PDF Employee's Withholding Certificate Internal Revenue Service 2021

What is the PDF Employee's Withholding Certificate?

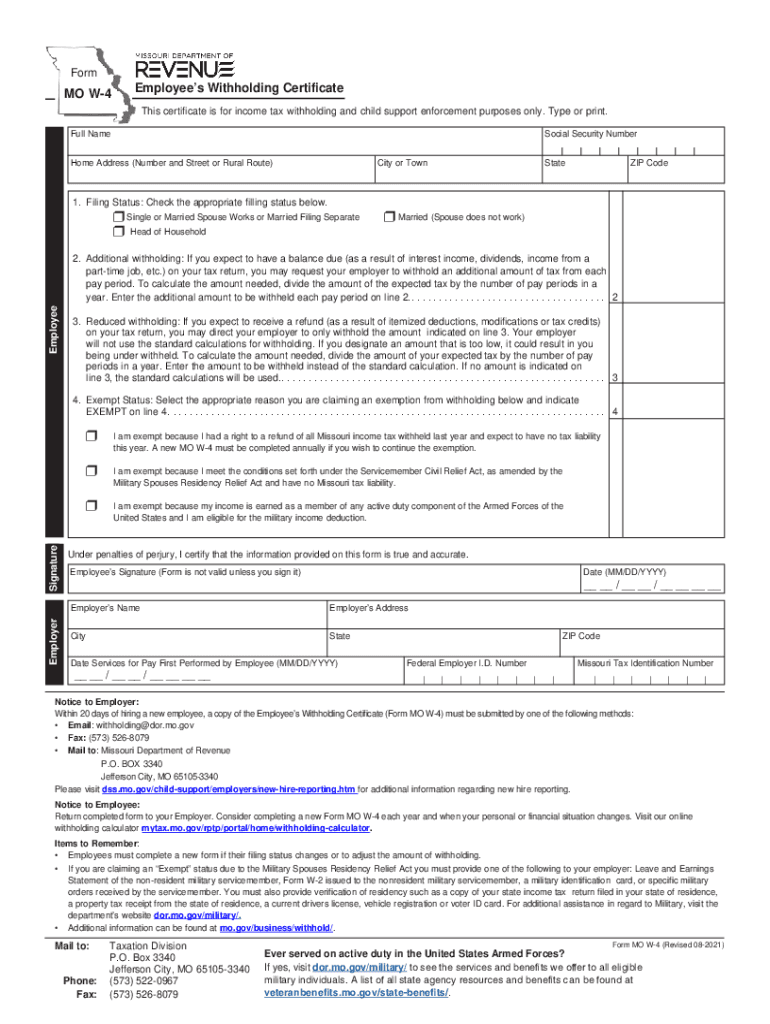

The PDF Employee's Withholding Certificate, commonly known as Form W-4, is an essential document used by employees in the United States to inform their employers about their tax withholding preferences. This form plays a crucial role in determining the amount of federal income tax withheld from an employee's paycheck. By accurately completing the W-4, employees can ensure that they pay the correct amount of taxes throughout the year, potentially avoiding underpayment penalties or large tax bills during tax season.

Steps to Complete the PDF Employee's Withholding Certificate

Filling out the W-4 form involves several straightforward steps that help employees specify their tax withholding needs:

- Personal Information: Begin by entering your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If applicable, indicate if you have more than one job or if your spouse works. This section helps in calculating the appropriate withholding amount.

- Claim Dependents: If you have qualifying children or other dependents, provide the necessary information to claim tax credits that may reduce your withholding.

- Other Adjustments: You can also indicate any additional income or deductions that may affect your tax situation.

- Signature: Finally, sign and date the form to validate your information.

Legal Use of the PDF Employee's Withholding Certificate

The W-4 form is legally recognized by the Internal Revenue Service (IRS) as the official document for employees to communicate their tax withholding preferences to their employers. Proper completion and submission of this form ensure compliance with federal tax regulations. Employers are required to honor the information provided on the W-4 and adjust tax withholdings accordingly. Failure to submit a W-4 may result in the employer withholding taxes at the highest rate, which could lead to over-withholding and unnecessary financial strain on the employee.

IRS Guidelines for Completing the W-4

The IRS provides specific guidelines for completing the W-4 form to help employees accurately report their tax situation. These guidelines include instructions on how to calculate the number of allowances, the impact of additional income, and how to adjust for tax credits. The IRS also emphasizes the importance of reviewing and updating the W-4 whenever there are significant life changes, such as marriage, divorce, or the birth of a child. Staying informed about these guidelines can help employees manage their tax obligations effectively.

Filing Deadlines and Important Dates

While there is no specific deadline for submitting a W-4, it is recommended that employees complete and submit the form to their employer as soon as they start a new job or experience a significant life change. Employers are required to implement the changes within a reasonable timeframe, typically by the next payroll period. Additionally, employees should review their W-4 annually or when their financial situation changes to ensure that their withholding remains accurate.

Form Submission Methods

The W-4 form can be submitted to employers through various methods, depending on the company’s policies. Common submission methods include:

- Online Submission: Many employers offer online portals where employees can fill out and submit their W-4 electronically.

- Email: Some employers may allow employees to email a scanned copy of the completed form.

- Physical Submission: Employees can also print the form and submit it in person or by mail to their HR department.

Quick guide on how to complete pdf employees withholding certificate internal revenue service

Effortlessly Prepare PDF Employee's Withholding Certificate Internal Revenue Service on Any Device

Digital document management has gained increased popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it stored online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage PDF Employee's Withholding Certificate Internal Revenue Service on any device with the airSlate SignNow apps available for Android or iOS and streamline any document-related process today.

Edit and eSign PDF Employee's Withholding Certificate Internal Revenue Service with Ease

- Obtain PDF Employee's Withholding Certificate Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign PDF Employee's Withholding Certificate Internal Revenue Service to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf employees withholding certificate internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf employees withholding certificate internal revenue service

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a W 4 form and why is it important?

The W 4 form is a crucial document that employees complete to inform their employer of their tax withholding preferences. It is essential for ensuring the correct tax amount is deducted from your paycheck. Knowing how to fill out a W 4 form properly can save you from underpayment or overpayment of taxes.

-

How can airSlate SignNow help with W 4 forms?

airSlate SignNow provides a streamlined process for sending, signing, and managing W 4 forms electronically. With our user-friendly platform, you can quickly share W 4 forms with employees and track their completion in real-time. This saves time and reduces paperwork while ensuring compliance.

-

Is airSlate SignNow compliant with IRS regulations for W 4 forms?

Yes, airSlate SignNow is compliant with IRS regulations for electronic signatures, making it a reliable choice for managing W 4 forms. Our platform adheres to strict security protocols and electronic signature laws, ensuring that your W 4 forms are valid and legally binding.

-

What features does airSlate SignNow offer for managing W 4 documents?

airSlate SignNow offers several features for managing W 4 documents, including customizable templates, document storage, and real-time status tracking. Advanced security features ensure that sensitive information is protected, while integrations with other platforms help streamline your HR processes.

-

How much does airSlate SignNow cost for businesses handling W 4 forms?

airSlate SignNow offers flexible pricing plans that can accommodate businesses of all sizes dealing with W 4 forms. Our plans are cost-effective, allowing you to manage document workflows efficiently without breaking the bank. You can choose a plan that best suits your organization's needs.

-

Can I integrate airSlate SignNow with other HR software for W 4 processing?

Absolutely! airSlate SignNow seamlessly integrates with a variety of HR software solutions to enhance your W 4 form processing. This integration allows for efficient data transfer and better management of employee documentation, leading to a more streamlined payroll process.

-

What are the benefits of using airSlate SignNow for W 4 forms?

Using airSlate SignNow for W 4 forms provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. The electronic signing process eliminates delays associated with paper forms and ensures that your documents are always up to date and easily accessible.

Get more for PDF Employee's Withholding Certificate Internal Revenue Service

- Assignment of mortgage by individual mortgage holder connecticut form

- Notice quit form

- Ct notice quit form

- Assignment of mortgage by corporate mortgage holder connecticut form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property connecticut form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497301091 form

- Connecticut notice intent form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential connecticut form

Find out other PDF Employee's Withholding Certificate Internal Revenue Service

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free