Using Keyboard Shortcuts to Access Animate Workspace 2021

IRS Guidelines for the Illinois Schedule M

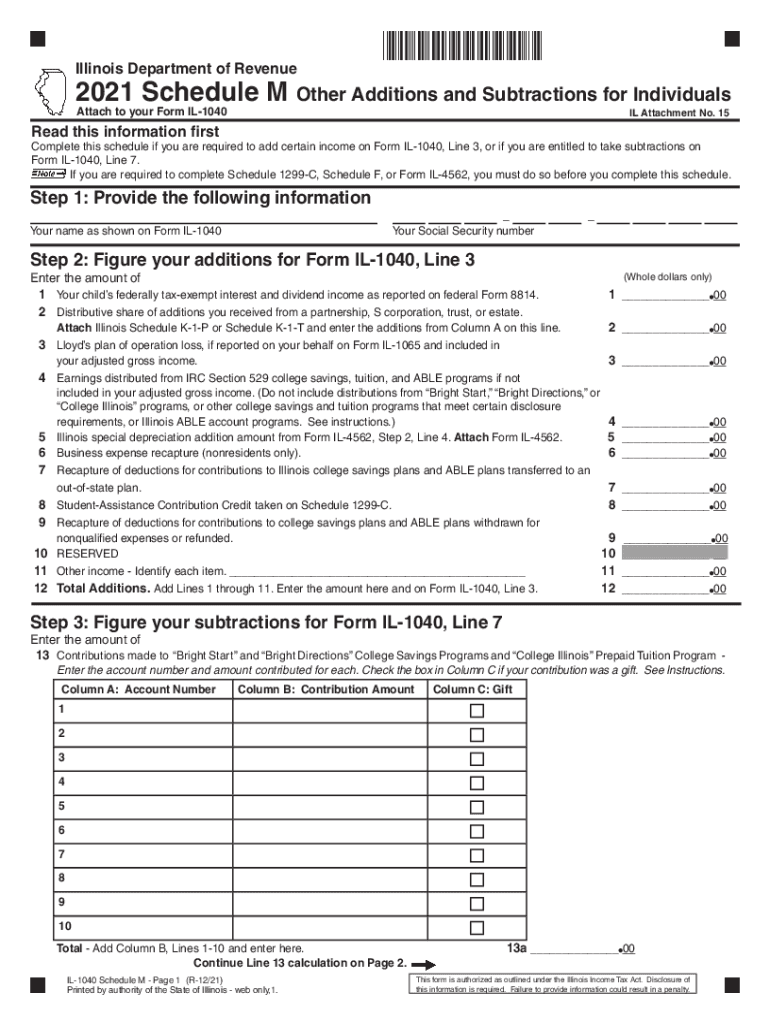

The Illinois Schedule M is a crucial form for taxpayers who need to report adjustments to their income on the Illinois 1040. According to IRS guidelines, this form is used to document specific additions and subtractions to federal adjusted gross income, which can affect the overall tax liability. Taxpayers must ensure that all information is accurate and complete to avoid issues with their filings.

Filing Deadlines for the Illinois Schedule M

For the 2021 tax year, the filing deadline for the Illinois Schedule M aligns with the standard tax return due date. Typically, this is April 15 of the following year, unless it falls on a weekend or holiday. Taxpayers should be aware of any extensions that may apply, as well as any changes in deadlines that could occur due to state or federal regulations.

Required Documents for Completing the Illinois Schedule M

To complete the Illinois Schedule M, taxpayers need several documents, including:

- Federal tax return (Form 1040)

- Documentation for any additions or subtractions, such as W-2s, 1099s, or other income statements

- Records of any applicable deductions or credits

Having these documents on hand will facilitate a smoother and more accurate filing process.

Form Submission Methods for the Illinois Schedule M

The Illinois Schedule M can be submitted through various methods:

- Online filing through approved tax software

- Mailing a paper copy to the Illinois Department of Revenue

- In-person submission at designated tax offices

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Penalties for Non-Compliance with the Illinois Schedule M

Failure to file the Illinois Schedule M or inaccuracies in reporting can lead to penalties. These may include:

- Late filing penalties, which can accumulate over time

- Interest on unpaid taxes

- Potential audits or further scrutiny from tax authorities

Taxpayers are encouraged to file accurately and on time to avoid these consequences.

Eligibility Criteria for Using the Illinois Schedule M

Eligibility for using the Illinois Schedule M typically includes:

- Individuals who file an Illinois 1040 tax return

- Taxpayers who have specific additions or subtractions to report

Understanding these criteria helps ensure that the correct forms are used for tax filings.

Quick guide on how to complete using keyboard shortcuts to access animate workspace

Complete Using Keyboard Shortcuts To Access Animate Workspace seamlessly on any device

Digital document management has become prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Using Keyboard Shortcuts To Access Animate Workspace on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest method to modify and eSign Using Keyboard Shortcuts To Access Animate Workspace effortlessly

- Find Using Keyboard Shortcuts To Access Animate Workspace and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to preserve your updates.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Using Keyboard Shortcuts To Access Animate Workspace and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct using keyboard shortcuts to access animate workspace

Create this form in 5 minutes!

How to create an eSignature for the using keyboard shortcuts to access animate workspace

The way to generate an e-signature for a PDF file in the online mode

The way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

The best way to generate an e-signature for a PDF file on Android

People also ask

-

What is IL Schedule M?

IL Schedule M is a form used by taxpayers in Illinois to report various adjustments to income. It is essential for ensuring accurate tax calculations and compliance. Understanding how IL Schedule M interacts with your overall tax return is crucial for maximizing deductions.

-

How does airSlate SignNow support IL Schedule M documentation?

airSlate SignNow allows users to easily prepare, send, and eSign IL Schedule M documents securely. With its intuitive interface, you can streamline the process of collecting signatures and managing forms. This helps ensure that your tax documentation is handled efficiently and stays compliant with regulations.

-

What pricing options are available for airSlate SignNow when managing IL Schedule M?

airSlate SignNow offers various pricing plans to fit different business needs, whether you're a freelancer or a larger enterprise. Each plan includes features that simplify managing IL Schedule M, ensuring you get the best value for your requirements. Explore our pricing page to find the best option for your business.

-

Are there any features specific to managing IL Schedule M with airSlate SignNow?

Yes, airSlate SignNow provides features tailored for managing IL Schedule M, like customizable templates and automated workflows. These features help you eliminate errors and enhance efficiency when eSigning IL Schedule M forms. Additionally, you can easily track document status and streamline your tax preparation process.

-

How can I integrate airSlate SignNow with other applications for IL Schedule M processing?

airSlate SignNow seamlessly integrates with popular applications to enhance your IL Schedule M processing. Whether you use Google Drive, Salesforce, or other CRM tools, our integrations allow for effortless management of your documents. This flexibility helps maintain workflow efficiency and keeps your operations organized.

-

What are the benefits of using airSlate SignNow for IL Schedule M?

Using airSlate SignNow for IL Schedule M brings numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are securely signed and stored, providing peace of mind during tax season. Moreover, its user-friendly interface enables quick learning and adoption for all team members.

-

Is airSlate SignNow compliant with IL Schedule M regulations?

Yes, airSlate SignNow adheres to compliance standards necessary for managing IL Schedule M and other tax documents. We prioritize the security and legal validity of your eSigned documents, which is crucial for effective tax reporting. Trust us to help you meet compliance requirements confidently.

Get more for Using Keyboard Shortcuts To Access Animate Workspace

- Final waiver form 497306014

- Quitclaim deed from corporation to corporation illinois form

- Warranty deed from corporation to corporation illinois form

- Illinois day notice template form

- Quitclaim deed from corporation to two individuals illinois form

- Warranty deed from corporation to two individuals illinois form

- Illinois modification form

- Illinois corporation llc form

Find out other Using Keyboard Shortcuts To Access Animate Workspace

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word