Form 8846 2020

What is the Form 8846?

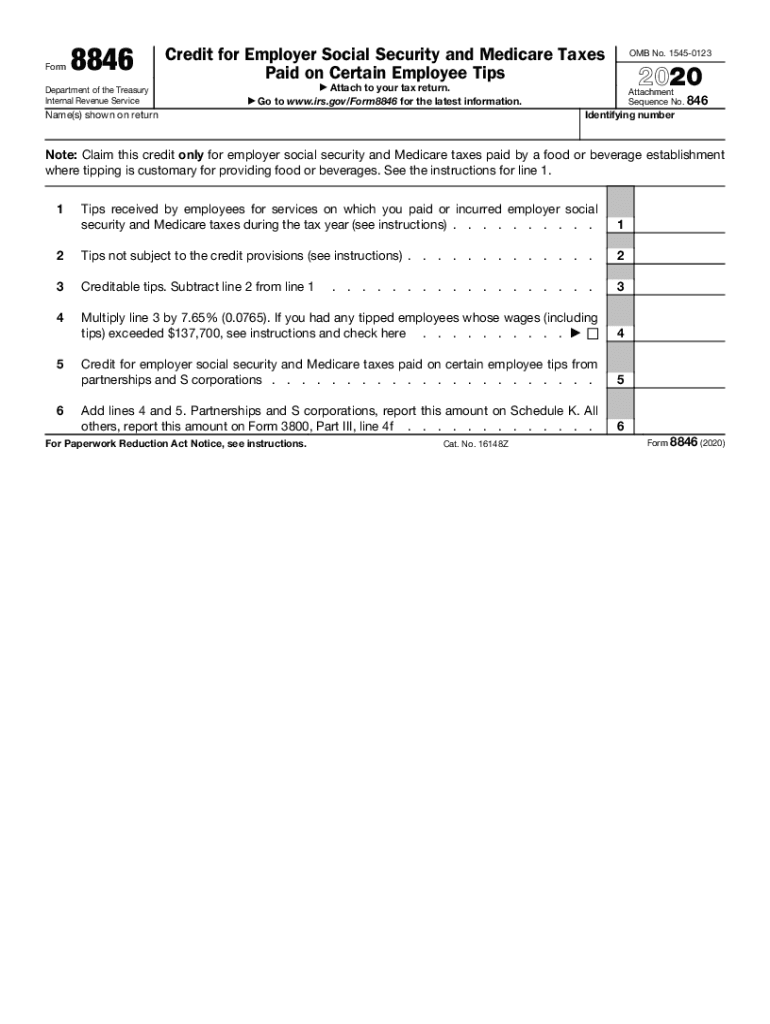

The Form 8846, also known as the 8846 credit form, is a tax document used by employers to claim the credit for social security and Medicare taxes paid on behalf of their employees. This form is particularly relevant for businesses that have employees working in specific industries, such as those engaged in providing certain types of services. The credit helps reduce the overall tax burden for eligible employers, making it an important aspect of tax planning and compliance.

How to Use the Form 8846

To effectively use the Form 8846, employers must first determine their eligibility for the credit. Once eligibility is confirmed, the employer should accurately complete the form by providing necessary information, including the number of employees and the total amount of social security and Medicare taxes paid. After filling out the form, it should be submitted along with the employer's tax return to the IRS. It is crucial to ensure that all information is accurate to avoid delays or penalties.

Steps to Complete the Form 8846

Completing the Form 8846 involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and records of social security and Medicare taxes paid.

- Fill out the form, ensuring that all required fields are completed accurately.

- Double-check the calculations to confirm the amount of credit being claimed.

- Sign and date the form, certifying that the information provided is true and correct.

- Submit the completed form with your tax return.

Legal Use of the Form 8846

The legal use of the Form 8846 is governed by IRS regulations. Employers must adhere to specific guidelines to ensure that the credit is claimed legitimately. This includes maintaining accurate records of employee wages and taxes paid. Failure to comply with IRS rules can result in penalties or disqualification from claiming the credit. Therefore, it is essential for employers to familiarize themselves with the legal requirements associated with this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8846 coincide with the employer's tax return due dates. Typically, this means that the form must be submitted by the same deadline as the employer's annual tax return, which is usually April fifteenth for most businesses. Employers should also be aware of any extensions that may apply, as these can affect when the form must be filed. Keeping track of these important dates is crucial for maintaining compliance with IRS regulations.

Eligibility Criteria

To qualify for the credit claimed on Form 8846, employers must meet specific eligibility criteria. Generally, the credit is available to businesses that have paid social security and Medicare taxes on behalf of their employees who are engaged in qualified activities. Additionally, employers must maintain proper documentation to support their claims. It is important to review the IRS guidelines to ensure that all eligibility requirements are met before submitting the form.

Quick guide on how to complete form 8846 2020

Create Form 8846 effortlessly on any device

Web-based document management has gained immense traction among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your documents swiftly without interruptions. Manage Form 8846 on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

How to modify and eSign Form 8846 effortlessly

- Find Form 8846 and click Get Form to initiate.

- Employ the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and bears the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 8846 while ensuring exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8846 2020

Create this form in 5 minutes!

How to create an eSignature for the form 8846 2020

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the form 8846 2020 and who needs it?

The form 8846 2020 is utilized by employers to claim the credit for contributions to qualified health plans for employees. If your business provided health coverage in 2020, it is essential to understand how to complete this form to ensure compliance and benefit from available credits.

-

How can airSlate SignNow help me with form 8846 2020?

airSlate SignNow provides a simple way to eSign and manage documents, including the form 8846 2020. With our platform, you can efficiently send, sign, and store your completed forms, ensuring that your documentation is secure and easily accessible.

-

Is there a cost associated with using airSlate SignNow for form 8846 2020?

Yes, using airSlate SignNow does involve pricing; however, it is designed to be cost-effective for businesses of all sizes. We offer various pricing plans, allowing you to select one that fits your budget while providing the tools necessary to manage your form 8846 2020 efficiently.

-

What features make airSlate SignNow ideal for handling form 8846 2020?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure document storage, all of which streamline the process of managing the form 8846 2020. These features enhance productivity and ensure you can complete necessary documentation without hassle.

-

Can I integrate airSlate SignNow with other software for form 8846 2020 management?

Absolutely! airSlate SignNow supports integrations with popular software applications, allowing you to manage the form 8846 2020 alongside other business processes. This integration capability makes it easier to keep your data organized and improve overall workflow.

-

What benefits does eSigning provide for form 8846 2020?

E-signing with airSlate SignNow ensures that your form 8846 2020 is signed quickly and securely, saving you time and reducing paper waste. Electronic signatures also provide a verifiable audit trail, enhancing the legitimacy of your documents during audits or submissions.

-

Is training available for new users managing form 8846 2020 with airSlate SignNow?

Yes, airSlate SignNow offers comprehensive training resources, including tutorials and support documentation, to help new users navigate the platform effectively. Learning how to handle the form 8846 2020 using our tools is simple, ensuring you can get started right away.

Get more for Form 8846

Find out other Form 8846

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement