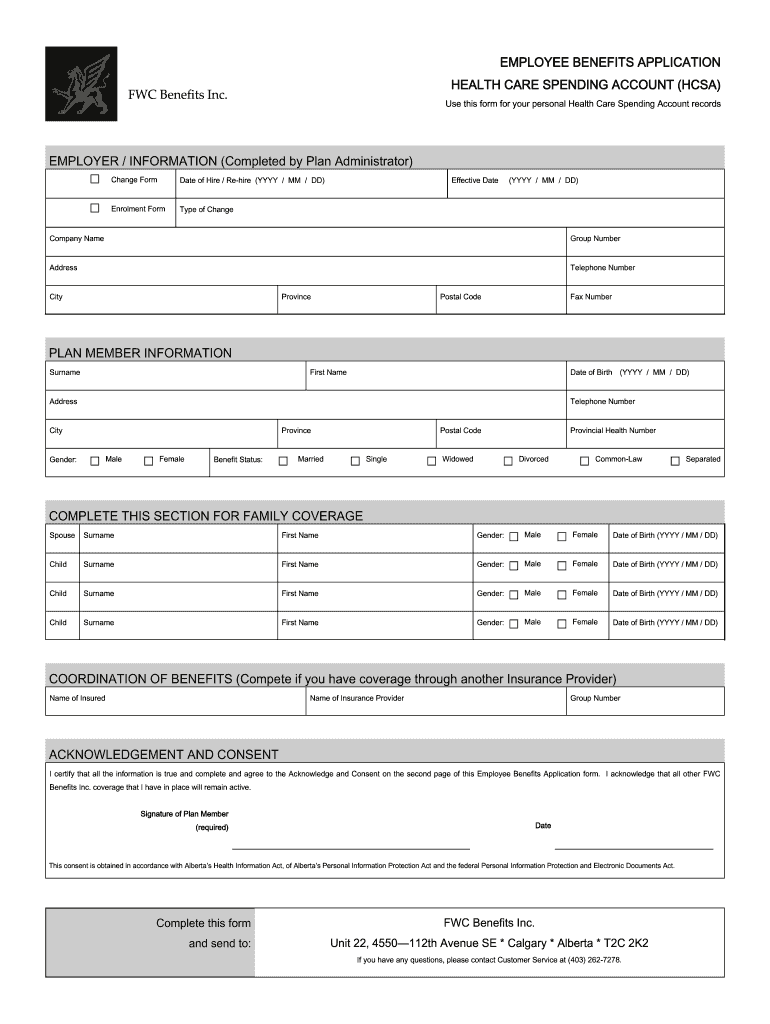

EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT Form

What is the employee benefits application health care spending account

An employee benefits application health care spending account (HCSA) is a pre-tax benefit that allows employees to set aside a portion of their earnings to pay for eligible medical expenses. This account is designed to help employees manage their health care costs while benefiting from tax savings. Contributions to the HCSA are deducted from the employee's paycheck before taxes are applied, reducing their taxable income.

Eligible expenses typically include out-of-pocket medical, dental, and vision costs that are not covered by insurance. This can encompass items such as co-pays, prescription medications, and certain medical supplies. Understanding the specifics of what qualifies as an eligible expense is crucial for maximizing the benefits of the account.

How to use the employee benefits application health care spending account

Using the employee benefits application health care spending account involves a few straightforward steps. First, employees need to enroll in the HCSA during their employer's open enrollment period. Once enrolled, employees can contribute a set amount to their account, which can be adjusted annually based on their expected health care needs.

When it comes time to use the funds, employees can submit claims for reimbursement for eligible expenses. This can often be done online through the employer's benefits portal, where employees can upload receipts and documentation of their expenses. It's important to keep records of all transactions to ensure compliance and facilitate reimbursement.

Eligibility criteria for the employee benefits application health care spending account

Eligibility for the employee benefits application health care spending account typically depends on the employer's specific plan and the employee's employment status. Generally, full-time employees are eligible to participate, while part-time employees may have different criteria.

Additionally, employees must be enrolled in a qualified health plan to use the HCSA. Some employers may also impose specific contribution limits and guidelines for eligible expenses, so it's essential for employees to review their employer's plan details to understand their eligibility and options fully.

Required documents for the employee benefits application health care spending account

To successfully utilize the employee benefits application health care spending account, employees must provide certain documentation when submitting claims for reimbursement. Commonly required documents include receipts that detail the date of service, the type of service or product purchased, and the amount spent.

In some cases, additional documentation may be necessary, such as a letter of medical necessity from a healthcare provider for specific treatments or services. Keeping organized records of all relevant documents will streamline the claims process and ensure timely reimbursement.

Steps to complete the employee benefits application health care spending account

Completing the employee benefits application health care spending account involves several key steps:

- Enroll in the HCSA during the open enrollment period offered by your employer.

- Determine the amount you wish to contribute based on your expected health care expenses.

- Keep track of eligible medical expenses throughout the year.

- Submit claims for reimbursement through your employer's benefits portal, ensuring you include all required documentation.

- Monitor your account balance and adjust contributions for the following year as necessary.

Legal use of the employee benefits application health care spending account

The legal use of the employee benefits application health care spending account is governed by federal regulations, including the Internal Revenue Code. To ensure compliance, employees must only use HCSA funds for qualified medical expenses as defined by the IRS.

Misuse of funds, such as using them for non-eligible expenses, can result in tax penalties and the requirement to repay any improperly used amounts. Employees should familiarize themselves with the IRS guidelines to avoid any legal issues and maintain the integrity of their HCSA.

Quick guide on how to complete employee benefits application health care spending account

Complete EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT on any device using airSlate SignNow's Android or iOS apps and enhance any document-related task today.

How to modify and eSign EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT with ease

- Locate EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate producing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Modify and eSign EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is self id in airSlate SignNow?

Self id in airSlate SignNow refers to the process of verifying your identity using electronic signatures and secure authentication methods. This feature ensures that your documents are signed by the intended recipients, adding an extra layer of security to your transactions.

-

How does self id improve document security?

Self id enhances document security by providing robust identity verification features that prevent unauthorized access. With airSlate SignNow, the self id feature ensures that only verified users can sign and manage documents, thus safeguarding sensitive information.

-

Is there a cost associated with using the self id feature?

The self id feature is included in the pricing plans offered by airSlate SignNow, making it a cost-effective solution for businesses of all sizes. By integrating self id into your document management processes, you can save on costs associated with traditional identification methods.

-

What are the key benefits of using self id in airSlate SignNow?

Using self id in airSlate SignNow offers numerous benefits, including enhanced security, improved user experience, and faster transaction times. Businesses can streamline their document signing process, ensuring that identity verification is efficient and trusted.

-

Can I integrate self id with other applications?

Yes, airSlate SignNow allows for seamless integrations with numerous applications, enhancing the functionality of self id. Whether you're using CRM systems or document management tools, you can easily incorporate the self id feature to maintain secure document workflows.

-

How does self id support compliance with legal standards?

Self id in airSlate SignNow supports compliance with various legal standards, ensuring that electronic signatures meet regulatory requirements. By using self id, businesses can confidently manage signed documents while adhering to laws pertaining to digital identity verification.

-

What industries benefit the most from self id?

Industries that rely heavily on secure documentation processes, such as finance, healthcare, and real estate, benefit signNowly from self id. AirSlate SignNow's self id feature provides these sectors with the security and efficiency needed to manage sensitive information.

Get more for EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT

- Schedule d schedule dform 1120 department of the

- 2021 form 1099 a acquisition or abandonment of secured property

- 2021 general instructions for forms w 2 and w 3about form w 2 wage and tax statementinternal general instructions for forms w 2

- Form 4972 tax on lump sum distributions from qualified

- Wwwirsgovforms pubsabout form 8938about form 8938 statement of specified foreign financial assets

- Request for a copy of exempt or political organization irs form

- Wwwirsgovpubirs pdfinstructions for form 941 rev june

- 2020 instructions for form 8915 c internal revenue service

Find out other EMPLOYEE BENEFITS APPLICATION HEALTH CARE SPENDING ACCOUNT

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online