TABLE of CONTENTS Kansas Department of Revenue Ksrevenue 2014

What is the Kansas Department of Revenue ksrevenue form?

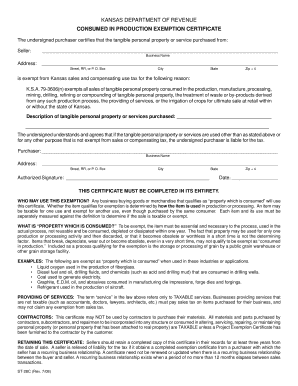

The Kansas Department of Revenue ksrevenue form is a crucial document used for various tax-related purposes within the state of Kansas. This form is primarily utilized for reporting income, calculating tax liabilities, and ensuring compliance with state tax regulations. It serves as an official record that taxpayers must complete accurately to avoid penalties and ensure proper processing by the department. Understanding the specific requirements and purpose of this form is essential for individuals and businesses operating in Kansas.

Steps to complete the Kansas Department of Revenue ksrevenue form

Completing the Kansas Department of Revenue ksrevenue form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions.

- Carefully read the instructions provided with the form to understand the specific requirements.

- Fill out the form accurately, providing all requested information, including your name, address, and Social Security number.

- Double-check your entries for accuracy to prevent errors that could lead to delays or penalties.

- Sign and date the form as required, ensuring that all necessary signatures are included.

- Submit the completed form by the designated deadline, either electronically or by mail.

Legal use of the Kansas Department of Revenue ksrevenue form

The legal use of the Kansas Department of Revenue ksrevenue form is governed by state tax laws and regulations. To be considered valid, the form must be completed in accordance with these laws. This includes providing truthful information and adhering to submission deadlines. Failure to comply with legal requirements can result in penalties, including fines or additional taxes owed. It is important for taxpayers to understand their legal obligations when using this form to avoid complications with the Kansas Department of Revenue.

Required documents for the Kansas Department of Revenue ksrevenue form

When completing the Kansas Department of Revenue ksrevenue form, certain documents are typically required to support your entries. These may include:

- W-2 forms from employers to report wages and taxes withheld.

- 1099 forms for reporting other income sources, such as freelance work or interest.

- Documentation for any deductions or credits claimed, such as receipts or statements.

- Previous tax returns for reference and to ensure consistency in reporting.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Filing deadlines for the Kansas Department of Revenue ksrevenue form

Filing deadlines for the Kansas Department of Revenue ksrevenue form are critical for compliance. Typically, individual income tax returns must be filed by April 15 of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, as late submissions can result in penalties and interest on unpaid taxes. Taxpayers should mark their calendars and prepare their forms in advance to meet these important dates.

Who issues the Kansas Department of Revenue ksrevenue form?

The Kansas Department of Revenue is the authoritative body responsible for issuing the ksrevenue form. This department oversees tax collection and enforcement within the state, ensuring that taxpayers comply with state tax laws. The form is designed to facilitate the reporting of income and the calculation of tax liabilities, helping the department maintain accurate records and effectively manage tax revenue. Understanding the role of the Kansas Department of Revenue is essential for navigating the state's tax system.

Quick guide on how to complete table of contents kansas department of revenue ksrevenue

Effortlessly Complete TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers a seamless, eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The Simplest Way to Edit and Electronically Sign TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue with Ease

- Locate TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or black out confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct table of contents kansas department of revenue ksrevenue

Create this form in 5 minutes!

People also ask

-

What is KSRevenue?

KSRevenue is a comprehensive solution designed to enhance your document management and eSignature needs. With airSlate SignNow, you can streamline the signing process, manage contracts effectively, and increase overall productivity. Our platform is easy to use, fundamentally aimed at simplifying your workflow associated with revenue documentation.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow starts at a competitive rate, making it accessible for businesses of all sizes. We offer various pricing plans that cater to different needs, ensuring you find the best fit for your operational requirements. You can learn more about our pricing options, including those specific to KSRevenue packages, on our website.

-

What features does airSlate SignNow offer?

airSlate SignNow comes packed with a variety of features tailored to meet your eSigning and document management needs. Key features include customizable templates, workflow automation, and robust security measures, all crucial for managing KSRevenue documentation effectively. This ensures you remain compliant while enhancing your efficiency.

-

Is airSlate SignNow secure for handling KSRevenue transactions?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption methods to protect your KSRevenue documents. Our platform adheres to strict compliance standards, ensuring that your data remains safe during the signing process. You can trust us to manage sensitive information without compromising security.

-

How can airSlate SignNow improve my KSRevenue management process?

Implementing airSlate SignNow can signNowly optimize your KSRevenue management by automating repetitive tasks, reducing turnaround time for contracts and agreements. With features like real-time tracking and reminders, you won’t miss critical deadlines that's crucial for any revenue-related documentation. Enhance your operational efficiency with our user-friendly platform.

-

Can I integrate airSlate SignNow with existing software for KSRevenue?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your KSRevenue functionality. For instance, you can connect it with CRM systems, project management tools, and accounting software, providing a unified approach to your revenue management. This integration ensures that your workflow remains uninterrupted and efficient.

-

What types of businesses can benefit from airSlate SignNow?

Businesses of all sizes, from startups to large enterprises, can signNowly benefit from airSlate SignNow. It’s particularly useful for those dealing with frequent KSRevenue documentation, such as contracts and agreements. The platform’s flexibility allows it to adapt to various industries, maximizing productivity and compliance.

Get more for TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue

- Seniors financial assistance application form july 2021 application form for seniors financial assistance programs

- Application for issue or renewal dl1 of driver licence form

- Form hlth178 ampquotmedical services plan msp enrolment

- 14 printable free employee handbook generator forms and

- Standing orders for over the counter medications form

- Ameritas cancellation form

- Attending physician statement mgm benefits group form

- Whs form 11 enterprise it services directorate request for data transferremovable media approval april dtic

Find out other TABLE OF CONTENTS Kansas Department Of Revenue Ksrevenue

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy