing tax obligations related to hotel operations, ensuring compliance with state regulations. It serves as a tool for the state to track revenue generated by hotels and assess appropriate taxes. Understanding this form is crucial for hotel owners and operators to maintain legal compliance and avoid penalties.

Steps to Complete the Business Axes for Hotels and Kansas Department of Revenue

Completing the Business Axes for Hotels and Kansas Department of Revenue form involves several key steps:

- Gather necessary financial documents, including revenue reports and expense records.

- Accurately fill in all required sections of the form, ensuring all figures are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Following these steps helps ensure that the form is filled out correctly, reducing the risk of compliance issues.

State-Specific Rules for the Business Axes for Hotels and Kansas Department of Revenue

Each state has unique regulations governing the taxation of hotel operations. In Kansas, it is important to be aware of specific rules that apply to the Business Axes for Hotels and Kansas Department of Revenue form. These rules may include:

- Tax rates applicable to hotel services and accommodations.

- Filing frequency, which may vary based on revenue thresholds.

- Specific exemptions or deductions available to hotel operators.

Understanding these state-specific rules can help hotel businesses optimize their tax obligations and ensure compliance.

Legal Use of the Business Axes for Hotels and Kansas Department of Revenue

The legal use of the Business Axes for Hotels and Kansas Department of Revenue form is critical for ensuring that all transactions and tax reporting comply with state laws. This form must be filled out accurately and submitted on time to avoid legal repercussions. Utilizing a reliable electronic signature solution can enhance the legal validity of the submitted documents, ensuring that they meet the requirements set forth by the state.

Required Documents for the Business Axes for Hotels and Kansas Department of Revenue

When completing the Business Axes for Hotels and Kansas Department of Revenue form, certain documents are typically required to support the information provided. These may include:

- Financial statements detailing revenue and expenses.

- Previous tax returns for reference.

- Business licenses and permits related to hotel operations.

Having these documents ready can facilitate a smoother completion process and help ensure accuracy in reporting.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential for hotel operators to maintain compliance. The Business Axes for Hotels and Kansas Department of Revenue form typically has specific due dates, which may vary based on the filing frequency determined by the state. It is advisable to mark these dates on a calendar and prepare the necessary documentation well in advance to avoid late submissions and potential penalties.

Quick guide on how to complete business axes for hotels and r kansas department of revenue

Effortlessly prepare Business Axes For Hotels And R Kansas Department Of Revenue on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Business Axes For Hotels And R Kansas Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to alter and eSign Business Axes For Hotels And R Kansas Department Of Revenue without effort

- Locate Business Axes For Hotels And R Kansas Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Modify and eSign Business Axes For Hotels And R Kansas Department Of Revenue and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business axes for hotels and r kansas department of revenue

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow for taxes hotels KS?

Using airSlate SignNow for taxes hotels KS streamlines the document signing process, making it easier to manage tax documents efficiently. The platform offers a user-friendly interface and secure eSigning capabilities, saving hotels valuable time and resources. Additionally, businesses can track the status of their documents in real-time, enhancing accountability.

-

How does airSlate SignNow integrate with existing systems for taxes hotels KS?

airSlate SignNow integrates seamlessly with various software solutions that hotels typically use for managing taxes hotels KS. This includes accounting software and property management systems, ensuring that all your tax documentation is synchronized and accessible. The integration helps maintain accuracy and reduces manual work associated with document handling.

-

What is the pricing structure for airSlate SignNow for taxes hotels KS?

The pricing for airSlate SignNow tailored for taxes hotels KS is competitive and designed to offer flexibility based on business size and needs. Plans typically include a monthly fee per user, with options for discounts on annual subscriptions. This makes it an economical choice for hotels looking to optimize their document management processes.

-

Is airSlate SignNow secure for handling tax documents in taxes hotels KS?

Yes, airSlate SignNow employs industry-leading security measures to ensure that your tax documents related to taxes hotels KS are protected. Features such as encryption, authentication, and compliance with regulations like GDPR make it a trusted solution for sensitive information. You can rest assured that your data is handled with the utmost care.

-

Can airSlate SignNow help expedite the tax document review process for hotels?

Absolutely! airSlate SignNow assists in expediting the tax document review process for taxes hotels KS by allowing multiple stakeholders to review and sign documents electronically. This reduces the back-and-forth time associated with traditional paper-based processes. The platform also provides notifications and reminders to keep everyone on track.

-

What features does airSlate SignNow offer for managing tax documentation in hotels?

airSlate SignNow offers various features tailored for managing tax documentation in taxes hotels KS, including customizable templates, automated workflows, and mobile access. These features enhance efficiency and simplify the process of gathering signatures and approvals. Hotels can also maintain compliance with tax regulations easily through proper documentation.

-

How can I get started with airSlate SignNow for taxes hotels KS?

Getting started with airSlate SignNow for taxes hotels KS is simple. You can sign up for a free trial to explore the features and see how they benefit your hotel operations. Once you're ready, finalizing your subscription and accessing all the tools for efficient document management is easy and quick.

Get more for Business Axes For Hotels And R Kansas Department Of Revenue

- Rc 226 1 business information form the business information form provides the legal name of the business doing business as name

- Application for a place on theparty general primary ballot 2 2 form

- Form application for a concealed carry firearm permit mississippi

- 54 printable bookmark template forms fillable samples in

- Verbatim reporter 1 form

- Mail your application and supplement form

- Form4 newxls

- Form5p nocheckboxesxls

Find out other Business Axes For Hotels And R Kansas Department Of Revenue

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation