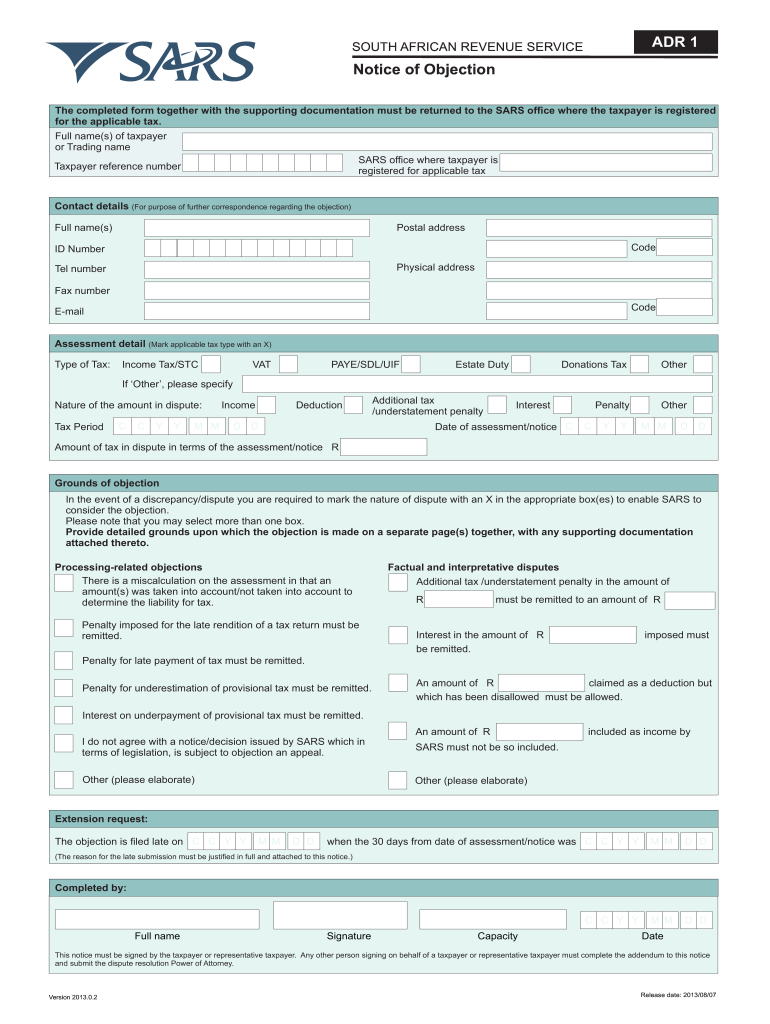

Adr1 Addendum Form

What is the ADR1 Addendum?

The ADR1 Addendum, often referred to as the sars objection form, is a crucial document used in the United States for individuals or entities wishing to formally object to a decision made by the South African Revenue Service (SARS). This form allows taxpayers to present their case and provide supporting evidence regarding their objection. Understanding the purpose and implications of this form is essential for ensuring compliance with tax regulations.

Steps to Complete the ADR1 Addendum

Completing the ADR1 Addendum involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your objection. This may include previous tax returns, correspondence with SARS, and any relevant financial records. Next, fill out the sars objection form carefully, ensuring all sections are completed accurately. Be sure to provide clear and concise explanations for your objection. Finally, review the form for any errors before submission to avoid delays in processing.

Legal Use of the ADR1 Addendum

The ADR1 Addendum must be used in accordance with legal guidelines set forth by the IRS and SARS. It is essential to ensure that the objections raised are valid and supported by appropriate documentation. Failure to comply with these legal requirements may result in the rejection of the objection or potential penalties. Understanding the legal framework surrounding this form can help taxpayers navigate the process more effectively.

Required Documents

When submitting the ADR1 Addendum, certain documents are required to substantiate your objection. These may include:

- Previous tax returns relevant to the objection.

- Correspondence with SARS regarding the issue.

- Financial records that support your claims.

- Any additional documentation specified by SARS.

Ensuring that all required documents are included with your submission can significantly impact the outcome of your objection.

Form Submission Methods

The ADR1 Addendum can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission via the SARS eFiling system.

- Mailing the completed form to the appropriate SARS office.

- In-person submission at designated SARS branches.

Each method has its own processing times and requirements, so it is advisable to choose the method that best suits your circumstances.

Examples of Using the ADR1 Addendum

There are several scenarios in which a taxpayer might use the ADR1 Addendum. For instance, if a taxpayer disagrees with the assessment of their tax liability, they can utilize the sars objection form to present their case. Another example includes situations where a taxpayer believes they were unfairly penalized for late payment or non-compliance. These examples illustrate the practical application of the form in addressing tax-related disputes.

Quick guide on how to complete adr1 addendum

Finalize Adr1 Addendum effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed papers, allowing you to locate the appropriate template and securely preserve it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage Adr1 Addendum on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Adr1 Addendum without any hassle

- Obtain Adr1 Addendum and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Bid farewell to lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Adr1 Addendum and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sars objection form?

A sars objection form is a crucial document for taxpayers who wish to dispute decisions made by the South African Revenue Service. This form allows individuals and businesses to formally object to assessments, ensuring their voices are heard in tax matters. By using airSlate SignNow, you can easily fill out and submit your sars objection form online.

-

How can airSlate SignNow help with sars objection forms?

airSlate SignNow provides a seamless platform to prepare, sign, and send your sars objection form electronically. Our user-friendly interface makes it easy to capture signatures and share documents securely. With airSlate SignNow, you can streamline the objection process, making it faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for sars objection forms?

Yes, airSlate SignNow offers different pricing plans tailored to meet various business needs. Each plan provides access to essential features that help manage your sars objection form effectively. We recommend checking our pricing page to find the best option for your organization.

-

What features does airSlate SignNow offer for managing sars objection forms?

airSlate SignNow includes key features such as document templates, custom workflows, and eSigning capabilities specifically designed for sars objection forms. Additionally, it provides secure cloud storage and team collaboration tools to ensure your documents are managed efficiently. These features help enhance your overall productivity.

-

Can I track the status of my sars objection form with airSlate SignNow?

Absolutely! airSlate SignNow offers document tracking features that allow you to monitor the status of your sars objection form in real-time. You can see when your document has been viewed, signed, or completed, ensuring that you stay informed throughout the process.

-

Does airSlate SignNow integrate with other software for processing sars objection forms?

Yes, airSlate SignNow provides integration capabilities with various applications, helping you manage your sars objection form within your existing workflows. This includes popular tools like CRM systems and document management software, allowing for a more streamlined operation. You can enhance collaboration and efficiency across your teams.

-

How secure is my information when using airSlate SignNow for sars objection forms?

Security is a top priority at airSlate SignNow. When you use our platform for your sars objection form, your data is protected with advanced encryption protocols and secure access controls. This ensures that your sensitive information remains confidential and protected from unauthorized access.

Get more for Adr1 Addendum

- Form 2210 f underpayment of estimated tax by farmers and

- Form mo 60 2021 application for extension of time to file

- Using keyboard shortcuts to access animate workspace form

- Pdf mo pts property tax credit schedule missouri department of form

- 2021 il 505 i automatic extension payment for individuals filing form il 1040

- Form mo scc shared care tax credit

- Use your mouse or tab key to move through the fields use form

- Irs form 1040 individual income tax return and w 2 wage

Find out other Adr1 Addendum

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation