Amended Quarterly Withholding Form Boone County, KY 2021

What is the Amended Quarterly Withholding Form Boone County, KY

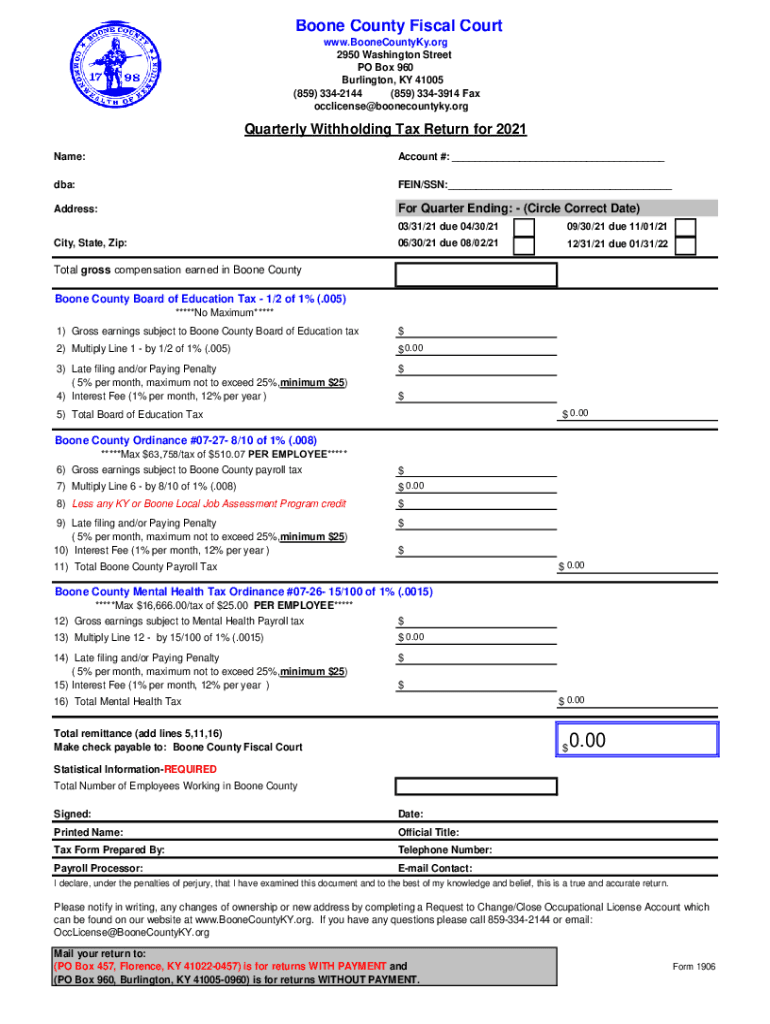

The Amended Quarterly Withholding Form for Boone County, Kentucky, is a crucial document for employers who need to correct previously submitted withholding tax returns. This form allows businesses to amend their quarterly tax filings, ensuring that any errors regarding employee withholdings are rectified. It is essential for maintaining compliance with local tax regulations and avoiding potential penalties.

How to use the Amended Quarterly Withholding Form Boone County, KY

To use the Amended Quarterly Withholding Form, an employer must first obtain the correct form, which is specifically designed for amendments. After filling out the necessary information, including the original amounts and the corrected figures, the employer must submit the form to the appropriate tax authority. This process ensures that the updated information is recorded and that the employer remains compliant with tax obligations.

Steps to complete the Amended Quarterly Withholding Form Boone County, KY

Completing the Amended Quarterly Withholding Form involves several key steps:

- Obtain the correct form from the Boone County tax authority.

- Fill in the employer's details, including name, address, and identification number.

- Provide the original amounts reported in the previous quarterly return.

- Enter the corrected amounts that need to be reported.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to the appropriate tax office.

Filing Deadlines / Important Dates

Filing deadlines for the Amended Quarterly Withholding Form are critical for compliance. Employers must submit the amended form by the same deadlines applicable to the original quarterly returns. Typically, these deadlines fall on the last day of the month following the end of each quarter. It is essential to stay informed about any changes to these dates to avoid late penalties.

Penalties for Non-Compliance

Failure to file the Amended Quarterly Withholding Form on time can result in significant penalties. These may include fines based on the amount of tax owed or additional interest charges on unpaid amounts. Employers should ensure timely submission to avoid these financial repercussions and maintain good standing with tax authorities.

Legal use of the Amended Quarterly Withholding Form Boone County, KY

The legal use of the Amended Quarterly Withholding Form is governed by state tax laws. Employers must ensure that the form is completed accurately and submitted within the designated time frames. This adherence to legal requirements helps protect businesses from audits and penalties, reinforcing the importance of maintaining accurate tax records.

Who Issues the Form

The Amended Quarterly Withholding Form is issued by the Boone County tax authority. This local government agency is responsible for overseeing tax compliance and ensuring that employers fulfill their withholding obligations. Employers should refer to the official Boone County tax website or contact the agency directly for the most current version of the form and any related guidance.

Quick guide on how to complete 2021 amended quarterly withholding form boone county ky

Effortlessly Prepare Amended Quarterly Withholding Form Boone County, KY on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Amended Quarterly Withholding Form Boone County, KY on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and Electronically Sign Amended Quarterly Withholding Form Boone County, KY with Ease

- Obtain Amended Quarterly Withholding Form Boone County, KY and click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal standing as a handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors requiring reprinting of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Amended Quarterly Withholding Form Boone County, KY, ensuring seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 amended quarterly withholding form boone county ky

Create this form in 5 minutes!

How to create an eSignature for the 2021 amended quarterly withholding form boone county ky

How to generate an e-signature for your PDF file in the online mode

How to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is Kentucky quarterly tax?

Kentucky quarterly tax is a tax obligation that businesses and self-employed individuals must pay each quarter based on their estimated income. Understanding your Kentucky quarterly tax responsibilities is crucial to avoid penalties and ensure compliance. Proper management of these taxes can signNowly aid in cash flow management for your business.

-

How can airSlate SignNow help with Kentucky quarterly tax filing?

airSlate SignNow provides a seamless platform for businesses to prepare and eSign essential documents related to Kentucky quarterly tax filings. Our easy-to-use interface allows users to streamline their tax paperwork, ensuring timely submissions. By digitizing the signing process, airSlate SignNow also helps reduce errors and improves overall efficiency.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking, which are vital for managing documents related to Kentucky quarterly tax. These functionalities enhance the user experience and help maintain organization, ensuring that deadlines aren't missed. Additionally, all documents are securely stored and easily accessible for future reference.

-

Is airSlate SignNow cost-effective for managing Kentucky quarterly tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing Kentucky quarterly tax documents. Our pricing plans are designed to fit various business sizes and needs, allowing you to select a package that works best for your budget. The savings on paper and time thanks to our digital signing solution can further justify the investment.

-

Can airSlate SignNow integrate with accounting software for Kentucky quarterly tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software systems, making it easier to manage your Kentucky quarterly tax documentation alongside your financial records. This integration ensures that data is consistent and reduces manual entry errors, saving you both time and effort during your tax preparations.

-

What are the benefits of using airSlate SignNow for Kentucky quarterly tax documents?

Using airSlate SignNow for Kentucky quarterly tax documents offers numerous benefits, including enhanced efficiency, error reduction, and increased compliance confidence. Our platform simplifies document preparation and signing, allowing you to focus on running your business. Moreover, our secure storage ensures that your sensitive tax files are protected at all times.

-

How does airSlate SignNow ensure security for Kentucky quarterly tax documents?

airSlate SignNow takes security seriously, utilizing industry-leading encryption technologies to protect your Kentucky quarterly tax documents. Our platform also features secure access controls and audit trails, ensuring that only authorized users can view or sign your tax documents. This commitment to security helps safeguard your sensitive financial information.

Get more for Amended Quarterly Withholding Form Boone County, KY

- Letter tenant notice 497301043 form

- Letter from tenant to landlord about sexual harassment connecticut form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children connecticut form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure connecticut form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497301047 form

- Letter tenant landlord rent form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497301049 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497301050 form

Find out other Amended Quarterly Withholding Form Boone County, KY

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement