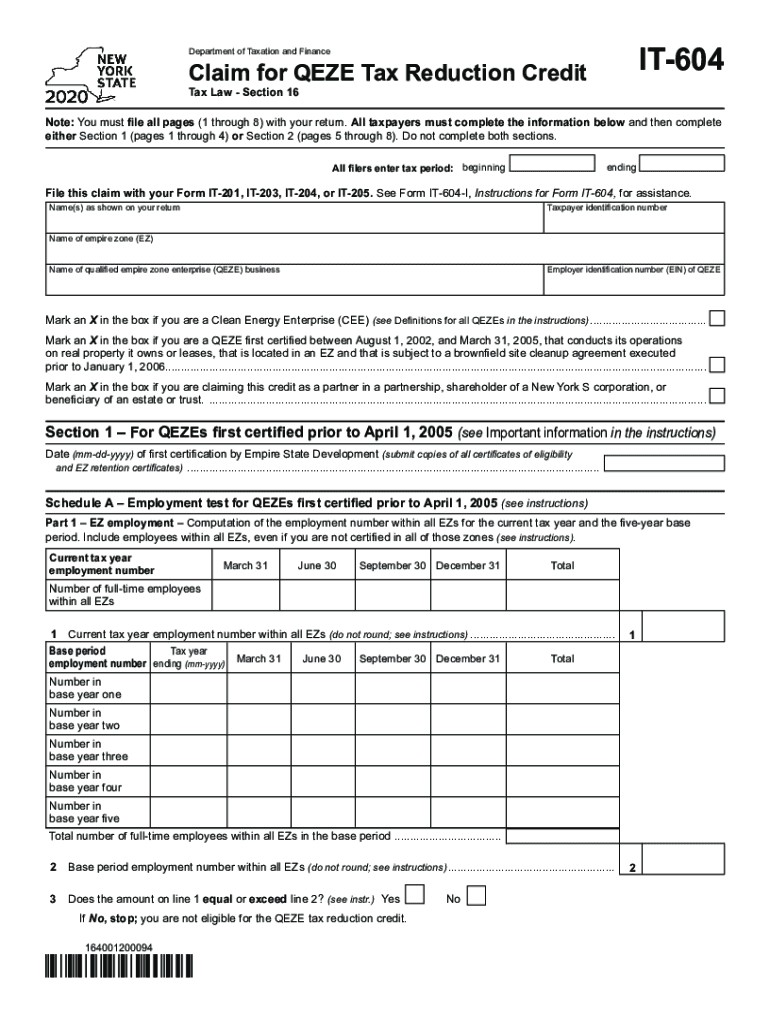

Form it 604 Claim for QEZE Tax Reduction Credit Tax Year 2020

What is the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

The Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year is a tax document used by eligible businesses in New York State to claim a tax credit aimed at promoting economic development in Qualified Empire Zone Enterprises (QEZE). This form allows businesses that meet specific criteria to reduce their tax liability, thereby encouraging growth and investment in designated areas. The credit is designed to support businesses that contribute to job creation and economic revitalization in economically distressed regions.

How to use the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

Using the Form IT 604 involves several steps to ensure accurate completion and submission. First, businesses must determine their eligibility based on the criteria set forth by the New York State Department of Taxation and Finance. After confirming eligibility, the form should be filled out with the required financial information, including income details and any relevant deductions. Once completed, the form can be submitted electronically or via mail, depending on the business's preference and compliance with state regulations.

Steps to complete the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

Completing the Form IT 604 requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Verify eligibility for the QEZE tax credit by reviewing the criteria established by the state.

- Fill out the form accurately, ensuring all sections are completed, including business identification and financial information.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through the appropriate state portal or mail it to the designated address.

Key elements of the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

The Form IT 604 includes several key elements that must be addressed for a successful claim. These elements typically include:

- Business Information: Name, address, and identification number of the business.

- Eligibility Criteria: Confirmation that the business meets the requirements for QEZE designation.

- Financial Information: Detailed income and deduction information pertinent to the tax year.

- Signature: A declaration by an authorized representative of the business affirming the accuracy of the information provided.

Eligibility Criteria

To qualify for the QEZE tax reduction credit, businesses must meet specific eligibility criteria established by the state. These criteria generally include:

- Being designated as a Qualified Empire Zone Enterprise.

- Operating within a designated Empire Zone.

- Meeting minimum employment and investment thresholds as defined by state regulations.

- Complying with all applicable local, state, and federal laws.

Form Submission Methods

The Form IT 604 can be submitted through various methods to accommodate different business needs. Businesses may choose to:

- Submit the form electronically via the New York State Department of Taxation and Finance online portal.

- Mail the completed form to the appropriate tax office as indicated in the form instructions.

- In some cases, businesses may deliver the form in person at designated tax offices.

Quick guide on how to complete form it 604 claim for qeze tax reduction credit tax year 2020

Complete Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to modify and eSign Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year effortlessly

- Obtain Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your eSignature using the Sign tool, which takes mere moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow manages all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 604 claim for qeze tax reduction credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 604 claim for qeze tax reduction credit tax year 2020

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The best way to create an e-signature for a PDF document on Android OS

People also ask

-

What is Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year is a necessary document for businesses claiming tax reductions under the Qualified Empire Zone Enterprise (QEZE) program. This form helps businesses reduce their tax burden and promotes economic development in designated areas.

-

How can airSlate SignNow help with Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

With airSlate SignNow, you can easily fill out and eSign the Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. Our platform streamlines the document workflow, ensuring that your forms are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Depending on the features you choose, you can access tools for managing your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year efficiently and cost-effectively.

-

What features does airSlate SignNow offer for managing Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, making it easy to manage your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. These tools enhance productivity and help you meet deadlines more effectively.

-

Can I integrate airSlate SignNow with other software for Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

Yes, airSlate SignNow offers integrations with a variety of applications, ensuring seamless collaboration while working on your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. This allows you to incorporate your existing workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

By using airSlate SignNow for your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year, you can enjoy faster turnaround times and reduced paper usage. Our platform also enhances security with encrypted eSignatures, providing peace of mind for sensitive financial documents.

-

Is support available for questions regarding Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year?

Absolutely! airSlate SignNow provides customer support to assist you with any questions related to completing and submitting your Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year. Our knowledgeable team is here to help you navigate the process seamlessly.

Get more for Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

- 10 1 information security policy weber state university

- Business purchase agreementbusiness purchase form canada

- New sales representative form

- Guidelines for progressive discipline ampamp grievance nctq form

- Name change secgov form

- Google domains domain name registration agreement form

- Sample lease klines resort form

- Confidentiality notice this e mail communication and form

Find out other Form IT 604 Claim For QEZE Tax Reduction Credit Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors