E Services FAQs for Business Registration Form

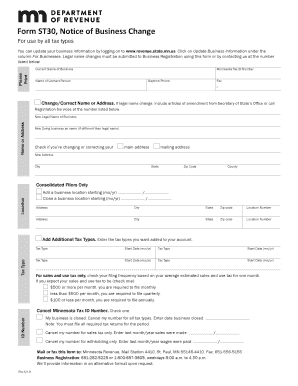

What is the form ST30?

The form ST30 is a specific document used in the state of Minnesota for sales tax exemption purposes. It allows eligible organizations, such as non-profits and government entities, to claim exemption from sales tax on purchases related to their exempt activities. By submitting the ST30 form, these organizations can avoid paying sales tax on items that are necessary for their operations, thereby reducing their overall costs.

How to use the form ST30

Using the form ST30 involves several straightforward steps. First, ensure that your organization qualifies for sales tax exemption under Minnesota law. Next, obtain the form from the appropriate state department or online resources. Complete the form by providing required information, including your organization’s name, address, and tax identification number. After filling out the form, submit it to the vendor from whom you are purchasing goods or services, allowing them to recognize your tax-exempt status.

Steps to complete the form ST30

Completing the form ST30 requires careful attention to detail. Follow these steps for accurate submission:

- Verify eligibility for sales tax exemption based on Minnesota regulations.

- Download the form ST30 from the Minnesota Department of Revenue website.

- Fill in your organization's name, address, and tax identification number.

- Indicate the nature of your organization and the specific purpose for which the exemption is requested.

- Review the completed form for accuracy and completeness.

- Provide the form to the vendor at the time of purchase.

Legal use of the form ST30

The legal use of the form ST30 is governed by Minnesota state tax laws. Organizations must ensure they meet the criteria for exemption to avoid potential penalties. Misuse of the form, such as using it for ineligible purchases, can lead to legal repercussions, including fines or back taxes owed. It is essential to maintain proper records of all transactions involving the ST30 to demonstrate compliance if audited.

Required documents for the form ST30

When completing the form ST30, certain documents may be necessary to support your claim for sales tax exemption. These may include:

- A copy of your organization’s tax-exempt status documentation.

- Proof of your organization's activities that qualify for exemption.

- Any additional state-specific forms that may be required for your type of organization.

Having these documents ready can facilitate a smoother process when submitting the form to vendors.

Form submission methods for ST30

The form ST30 can be submitted in various ways, depending on the vendor's preferences. Common methods include:

- In-person delivery at the time of purchase.

- Mailing the completed form to the vendor prior to making a purchase.

- Emailing a scanned copy of the completed form if the vendor accepts digital submissions.

Always confirm with the vendor which submission method they prefer to ensure proper processing of the tax-exempt purchase.

Quick guide on how to complete e services faqs for business registration

Complete E Services FAQs For Business Registration seamlessly on any device

Electronic document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your files quickly and efficiently. Manage E Services FAQs For Business Registration on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign E Services FAQs For Business Registration with minimal effort

- Obtain E Services FAQs For Business Registration and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and eSign E Services FAQs For Business Registration and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form st30 and how can airSlate SignNow help with it?

The form st30 is a legal document used for various purposes, and airSlate SignNow simplifies the process of managing this form. With our platform, you can easily fill out, sign, and send the form st30 securely and efficiently, ensuring compliance and reducing paper usage.

-

Is the form st30 customizable within airSlate SignNow?

Yes, the form st30 can be customized within airSlate SignNow to meet your specific requirements. Our easy-to-use interface allows you to add text fields, checkboxes, and signature fields to tailor the document according to your needs.

-

What pricing plans does airSlate SignNow offer for using the form st30?

airSlate SignNow provides various pricing plans that cater to different business sizes and needs when managing the form st30. Our plans are cost-effective, starting from basic features to advanced functionalities, ensuring that you only pay for what you need.

-

Can I integrate airSlate SignNow with other applications for handling the form st30?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms, allowing you to streamline your workflow when dealing with the form st30. This functionality enhances productivity and ensures you can work efficiently across different tools.

-

What are the benefits of using airSlate SignNow for the form st30?

Using airSlate SignNow for the form st30 provides numerous benefits including easy eSigning, secure document storage, and quick turnaround times. This results in improved operational efficiency, reduced paperwork, and a more environmentally friendly approach to handling documents.

-

How does airSlate SignNow ensure the security of the form st30?

airSlate SignNow ensures the security of the form st30 through advanced encryption and compliant storage solutions. We prioritize your data protection, guaranteeing that all your signed documents are secure and safeguarded against unauthorized access.

-

What support options are available for users of the form st30 on airSlate SignNow?

airSlate SignNow offers comprehensive support options, including tutorials, a knowledge base, and customer service representatives ready to assist you with any queries regarding the form st30. We are committed to ensuring that you have the resources needed to effectively use our platform.

Get more for E Services FAQs For Business Registration

- It 250 form

- 611 form

- Form it 604 claim for qeze tax reduction credit tax year 2020

- Pa w form

- Personal income tax forms state of rhode island file your annual report rhode island nellie m gorbearhode island office of the

- Capacity to make or revoke a will form

- Cle tracking form to enter an affidavit or review your

Find out other E Services FAQs For Business Registration

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement