Sales & Use Tax Department of RevenueDepartment of Revenue KentuckyBusiness Registration Department of RevenueBusiness R 2021

Understanding the Kentucky Form 10A100

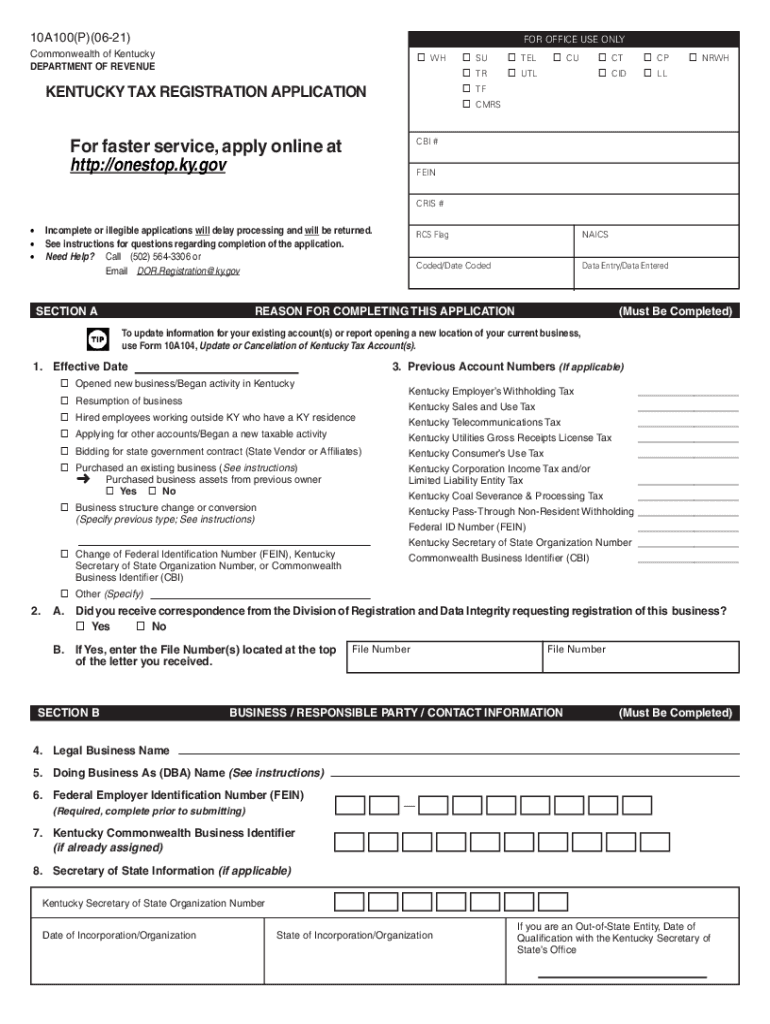

The Kentucky Form 10A100 is a crucial document for businesses registering for sales and use tax in the state. It serves as a means for the Kentucky Department of Revenue to collect necessary information from businesses that wish to comply with state tax laws. This form is essential for ensuring that businesses are properly registered to collect sales tax on taxable transactions. Completing this form accurately is vital for compliance and to avoid potential penalties.

Steps to Complete the Kentucky Form 10A100

Filling out the Kentucky Form 10A100 involves several straightforward steps:

- Gather necessary information, including your business name, address, and federal employer identification number (FEIN).

- Indicate the type of business entity you are registering, such as a sole proprietorship, partnership, or corporation.

- Provide details about the nature of your business and the types of products or services you will sell.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the form electronically through the Kentucky Department of Revenue's online portal or print and mail it to the appropriate address.

Legal Use of the Kentucky Form 10A100

The Kentucky Form 10A100 is legally binding once it is signed and submitted to the Department of Revenue. This form must be completed in accordance with state regulations to ensure that your business is recognized as a legitimate entity for tax purposes. Proper execution of this form helps to establish your business's compliance with Kentucky tax laws, which is essential for avoiding legal complications and penalties.

Key Elements of the Kentucky Form 10A100

When completing the Kentucky Form 10A100, it is important to pay attention to several key elements:

- Business Information: Accurate details about your business, including the legal name and address.

- Entity Type: Clearly indicate the type of business entity to ensure proper classification.

- Tax Identification: Provide your FEIN or Social Security number, as applicable.

- Signature: An authorized representative must sign the form to validate its contents.

Filing Deadlines for the Kentucky Form 10A100

It is important to be aware of the filing deadlines associated with the Kentucky Form 10A100. Businesses should submit this form prior to commencing sales activities to ensure compliance with state tax regulations. Late submissions may result in penalties or delays in obtaining the necessary tax identification number, which can affect your ability to operate legally.

Form Submission Methods for the Kentucky Form 10A100

The Kentucky Form 10A100 can be submitted through various methods to accommodate different preferences:

- Online Submission: Businesses can complete and submit the form electronically via the Kentucky Department of Revenue's website.

- Mail: Alternatively, the completed form can be printed and mailed to the designated address provided on the form.

- In-Person: Businesses may also choose to deliver the form in person at a local Department of Revenue office.

Quick guide on how to complete sales ampamp use tax department of revenuedepartment of revenue kentuckybusiness registration department of revenuebusiness

Effortlessly Prepare Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R on Any Gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R with ease

- Obtain Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Alter and eSign Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales ampamp use tax department of revenuedepartment of revenue kentuckybusiness registration department of revenuebusiness

Create this form in 5 minutes!

How to create an eSignature for the sales ampamp use tax department of revenuedepartment of revenue kentuckybusiness registration department of revenuebusiness

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is 10a100 in the context of airSlate SignNow?

The term 10a100 refers to the capabilities of airSlate SignNow that allow businesses to efficiently manage their document signing processes. This powerful feature set streamlines workflows and ensures quick contract turnaround times, making it easier for teams to focus on what matters most.

-

How does airSlate SignNow pricing work for the 10a100 plan?

The 10a100 plan offers flexible pricing that scales with your business needs. You can choose between monthly or annual subscriptions, allowing you to optimize your budget while taking advantage of all the features airSlate SignNow offers.

-

What key features does airSlate SignNow offer under the 10a100 package?

Under the 10a100 package, airSlate SignNow includes essential features such as secure eSigning, customizable templates, and real-time tracking. These tools help businesses ensure accuracy and efficiency in their document management processes.

-

What are the benefits of using airSlate SignNow with the 10a100 plan?

With the 10a100 plan, businesses can experience enhanced productivity and reduced turnaround times for contract signing. The user-friendly interface and advanced security measures further bolster confidence in document handling.

-

Can I integrate airSlate SignNow using the 10a100 plan with other applications?

Yes, the 10a100 plan supports seamless integrations with various applications, including CRM systems and document storage solutions. This feature allows businesses to streamline their workflows by connecting airSlate SignNow with the tools they already use.

-

Is there customer support available for users on the 10a100 plan?

Absolutely! Users on the 10a100 plan receive dedicated customer support to assist them with any questions or technical issues they may encounter. Our team is committed to ensuring you get the most out of airSlate SignNow.

-

How secure is the data processed through the airSlate SignNow 10a100 plan?

Security is a top priority for airSlate SignNow, especially for users on the 10a100 plan. We employ industry-leading encryption standards and compliance measures to protect your sensitive data during the eSigning process.

Get more for Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R

Find out other Sales & Use Tax Department Of RevenueDepartment Of Revenue KentuckyBusiness Registration Department Of RevenueBusiness R

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement