Irs Form 8846 2013

What is the IRS Form 8846

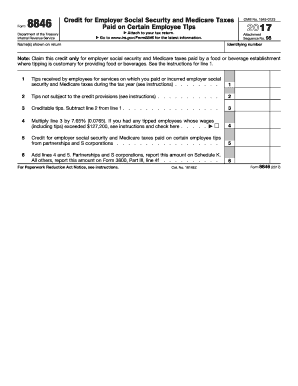

The IRS Form 8846, also known as the Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, is a tax form used by employers to claim a credit for the social security and Medicare taxes they have paid on tips received by their employees. This form is particularly relevant for businesses in the restaurant and hospitality industries, where tipping is a common practice. By filing this form, employers can reduce their overall tax liability, making it an essential tool for financial management.

How to use the IRS Form 8846

Using the IRS Form 8846 involves several steps to ensure accurate completion and submission. Employers must first gather necessary information, including the total amount of tips received by employees and the corresponding social security and Medicare taxes paid. Once this information is compiled, employers can fill out the form, detailing the amounts and calculations required. After completing the form, it should be submitted along with the employer's tax return to the IRS. This process helps ensure that the employer receives the appropriate credit for the taxes paid on employee tips.

Steps to complete the IRS Form 8846

Completing the IRS Form 8846 requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial information, including total tips received by employees and the amount of social security and Medicare taxes paid.

- Fill out the form accurately, ensuring all calculations are correct. Include details such as the business name, employer identification number, and the specific amounts related to employee tips.

- Review the completed form for any errors or omissions. Double-check all figures to ensure accuracy.

- Submit the form with your tax return by the appropriate deadline to ensure you receive the credit.

Legal use of the IRS Form 8846

The IRS Form 8846 is legally binding when completed correctly and submitted according to IRS guidelines. It is essential for employers to provide accurate information to avoid any legal complications. The form must be filed within the specified deadlines to ensure compliance with tax regulations. Employers should retain copies of the form and any supporting documents for their records, as these may be needed for future reference or in case of an audit.

Eligibility Criteria

To qualify for the credit claimed on the IRS Form 8846, employers must meet specific eligibility criteria. These include:

- Being an employer who pays social security and Medicare taxes on tips received by employees.

- Operating within industries where tipping is customary, such as restaurants and bars.

- Accurately reporting all tips received by employees to the IRS.

Form Submission Methods

The IRS Form 8846 can be submitted through various methods, ensuring flexibility for employers. These methods include:

- Filing electronically through tax software that supports IRS forms.

- Submitting a paper form by mail to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Filing Deadlines / Important Dates

Filing the IRS Form 8846 must be done by specific deadlines to ensure compliance with tax regulations. Generally, the form should be submitted along with the employer's annual tax return. Employers should be aware of the following important dates:

- The due date for filing the annual tax return, typically April 15 for most businesses.

- Extensions may be available, but the form must still be submitted by the extended deadline to claim the credit.

Quick guide on how to complete irs form 8846

Complete Irs Form 8846 effortlessly on any gadget

Web-based document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Irs Form 8846 on any gadget through airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Irs Form 8846 with ease

- Find Irs Form 8846 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and eSign Irs Form 8846 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8846

Create this form in 5 minutes!

How to create an eSignature for the irs form 8846

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is IRS Form 8846?

IRS Form 8846 is a tax form used by businesses to claim the credit for employer social security and Medicare taxes paid on certain employee tips. It's particularly relevant for businesses in the restaurant and hospitality industry. Understanding this form can help ensure you maximize your tax benefits.

-

How can airSlate SignNow help with IRS Form 8846?

airSlate SignNow allows businesses to easily prepare, send, and eSign IRS Form 8846 electronically. This solution streamlines the process, ensuring accurate and timely submissions. With our user-friendly interface, you'll find managing your forms easier than ever.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8846?

Yes, there is a pricing structure for using airSlate SignNow, which is designed to be cost-effective for businesses of all sizes. We offer various plans that cater to different needs, ensuring you can find a solution that fits your budget while allowing for efficient handling of IRS Form 8846.

-

What features does airSlate SignNow offer for IRS Form 8846?

airSlate SignNow provides multiple features for IRS Form 8846, including easy document preparation, eSigning capabilities, and customizable templates. These features help businesses manage their tax forms more efficiently, reducing the likelihood of errors and improving overall productivity.

-

Can I integrate airSlate SignNow with other software for IRS Form 8846?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software to simplify the process of managing IRS Form 8846. This integration can save time and reduce manual entry errors, ensuring your company's financial data is accurate and up to date.

-

What are the benefits of using airSlate SignNow for IRS Form 8846 submissions?

Using airSlate SignNow for IRS Form 8846 submissions offers numerous benefits, including increased efficiency, enhanced security, and reduced turnaround times. Businesses can track the status of their forms in real-time, leading to improved compliance and peace of mind during tax season.

-

Is airSlate SignNow user-friendly for non-technical users handling IRS Form 8846?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for non-technical users managing IRS Form 8846. The platform offers intuitive navigation and clear instructions, which help streamline the eSigning process without requiring extensive technical knowledge.

Get more for Irs Form 8846

- Da 1380 form

- Dl 4006 form

- Sudbury police vulnerable sector check form

- Nic st lucia sick leave form

- Personal training client form

- Eligibility requirements if you have transitioned through the home choice program after july 2019 you are not eligible to form

- Petition certificate title form

- Cnr recertification formdocx

Find out other Irs Form 8846

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free